Five payment technology trends to watch

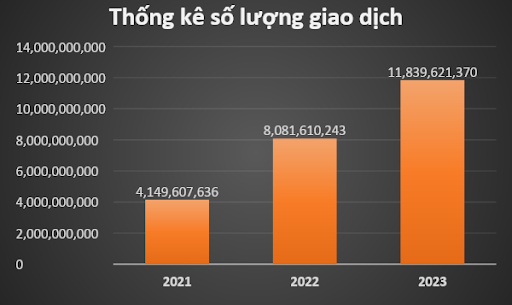

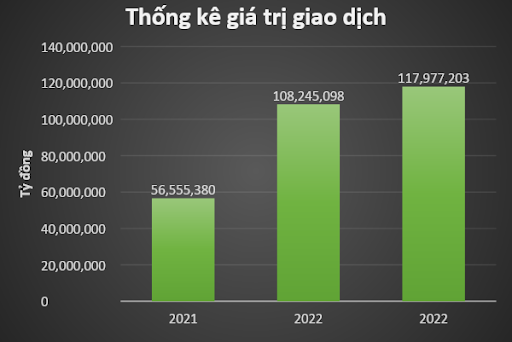

The explosion of digital technology has comprehensively and profoundly changed all aspects of socioeconomic life. This trend is also prominent in the sphere of electronic payments. The world is witnessing the formation of numerous new payment trends, each of which will be appropriate for a certain country, region, and user habits in one particular area. The use of non-cash payments is rapidly growing in Vietnam, particularly in the wake of the COVID-19 pandemic. The number of non-cash transactions increased by almost three times between 2021 and 2023 (from over four billion transactions to almost 12 billion transactions annually), and the value of transactions doubled (from VND 56 quadrillion to almost VND 120 quadrillion annually), according to the statistics.

- Open Banking

Open Banking is not just a trend. It is a revolution. Open Banking enables the sharing of certain financial data that is only visible to you and the bank, such as your account balance or transaction history, with other financial institutions or services of your choice. By utilizing APIs, an easily connected, efficient, secure, and consumer-centric ecosystem is established in the banking and finance sectors. The movement toward Open Banking will give consumers control over their financial data and promote personalized financial products. There is a lot of potential here, as direct bank-to-bank transactions involving traditional cards may result in reduced fees and faster payments.

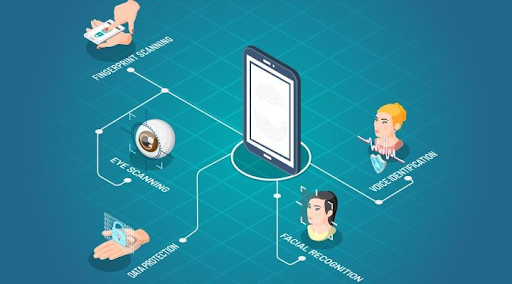

- Biometric Payments

Biometric payment methods are setting new security and convenience standards. As fingerprint and facial recognition technologies rapidly proliferate, payments will be safer and faster. The development of voice and iris recognition technology continues to push the envelope, making payments simpler and more secure. In Vietnam, the State Bank of Vietnam (SBV) issued Decision 2345/QD-NHNN requiring organizations providing payment services and payment intermediary service providers (PSPs) on the internet to apply biometric authentication under certain specific conditions.

- Payments embrace AI

Artificial intelligence (AI) is on the rise. AI has transformed many business industries, improving operational efficiency and reducing labor costs. The financial sector has not lagged behind in this race. With AI-based financial solutions, businesses wish to adopt modern payment services to improve cash flow and transaction security.

AI seeks to make modern business environments easier in the following ways:

Personalized payments

AI can analyze customer data to personalize the payment experience. Businesses can improve the overall customer-business transaction experience by implementing AI-based payment solutions.

Fraud detection and prevention

AI-powered payment systems can detect anomalies in transactions and personal data to prevent fraud. These tools have the power to transform how businesses manage their finances.

Automated payment processing

Using AI in payment processing can help businesses automate transactions to streamline operations. This can be a great option for companies that operate in different time zones.

- Payment Orchestration

Payment Orchestration, also known as Payment Orchestration Platform (POP), is a software solution that connects merchants with multiple PSPs, buyers, and payment partners, and allows merchants to manage everything from one interface. It unites most aspects of the online payment process in one place, including payment authorization, transaction routing, reconciliation, payouts, ledgers, analytics, and payment settlement details.

The purpose of POP is to remove complexity for merchants by enabling them to take advantage of working with different payment service providers without having to integrate them all one by one. This streamlining allows merchants to route payments in a multitude of ways and based on a wide range of factors, including payment processor availability, best fee conditions, highest authorization rates, and locality. Connecting to multiple providers can help protect against failed payments and reduce costs associated with payment processing. Adopting POP also saves merchants the trouble of maintaining all integrations separately after they have been added. With POP, merchants can easily manage all of their integration from one central place.

Interestingly, AI also starts to play a role in this solution by intelligently introducing routing rules and determining the best time of day to transfer money.

- Financial Data Security

The future of payment technology depends heavily on financial security. In the first quarter of 2024, several financial and technology organizations in Vietnam suffered ransomware attacks that encrypted all corporate data, forcing businesses to close for several days. Individual customers’ account information was compromised, causing significant financial losses. The enhancement of financial security across several domains is a primary focus of global financial markets.

- Multi-factor authentication (MFA): when one authentication factor is insufficiently effective, businesses will utilize multi-factor authentication (SMS OTP, App OTP, fingerprint, face, and iris authentication, etc.)

- Tokenization: a mechanism to create tokens for sensitive data (cardholder name, card number, CVV2 code, etc.)

- Data Encryption: encrypts all data to protect financial information

| Exclusive article by FPT IS Expert

Author Lam Ngoc Khanh – Deputy Director of Corporate Banking Center |