ESG: All We Need to Know

Navigating ESG: Essential Terms and Frameworks for Enterprise-Level Action

The growing focus on Environmental, Social, and Governance (ESG) presents both challenges and opportunities. With its specialized terminology, it can be daunting for those new to the field. To accelerate your ESG strategy, here’s a breakdown of critical terms and frameworks:

- CDP (formerly Carbon Disclosure Project): A global non-profit driving environmental transparency and action through comprehensive disclosure.

- GRI (Global Reporting Initiative): Offers the world’s most widely adopted sustainability reporting standards.

- SASB (Sustainability Accounting Standards Board): Provides industry-specific guidance for material ESG disclosures in financial filings.

- TCFD (Task Force on Climate-related Financial Disclosures): Develops recommendations for climate risk assessment and disclosure aligned with financial reporting.

The Big Five of Sustainability Reporting (Peers, 2024)

As investors and stakeholders demand ESG accountability, mastering these concepts is vital. Understanding them will streamline your reporting, enhance risk management, and unlock the strategic value of sustainable business practices.

Note: ESG key terms would be sorted in anphabet sequence

1. Benchmarking

Benchmarking involves comparing ESG performance with industry peers to assess a company’s standing. Alignment with ESG frameworks and standards is crucial for accurate benchmarking. The EU introduced new climate benchmarks like the EU Climate Transition Benchmark (EU CTB) and EU Paris-Aligned Benchmark (EU PAB) to promote low-carbon investment strategies and prevent greenwashing. The World Benchmarking Alliance’s Climate and Energy Benchmark ranks influential companies in high-emitting sectors based on their alignment with the Paris Agreement and just transition indicators. Climate Action 100+ offers a Net Zero Company Benchmark to evaluate companies’ emissions reduction, governance, and net zero transition plans. Persefoni’s Climate Impact Benchmarking Module enables companies to benchmark carbon performance against peers, calculate emissions, attribute emissions to portfolios, and assess impact on fund. Such tools aid in making informed data-driven decisions to enhance sustainability practices.

2. Carbon Accounting

Carbon accounting is the meticulous process of quantifying and monitoring the greenhouse gas (GHG) emissions generated by both private and public enterprises. This systematic approach involves measuring an organization’s carbon emissions to pinpoint their sources and quantities accurately. Vital for evaluating environmental impact, articulating sustainability strategies, meeting regulatory obligations, and making informed decisions to curtail emissions towards achieving carbon neutrality, carbon accounting typically encompasses the assessment of emissions across different scopes: scope 1 (direct emissions from on-site activities), scope 2 (indirect emissions from purchased energy), and scope 3 (other indirect emissions throughout the value chain, including supplier and customer-related emissions). By leveraging various standards and tools to collect and report carbon accounting data, organizations can effectively manage and diminish their carbon footprint.

3. Carbon Credits

Carbon credits, also referred to as carbon allowances, are exchangeable permits or certificates that symbolize the compensation of one metric ton of carbon dioxide equivalent (CO2e) emissions. These instruments are utilized in carbon markets to incentivize and facilitate organizations in offsetting their greenhouse gas emissions. Tradable in nature, these credits are transacted with the aim of counterbalancing emissions through the backing of projects or endeavors that mitigate, eliminate, or prevent an equivalent volume of emissions elsewhere. Employed in both voluntary and mandatory markets, carbon credits enable entities to meet emission reduction objectives and endorse sustainable endeavors. Nonetheless, they can provoke debate as they may be perceived at times as enabling companies to persist in emitting carbon without making significant strides towards decarbonization.

4. Carbon Neutral vs Net Zero

Carbon neutrality and net zero represent distinct strategies for addressing greenhouse gas (GHG) emissions. Carbon neutrality aims to balance an entity’s carbon emissions with carbon removals, often through sustainable carbon offset programs, ensuring that emitted carbon is offset by an equivalent amount removed from the atmosphere. On the other hand, net zero initiatives extend beyond carbon neutrality by targeting the neutralization of all greenhouse gases, not just carbon dioxide. Net zero efforts involve reducing emissions within an entity’s operations and value chain, in addition to engaging in carbon removal projects. While these terms are sometimes used interchangeably, they have different scopes and objectives, with net zero representing a more comprehensive and ambitious approach to combating climate change by addressing all GHGs. Understanding these distinctions is crucial for making informed environmental and sustainability decisions in large enterprise settings focused on carbon emission reporting, carbon credits, and ESG considerations.

5. Carbon Footprint

A carbon footprint is an estimation of the amount of carbon dioxide generated to sustain an individual’s or organization’s lifestyle. It gauges the impact on the climate based on the volume of carbon dioxide produced. Factors contributing to a carbon footprint include travel methods and overall energy consumption. This concept extends to larger scales, encompassing companies, businesses, and even countries. Calculating a carbon footprint involves intricate considerations such as household energy use, transportation habits, and waste management. Various online tools like personal carbon footprint calculators are available to help individuals assess their greenhouse gas emissions and understand the environmental impact of their actions.

6. Carbon Offsets

Carbon offsets serve as a means to counterbalance the volume of carbon emissions released by an individual or organization into the air. Operating within a financial framework, carbon offsets offer a solution for companies to adhere to emission regulations by procuring carbon credits from an external entity. These credits are then utilized by the organization to sponsor initiatives that diminish carbon levels in the atmosphere. Individuals can also participate in this system by financially compensating for their personal carbon output, either in lieu of or in conjunction with direct actions like reducing driving or practicing recycling.

Large enterprise business users often leverage carbon offsets as a strategy to mitigate their carbon footprint while maintaining compliance with emission standards. Typically centered around renewable energy projects, these offsets enable companies to support environmentally friendly endeavors. For instance, a corporation based in Massachusetts could invest in erecting a wind turbine along the coastline. Through this investment in renewable energy, the company effectively counteracts its own carbon emissions, showcasing a commitment to sustainability and environmental responsibility.

7. CDP

CDP, established in 2000 as a non-profit organization, operates a worldwide disclosure platform catering to investors, corporations, municipalities, states, and regions seeking to monitor and address their environmental footprints. Specializing in climate change, water management, and forest conservation, CDP provides valuable insights and tools across these critical domains. Participating entities engage by completing a structured questionnaire, enabling CDP to evaluate and assign performance ratings (e.g., A+, B, C) based on the responses. These scored assessments can then be exported and shared with relevant stakeholders.

Renowned for hosting the most extensive repository of voluntarily submitted environmental data globally, CDP is widely recognized as the premier authority in environmental disclosure. Its reports and resources are instrumental in guiding businesses towards sustainable practices and facilitating informed decision-making in alignment with environmental best practices. For large enterprise business users committed to carbon emission reporting, carbon credits, and ESG considerations, leveraging CDP’s expertise can prove invaluable in enhancing transparency, credibility, and sustainability performance within the corporate landscape.

8. Climate

In the realm of environmental science, climate encompasses the collective weather conditions and trends observed across a specific timeframe, spanning years, decades, or even centuries. To draw a comparison, while weather represents individual meals, climate can be likened to the broader, sustained dietary habits over an extended period.

9. Climate Risk

Climate risks encompass both physical risks, such as flooding and extreme weather events impacting infrastructure and supply chains, and transition risks associated with the shift towards a low-carbon economy. Transition risks include factors like carbon taxes, mandates for carbon disclosure, and the adoption of renewable energy sources. While all companies face climate risks, industries like oil and gas and automotive encounter more significant challenges due to their carbon-intensive operations. Evaluating and mitigating climate risks is crucial for cost reduction, meeting sustainability expectations, enhancing reputation, and seizing climate-related opportunities in areas like renewable energy and sustainable solutions

10. CMAP – Climate Management and Accounting Platform

A Carbon Management and Accounting Platform (CMAP) is a software solution designed to streamline the carbon accounting process, significantly reducing calculation times from months to days. These platforms leverage established guidelines such as the Greenhouse Gas Protocol (GHGP) and Partnership for Carbon Accounting Financials (PCAF) to compute carbon emissions accurately, providing tailored solutions based on organizational data. By utilizing CMAPs, companies can effectively monitor their emissions, establish carbon reduction targets, track progress, and compare performance against industry peers. This capability enables organizations to assess their progress in reducing emissions over time and effectively monitor advancements towards science-based and net-zero commitments using the latest available data.

In the realm of large enterprise business users interested in carbon emission reporting, carbon credits, and ESG considerations, CMAPs play a pivotal role in enhancing operational efficiency, ensuring compliance with environmental standards, and fostering sustainability practices. These platforms not only facilitate emissions tracking but also empower companies to make informed decisions regarding emission reduction strategies, thereby enhancing cost-effectiveness, meeting sustainability objectives, bolstering reputation, and capitalizing on emerging opportunities in renewable energy and sustainable solutions

11. Consolidation

The consolidation of greenhouse gas (GHG) emissions data from individual operations within a single company or a consortium of companies involves amalgamating data sources to create a comprehensive overview of carbon emissions. This process entails integrating emissions data from various operational entities to provide a holistic view of the organization’s carbon footprint. By merging data from different sources, companies can gain a more thorough understanding of their environmental impact and enhance their carbon emission reporting accuracy. This practice is essential for large enterprise business users seeking to effectively manage carbon emissions, evaluate sustainability performance, and align with ESG principles.

12. CSR – Corporate Social Responsibility

Corporate Social Responsibility (CSR) represents a voluntary initiative for businesses to uphold ethical standards and enhance their environmental, economic, and social sustainability efforts. Environmental, Social, and Governance (ESG) criteria serve as a framework for evaluating a company’s CSR performance. This transition brings us to the next crucial aspect:

13. CSRD

The CSRD impacts a broad spectrum of over 50,000 companies across Europe, encompassing both large public and private entities, listed companies on European regulated markets, and approximately 10,000 non-EU firms, including about 3,000 U.S. companies with substantial European operations, underscoring its global scope. Introduced within the framework of the “European Green Deal,” its primary objective is to meet the informational needs of investors, civil society, consumers, and stakeholders regarding sustainability practices. This directive mandates reporting on 10 key sustainability areas, encompassing climate-related factors such as mitigation strategies, adaptation policies, energy consumption, and greenhouse gas emissions (including Scope 3 emissions), with external assurance gradually being introduced. It necessitates compliance with European Sustainability Reporting Standards established through a materiality assessment to ensure disclosure of critical aspects while emphasizing that materiality does not render reporting optional. Scheduled to commence from the financial year 2024, the implementation will be phased in until 2028, with a requirement for reasonable assurance by that time. Reporting obligations will be integrated into Annual Reports, with additional details determined through processes at the Member State level.

14. Decarbonization

Decarbonization involves the reduction or elimination of carbon emissions, specifically focusing on global efforts to decrease carbon emissions significantly. When discussing decarbonization in this context, the goal is to minimize carbon emissions on a worldwide level. Achieving complete decarbonization necessitates halting carbon production and extracting existing carbon from the atmosphere.

15. Emission Factors

Greenhouse gas (GHG) emissions are discharged into the air as a result of economic activities or processes that produce hydrocarbons. To quantify these emissions, a carbon dioxide equivalent (CO2e) value is assigned based on the activity linked to the GHG release; this is referred to as an emission factor.

Emission factors are utilized to convert activity data into greenhouse gas (GHG) emissions. A wide array of activities require emission factors to quantify their GHG emissions, including fuel combustion, waste landfilling, electricity consumption, vehicle travel, purchased heat and steam, and animal agriculture

16. EPA – Environmental Protection Agency

The United States Environmental Protection Agency (EPA) is an autonomous executive branch agency established to oversee and manage environmental protection concerns. The agency was initiated by President Richard Nixon on July 9, 1970, and officially commenced operations on December 2, 1970, following the signing of an executive order. The EPA is responsible for the publication of emission factor sets, which are maintained within the Persefoni platform, providing a critical resource for environmental protection and regulation

17. ESG – Environmental, Social, and Governance

Environmental, Social, and Governance (ESG) criteria constitute the triad of key performance indicators that evaluate an organization’s impact on both the environment and society. Originally conceived as a metric for investors to gauge the potential for long-term financial returns, ESG considerations have now become integral to corporate strategic planning. These criteria are instrumental in assessing a company’s capacity to navigate and address the most pressing challenges of our era, including climate change, environmental deterioration, social inequity, and disparities in wealth and opportunity.

18. Financed Emissions

Financed emissions refer to greenhouse gas emissions indirectly produced through investments and loans, falling under scope 3, category 15 of the GHG Protocol. These emissions are significant contributors to global GHG emissions, with financial institutions playing a crucial role in managing them. Financial institutions can measure, reduce, and disclose financed emissions using standards and frameworks provided by organizations like GHGP, PCAF, SBTi, and CMAPs. These efforts are essential for transitioning to a low-carbon economy and aligning with climate goals such as the Paris Agreement.

As of August 2022, more than 300 financial institutions have pledged to measure and disclose their emissions following the PCAF Standard, representing approximately $79 trillion in total assets. This commitment underscores the growing importance of environmental accountability within the financial sector, with institutions leveraging standardized methodologies to quantify and report their greenhouse gas emissions associated with various financial activities

19. Fossil Fuel

Fossil fuels represent a broad category encompassing organic matter derived from ancient plant and animal remains, subjected to immense heat and pressure over geological timescales, resulting in the formation of oil, coal, or natural gas.

20. Fugitive Emissions

Fugitive emissions refer to the release of greenhouse gases (GHGs) into the atmosphere due to intentional or unintentional leaks from pressurized containment systems, such as storage tanks or pipelines, commonly occurring in industrial activities like production, processing, and transportation of fuels and chemicals. These emissions contribute to local air pollution and environmental damage, with gases like refrigerants, natural gas, perfluorocarbons, sulfur hexafluoride, and nitrogen trifluoride being common culprits. Despite being challenging to detect due to their small scale and elusive nature, fugitive emissions have a significant global impact, accounting for a notable portion of greenhouse gas emissions worldwide

21. GHG Source

Any physical unit or process that releases GHG into the atmosphere.

22. GHGP – Greenhouse Gas Protocol

The Greenhouse Gas Protocol (GHGP), established in 1997, serves as the foundational standard for carbon accounting, offering guidelines for organizations to construct inventories of their greenhouse gas (GHG) emissions. The GHGP classifies emissions into three scopes: Scope 1 covers direct emissions from an organization’s operations, including those from company vehicles and buildings; Scope 2 encompasses indirect emissions from purchased electricity, heating, and cooling; and Scope 3 includes all other indirect emissions within a company’s value chain. While Scopes 1 and 2 are mandatory for measurement, Scope 3 is currently considered optional.

.Global warming refers to the gradual increase in the Earth’s surface and tropospheric temperatures, leading to alterations in global climate patterns. This phenomenon can result from various factors, both natural and human-induced. In everyday language, “global warming” often denotes the temperature rise linked to heightened greenhouse gas emissions stemming from human activities.

23. Greenwashing

Greenwashing is the practice where organizations present themselves as more environmentally friendly, ethical, or sustainable than they actually are, often for marketing benefits. This misleading behavior involves companies providing false information or making unsupported assertions to gain a competitive edge. To address this issue, certain regions have started implementing regulations to counter greenwashing practices. An instance of such legislation is the EU’s taxonomy regulation, aimed at curbing deceptive environmental claims and promoting transparency in sustainability reporting within the business sector.

24. Green Finance

Green finance pertains to funding initiatives and projects that promote environmental sustainability, combat climate change, and lower emissions. This type of financing supports endeavors such as renewable energy development, energy efficiency improvements, and conservation programs, facilitating the transition to a low-carbon economy. By engaging in green finance, businesses can not only contribute to environmental goals but also reap financial advantages while aligning with climate objectives.

25. GRI – The Global Reporting Initiative

Established in 1997 in response to public concern sparked by the Exxon Valdez oil spill, the Global Reporting Initiative (GRI) developed the pioneering global standards for sustainability reporting known as the GRI Standards. These standards have become widely adopted and are among the most prevalent reporting frameworks utilized by businesses, governments, and various organizations. They play a crucial role in enabling entities to comprehend and articulate the influence of companies on significant sustainability matters.

26. GWP – Global Warming Potential

Every greenhouse gas (GHG) possesses a Global Warming Potential (GWP), representing its heat-trapping capacity compared to that of carbon dioxide (CO2). Given the differing abilities of GHGs to retain heat in the atmosphere, certain gases have a more detrimental impact on the climate than others. For instance, methane is 25 times more potent than CO2, resulting in methane having a GWP of 25.

27. Investor-Grade Reporting

Investor-grade reporting, akin to financial reporting, ensures the accuracy, timeliness, auditability, and comparability of ESG (Environmental, Social, and Governance) data. This type of reporting is increasingly crucial as regulators and investors seek dependable ESG information to evaluate climate and sustainability risks. The collection of high-quality ESG data poses challenges due to its diverse sources and decentralized nature within organizations. To achieve investor-grade reporting, companies need to involve cross-functional teams, utilize appropriate technology solutions, adhere to relevant reporting standards, and integrate ESG considerations into their business strategies. This comprehensive approach facilitates improved decision-making, regulatory compliance, competitiveness, and risk mitigation associated with climate change and sustainability.

28. IPCC – Intergovernmental Panel on Climate Change

The Intergovernmental Panel on Climate Change (IPCC) is a United Nations intergovernmental body established in 1988 by the World Meteorological Organization (WMO). It plays a crucial role in advancing knowledge on human-induced climate change by providing policymakers with regular scientific assessments of climate change, its implications, potential future risks, and proposing adaptation and mitigation options.

.The IPCC’s Working Group III focuses on climate change mitigation, which involves actions aimed at reducing the rate of climate change. Mitigation efforts include limiting or preventing greenhouse gas emissions and enhancing activities that remove these gases from the atmosphere. These actions are applicable across various sectors such as energy, transport, buildings, industry, waste management, agriculture, forestry, and land management. Working Group III adopts an interdisciplinary approach to address all aspects of mitigation, including technical feasibility, costs, and the necessary enabling environments for implementing measures. The group does not advocate for specific mitigation options but supports a solution-oriented approach that considers both near-term decision-making and long-term climate policy goals.

.The IPCC’s reports provide comprehensive assessments of climate change impacts, risks, vulnerabilities, and adaptation options across different regions and sectors. These reports are crucial for policymakers, businesses, and organizations to understand the implications of climate change and make informed decisions to address climate-related challenges effectively.

29. ISSB

The International Sustainability Standards Board (ISSB) was established by the International Financial Reporting Standards (IFRS) Foundation in November 2021 with the objective of developing high-quality sustainability standards to meet the informational needs of investors. These standards, such as IFRS S1 for general sustainability disclosures and IFRS S2 for climate-related disclosures, aim to enhance transparency in reporting by providing guidelines for identifying, measuring, and disclosing financial information related to sustainability. They focus on areas like greenhouse gas emissions (scopes 1, 2, and 3) and require specific details on methodologies used. While these standards have been available for voluntary use since June 2023, they will officially come into effect on January 1, 2024. The adoption of these standards by jurisdictions like Nigeria and Ghana reflects a growing trend towards transparent and comparable sustainability reporting within General Purpose Financial Reporting

30. ISO 14064

ISO 14064, established in 2006, is an international standard for measuring and reporting greenhouse gas emissions. This standard, a part of the International Standardization Organization’s environmental management standards, is divided into three parts, each focusing on a distinct technical approach. Part 1 provides guidance on quantifying a greenhouse gas inventory for organizations using a bottom-up data collection method. Part 2 addresses the quantification and reporting of emissions from individual project activities, while Part 3 establishes a process to verify an organization’s emissions’ validity.

The ISO 14064 standard is continuously evolving with new iterations enhancing and refining its requirements. It is closely aligned with the Greenhouse Gas Protocol (GHGP), which concentrates on best practices for creating GHG inventories. While the GHGP emphasizes these best practices, ISO 14064 sets minimum compliance levels against them. Despite slight differences, these two standards complement each other in providing comprehensive guidelines for greenhouse gas emissions measurement, reporting, and verification

31. Kyoto Protocol

The Kyoto Protocol, an extension of the United Nations Framework Convention on Climate Change (UNFCCC), focuses on seven greenhouse gases: carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), hydrofluorocarbons (HFCs), perfluorocarbons (PFCs), sulfur hexafluoride (SF6), and nitrogen trifluoride (NF3). While the UNFCCC urges industrialized nations to adopt policies for reducing greenhouse gas emissions, the Kyoto Protocol mandates specific actions, requiring nations to limit and decrease their emissions according to agreed-upon individual targets

32. Materiality

In the realm of corporate sustainability, ESG matters are deemed significant when they play a crucial role in evaluating an enterprise’s risks and prospects. These pivotal concerns, known as material issues, are indispensable in gauging the long-term viability of a business. The concept of materiality has progressed into a paradigm of “double materiality,” underscoring the dual significance of ESG factors from both financial and non-financial standpoints. This evolution highlights the interconnectedness of environmental, social, and governance considerations with financial performance, emphasizing their relevance for comprehensive corporate reporting and strategic decision-making in today’s dynamic business landscape.

33. Net Zero

Net zero, a target embraced by organizations to achieve by 2050 as advised by the IPCC, entails offsetting the carbon emissions produced by a company with equivalent carbon removal through offsets and permanent storage in carbon sinks. This ambitious goal necessitates a comprehensive transformation in energy production, transportation, and consumption practices to mitigate climate change effectively. The transition to net zero involves a significant push towards clean energy technologies by 2030, emphasizing the urgent deployment of clean and efficient energy solutions to stay on track towards achieving this milestone. Governments, businesses, and other entities are increasingly committing to net-zero emissions by 2050, recognizing the imperative for immediate action to combat climate change

34. Organizational and Operational Boundaries

Organizational boundaries in carbon accounting involve delineating whether an organization is part of a larger entity or subsidiary, impacting its control over assets and the share of emissions it is accountable for. Operational boundaries define the scope of direct and indirect emissions within these organizational boundaries. Direct emissions stem from sources owned or controlled by the company, while indirect emissions arise from the company’s activities but occur at sources controlled by other entities. Operational boundaries are categorized into Scope 1 (direct emissions), Scope 2 (indirect emissions from purchased energy), and Scope 3 (other indirect emissions in the value chain). Automated carbon accounting software aids in defining and calculating these boundaries, assisting organizations in meeting reporting requirements and sharing data with relevant stakeholders

35. (The) Paris Agreement

The Paris Agreement, a binding international treaty on climate change, sets the ambitious goal of limiting global warming to well below 1.5°C compared to pre-industrial levels. This landmark agreement aims for a climate-neutral world by mid-century, marking the first time all nations have united under a binding pact to combat the climate crisis. To achieve the 1.5°C target, a substantial reduction of greenhouse gas emissions by 55% is required by 2030. The Paris Agreement emphasizes the urgent need for global cooperation and concerted efforts to address climate change effectively and transition towards a sustainable future.

36. PCAF – Partnership for Carbon Accounting Financials

The Partnership for Carbon Accounting Financials (PCAF) introduced a standardized approach, the Global GHG Accounting and Reporting Standard for the Financial Industry, in response to industry demand for a global standard. This initiative focuses on measuring and reporting financed emissions, specifically addressing GHG emissions associated with six asset classes: listed equity and corporate bonds, business loans and unlisted equity, project finance, commercial real estate, mortgages, and motor vehicle loans. The PCAF Standard aids financial institutions in assessing and disclosing greenhouse gas emissions linked to their financial activities, enabling them to manage risks, identify opportunities related to emissions, and embark on the path towards decarbonization. The Standard has evolved with subsequent versions and additional parts like the Facilitated Emissions Standard and the Insurance-Associated Emissions Standard to provide comprehensive guidance for measuring and reporting emissions associated with various financial activities.

37. Physical Risk

Physical risks related to climate change encompass the economic costs and financial implications arising from climate-related events such as extreme weather occurrences, significant climate variations, and other indirect consequences like water scarcity. An example of a physical risk is the destruction of assets such as real estate, infrastructure, or land during severe weather events like storms or floods. These risks are becoming increasingly pertinent as the impacts of climate change intensify, leading to rising economic damages and necessitating enhanced preparedness and resilience measures across various sectors. Understanding and addressing physical risks associated with climate change are crucial for organizations, policymakers, and financial institutions to mitigate potential losses, ensure business continuity, and foster sustainable development in the face of a changing climate

38. SASB – Sustainability Accounting Standards Board

The Sustainability Accounting Standards Board (SASB) is a non-profit organization established to develop industry-specific standards that assist companies in identifying and disclosing financially material sustainability information. These standards enable organizations to provide disclosures tailored to their industry, focusing on sustainability-related risks and opportunities that could impact cash flows, access to finance, or cost of capital over the short, medium, or long term. SASB Standards cover 77 industries and were developed through a rigorous process involving evidence-based research and input from companies, investors, and subject-matter experts. The International Sustainability Standards Board (ISSB) of the IFRS Foundation has taken over the responsibility for maintaining and evolving the SASB Standards since August 2022. The integration of SASB Standards into the IFRS Sustainability Disclosure Standards underscores their importance in facilitating consistent and comparable sustainability reporting for companies

39. SEC Climate Disclosure

The SEC Climate Rule impacts U.S. Public Companies and Foreign Private Issuers, aiming to fulfill investor demands for more consistent, comparable, and reliable climate-related disclosures. The proposal, inspired by the TCFD framework, requires narrative disclosures, Scopes 1 and 2 GHG emissions reporting, and Scope 3 if material or included in reduction targets (except for Smaller Reporting Companies). Larger companies would need external assurance over Scopes 1 and 2 GHG emissions, with phased implementation. Additionally, a financial statement note on climate-related impacts is required unless the impact is under 1% of the line item. If adopted, reporting is expected to begin in FY2025 based on FY2024 data, impacting Form 10-K, 20-F, and registration statements. The SEC’s Climate Rule represents a significant step towards enhancing transparency and accountability in climate-related disclosures for companies operating in the U.S. market, aligning with global efforts to address climate change through improved reporting standards and practices

40. Science-Based Targets

Science-Based Targets (SBTs) are emission reduction objectives aligned with the decarbonization necessary to limit global temperature increases, as outlined in the Paris Agreement. These targets aim to restrict global temperature rises to below 2°C above pre-industrial levels, with a preference to keep the increase below 1.5°C. The Science-Based Targets Initiative (SBTi) offers guidance and validation for companies establishing SBTs, enabling them to harmonize their emission reduction goals with global climate objectives. SBTs play a crucial role in guiding companies towards sustainable practices and aiding in the transition to a low-carbon economy by setting clear and measurable goals aligned with climate science

41. Scope 1, 2 and 3 Emissions

Scope 1, 2, and 3 emissions are categories used to classify different types of emissions within an organization:

- Scope 1 emissions: These are direct emissions resulting from an organization’s owned operations, such as emissions from company-owned vehicles and on-site buildings. They include fuel combustion, fugitive emissions, mobile combustion, and process emissions.

- Scope 2 emissions: These encompass indirect emissions associated with purchased electricity, gas, steam, heating, and cooling generated by the organization. These emissions are not directly owned or controlled by the organization but are crucial to report as they result from the organization’s activities.

- Scope 3 emissions: This category includes all other indirect emissions that occur throughout the organization’s value chain, extending beyond its direct operations. Scope 3 emissions can be complex to measure and comprise 15 categories like purchased goods and services, waste generated, transportation, use of sold products, and more. Scope 3 emissions often represent a significant portion of an organization’s total emissions.

Measuring and reporting on all these scopes is essential for organizations to gain transparency, meet regulatory requirements, set benchmarks for net-zero goals, identify opportunities for emissions reduction, enhance efficiency, and manage environmental and climate impacts effectively.

42. Scope 4 Emissions

“Scope 4 emissions,” though not an officially recognized category like scopes 1, 2, and 3 emissions, refer to potential emissions reductions resulting from more efficient products or services replacing less efficient alternatives. These emissions are attempts to quantify the climate benefits of these replacements, such as a company claiming to have reduced emissions by transitioning customers to more energy-efficient products. However, measuring scope 4 emissions is complex due to various assumptions and challenges, and there is no universally accepted standard for their calculation. These emissions are not required to be reported, and unsubstantiated claims can lead to greenwashing. Therefore, it is advisable for organizations to focus on measuring and managing scopes 1, 2, and 3 emissions

43. SDG – Sustainable Development Goals

The Sustainable Development Goals (SDGs) are 17 interconnected goals for sustainable development set by the UN in 2015, with the objective of achieving these goals by 2030. The SDGs aim to provide a shared blueprint for peace and prosperity for people and the planet, emphasizing the integration of actions across social, economic, and environmental sustainability. These goals cover a wide range of areas including poverty eradication, zero hunger, good health and well-being, quality education, gender equality, clean water and sanitation, affordable and clean energy, industry innovation and infrastructure, climate action, life below water, life on land, peace, justice and strong institutions, among others. While initially intended to support governmental progress, these goals are now widely used by companies to disclose their sustainability practices and align their efforts with global sustainability objectives.

44. Supplier Tiers

Supplier tiers refer to the categorization of suppliers within a supply chain based on their relationship and proximity to the purchasing company. Understanding these tiers is crucial for companies to gain insight into their supply chain, manage operational, legal, and ethical risks, and accurately account for emissions in their scope 3 carbon footprint. The different tiers are as follows:

- Tier 1 suppliers: These are suppliers with whom a company directly contracts and engages. They are the closest to the purchasing company and play a significant role in the final product or service offered.

- Tier 2 suppliers: These suppliers provide resources to tier 1 suppliers and are one level removed from the purchasing company. They are essential for supporting the operations of tier 1 suppliers.

- Tier 3 suppliers: These suppliers provide resources to tier 2 suppliers, often involving raw materials or components that eventually make their way into the final products or services offered by the purchasing company. They are further removed but still crucial for the supply chain.

Understanding supplier tiers helps companies manage risks, enhance transparency, and improve sustainability practices by identifying key partners in their supply chain and addressing potential issues related to quality, ethics, legal compliance, and environmental impact.

45. Sustainable Finance

Sustainable finance involves financial practices and investments that prioritize environmental, social, and governance (ESG) factors to generate financial returns while promoting sustainable outcomes for the planet and society. It encompasses strategies like impact investing, green bonds, and responsible banking. Key points from the search results include:

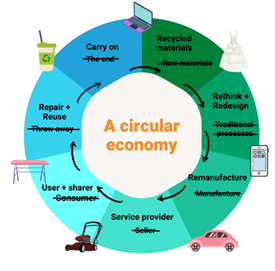

- Environmental considerations in sustainable finance involve climate change mitigation, biodiversity preservation, pollution prevention, and the circular economy.

- Social considerations encompass issues of inequality, inclusiveness, labor relations, human rights, and community investment.

- Governance factors focus on management structures, employee relations, and executive remuneration to ensure social inclusion

Sustainable finance is crucial for achieving policy objectives like the European Green Deal by directing private investment towards a climate-neutral, resource-efficient economy. It involves financing both environmentally friendly projects (green finance) and transitioning existing high-emission activities towards sustainability (transition finance). Sustainable finance is gaining importance as consumers prefer companies aligned with their values, investors seek ESG opportunities, and businesses aim to enhance their reputation through sustainability initiatives

46. Sustainable Procurement

Sustainable procurement is the process of integrating environmental, social, and governance (ESG) considerations into the acquisition of services and goods. It involves assessing suppliers against specific criteria and collaborating with them to achieve sustainability objectives, such as reducing greenhouse gas emissions and improving sustainability practices across the supply chain. Sustainable procurement aims to create opportunities for reducing risks and costs, enhancing operational efficiency, and positively influencing suppliers by aligning with sustainability goals beyond profit considerations. This practice is essential for addressing environmental and ethical concerns, complying with emerging sustainability regulations, and enhancing brand reputation

47. TCFD – Task Force for Climate-Related Financial Disclosures

The Task Force on Climate-related Financial Disclosures (TCFD) was founded in 2017 as an industry-agnostic framework focusing on climate-related disclosures. It consists of eleven recommendations across four key areas: governance, strategy, risk management, and metrics and targets. The TCFD aims to enhance the quality of data provided by companies to support informed capital allocation decisions. Unlike some other frameworks like CDP, TCFD reporting does not have a scoring system but is widely recognized for its robust considerations and is increasingly being adopted by regulators globally

48. Transition Risk

Transition risk is a type of risk associated with the transition to a low-carbon economy, involving changes in climate policy, regulations, and market sentiment towards sustainability. It encompasses potential costs society faces during this shift, such as policy changes, technological innovations, and shifts in consumer preferences towards greener options. Transition risks can lead to adverse economic impacts and affect various sectors, including insurance companies through their investment portfolios.

The Task Force on Climate-Related Financial Disclosures (TCFD) identifies four key types of transition risks:

- Policy and Legal Risks

- Technology Risks

- Market Risks

- Reputation Risks

Mitigating transition risks involves conducting a materiality assessment, scenario analysis, identifying opportunities aligned with decarbonization goals, setting carbon reduction targets, and disclosing climate risks and opportunities in annual filings.

Industries facing significant transition risks include carbon-intensive sectors like oil and gas or transportation. These industries need to adapt their operations gradually to align with the shift towards a low-carbon economy. Companies must assess how transition risks may impact their finances and adapt accordingly to seize financial opportunities that may arise from the transition

49. UNFCCC – United Nations Framework Convention on Climate Change

The ultimate goal of the UNFCCC (United Nations Framework Convention on Climate Change) is to stabilize greenhouse gas concentrations at a level that would prevent dangerous anthropogenic interference with the climate system. This stabilization should be achieved within a timeframe sufficient to allow ecosystems to naturally adapt to climate change, ensure food production is not threatened, and enable sustainable economic development. The Convention has 197 member countries, with developed nations being tasked to take the lead in addressing climate change.

The SEC (Securities and Exchange Commission) has proposed climate-related disclosure rules that would impact foreign private issuers (FPIs). These rules would require companies to disclose the impact of climate-related events and transition activities in their financial statements. FPIs subject to these rules may face higher disclosure obligations compared to their U.S. counterparts. The proposed rules could also affect Canadian filers in the U.S., potentially leading to redundancies and additional burdens for companies complying with multiple disclosure regimes.

The TCFD (Task Force on Climate-related Financial Disclosures) focuses on reporting organizations’ impact on the global climate. It aims to make firms’ climate-related disclosures more consistent and comparable, helping companies integrate climate-related risks and opportunities into their decision-making processes. The TCFD’s recommendations cover areas such as governance, strategy, risk management, and metrics/targets, providing a framework for organizations to disclose their climate-related risks and opportunities effectively

50. Value Chain Emissions

GHG emissions from the upstream and downstream activities are associated with the full scope of operations (value chain) of the reporting company.

51. Verification

An independent assessment of the reliability (considering completeness and accuracy) of a GHG inventory.

52. VRF – Value Reporting Framework

Established in 2011 as SASB, the VRF is a prominent global nonprofit dedicated to providing a robust array of tools tailored for large enterprise businesses and investors. Its primary objective is to facilitate a unified comprehension of enterprise value, encompassing its generation, sustenance, and depletion.

53. The VRF covers three frameworks:

The Value Reporting Foundation (VRF) encompasses three key frameworks:

- Integrated Thinking Principles: These principles guide board and management in planning and decision-making processes.

- Integrated Reporting Framework: This framework offers principles-based, multi-capital guidance for comprehensive corporate reporting.

- SASB Standards: These standards serve as a robust tool to inform investor decision-making when integrated into investment tools and processes.

Together, these resources provide a comprehensive suite of tools tailored to assist large enterprise businesses and investors in cultivating a shared understanding of enterprise value, including its creation, preservation, and erosion over time