Green credit programs of commercial banks in Vietnam

In the context of Vietnam’s commitment to achieving net zero emissions by 2050, green credit is becoming one of the key financial tools to promote green transformation in the economy. Commercial banks play a key role in shaping capital flows towards sustainability, through providing credit to environmentally friendly projects such as renewable energy, organic agriculture, green buildings or waste treatment.

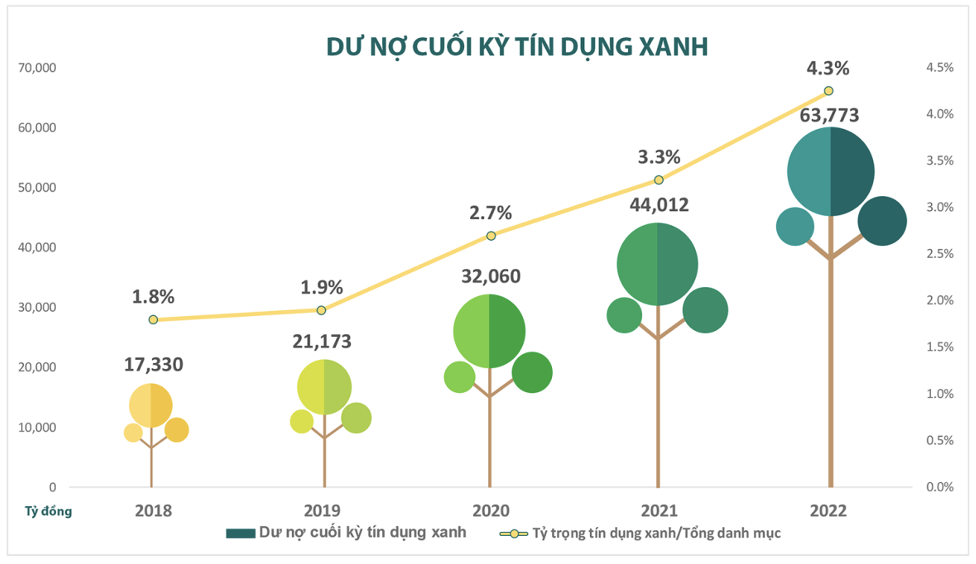

According to the Government Newspaper (2025), green credit in Vietnam has grown significantly, with outstanding green credit reaching nearly VND 564,000 billion by the end of 2023 , accounting for about 4.4% of total outstanding loans in the entire economy. This shows the growing interest from both credit institutions and businesses in green finance activities.

However, Vietnam has not yet issued a unified green classification list across the system, causing many difficulties in identifying and evaluating projects eligible for funding (VnEconomy, 2024). Each bank currently has a lending framework, preferential interest rates and specific disbursement conditions depending on the capital situation of each bank.

This article will review the banks that are leading in the field of green credit in Vietnam and the sustainable financial products they are implementing to help businesses more quickly access green capital.

1. BIDV – Leading the green credit market in Vietnam

1.1. General introduction

The Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) was honored at the Vietnam Sustainable Enterprises 2024 (CSI 2024) Award Ceremony, held on November 29, 2024 in Hanoi. The award is a recognition of BIDV’s persistent efforts in integrating sustainable development into its business strategy, as well as its practical contributions to the National Sustainable Development Strategy.

BIDV General Director Le Ngoc Lam represented the Bank to receive the award.

Source: BIDV (2024)

In its Development Strategy for the period 2021–2025, with a vision to 2030, BIDV identifies the core message of “Pioneering in creating sustainable values”, taking sustainable development as a consistent orientation. The Bank aims to become the leading financial institution in Vietnam in ESG (Environment – Society – Governance) practices and aims for a Net-Zero Bank model by 2045.

1.2. The Fusion of Finance & Technology

In February 2025, the Joint Stock Commercial Bank for Investment and Development of Vietnam (BIDV) and FPT Information System Company (FPT IS) signed a Memorandum of Understanding on cooperation in implementing digital solutions for managing and inventorying greenhouse gas emissions for businesses. The event marked an important step forward in accompanying businesses in implementing digital transformation associated with green transformation, towards sustainable development.

Under the agreement, BIDV and FPT IS will jointly deploy the VertZéro platform – a software solution that helps businesses inventory emissions, build emission reduction roadmaps, and make environmental data transparent. Businesses that are BIDV customers will be supported to use the VertZéro solution for free for the first 6 months, and enjoy discounts of up to 25% in the following phases.

Mr. Tran Long – Deputy General Director of BIDV – shared: “Through this cooperation, we hope to accompany businesses in their journey to access green credit, standardize environmental data and improve their ability to comply with international standards on sustainable development. This is the premise for BIDV to be able to disburse green loan packages more effectively in the future.”

With the support of FPT IS – a unit with experience in deploying emission measurement platforms according to international standards (ISO 14064, GHG Protocol, PCAF…) – BIDV expects to improve the quality of approval and disbursement of green loans, thereby spreading the spirit of environmental responsibility throughout the corporate customer ecosystem.

Ms. Do Thi Thanh Huyen – Director of BIDV Wholesale Product Policy Department and Mr. Dao Hong Giang – Director of FPT IS Banking Finance Division – represented the two units to sign the Memorandum of Understanding.

Source: BIDV (2025)

Under the agreement, BIDV and FPT IS will jointly deploy the VertZéro platform – a software solution that helps businesses inventory emissions, build emission reduction roadmaps, and make environmental data transparent. Businesses that are BIDV customers will be supported to use the VertZéro solution for free for the first 6 months, and enjoy discounts of up to 25% in the following phases.

Mr. Tran Long – Deputy General Director of BIDV – shared: “Through this cooperation, we hope to accompany businesses in their journey to access green credit, standardize environmental data and improve their ability to comply with international standards on sustainable development. This is the premise for BIDV to be able to disburse green loan packages more effectively in the future.”

With the support of FPT IS – a unit with experience in deploying emission measurement platforms according to international standards (ISO 14064, GHG Protocol, PCAF…) – BIDV expects to improve the quality of approval and disbursement of green loans, thereby spreading the spirit of environmental responsibility throughout the corporate customer ecosystem.

As of September 30, 2024, BIDV has granted green credit to 1,680 customers, supporting 2,068 projects, with green outstanding loans reaching VND 75,100 billion, accounting for 11.3% of total green credit outstanding loans of the whole economy and 3.9% of total BIDV outstanding loans.

Priority areas for funding include:

- Renewable energy and clean energy,

- Low carbon consumer production,

- Climate change adaptation,

- Water supply and clean water treatment infrastructure.

Typical programs include:

- 4,200 billion package for textile and garment enterprises that meet international sustainability standards (eg: GlobalG.AP, WRAP, ISO 14064);

- 10,000 billion VND package for businesses to invest in green buildings, saving resources;

- 5,000 billion VND package for clean water supply projects, improving urban quality of life;

- Green credit package for individuals worth 10,000 billion VND to support the purchase of green energy products (electric cars, energy-saving devices…).

Green credit balance at BIDV

Source: Cafef (2024)

BIDV also cooperates with many domestic and foreign electric vehicle companies to deploy financial products to support people in switching to green vehicles.

BIDV is currently the leading credit institution in issuing ESG bonds in the domestic market, with two successful issuances in the 2023-2024 period, mobilizing a total of VND 5,500 billion (equivalent to USD 220 million) from green bonds and sustainable bonds.

1.3. Approval & Disbursement Process

1.3.1. Step 1: Evaluate and select eligible projects

1.3.1.1. Identify green projects

The project must comply with the List of Eligible Projects specified in Appendix 1 of the BIDV Green Bond Framework. The areas include:

- Renewable energy and clean energy,

- Green industry,

- Sustainable transport,

- Green construction,

- Green agriculture, sustainable forestry,

- Waste treatment and environmental protection,

- Recycling resources,..

At the same time, the project must not violate the exclusion criteria stated in Appendix 2, for example: Activities related to forced labor, primary logging, weapons production, cross-border waste trading, etc.

1.3.1.2. Environmental and social risk assessment (E&S Risk)

- BIDV’s environmental and social risk management policies will be applied for assessment. Projects in sensitive sectors must provide:

- Environmental impact assessment report,

- Environmental license,

- Social risk management report (if any).

1.1.1.3. Credit profile assessment

- RM (customer relationship management) prepares credit proposal report,

- The credit appraisal department performs financial and ESG risk appraisal,

- Specialized departments coordinate to verify compliance with green criteria.

Step 2: Credit approval and disbursement

2.1.1. Credit approval

Green credit files are submitted for approval through competent authorities at BIDV according to current regulations. Projects are only approved when they simultaneously meet:

- Green Project Screening,

- Credit Analysis & Approval.

2.1.2. Disbursement

Once approved, the credit limit is activated and disbursed. BIDV closely monitors the progress of capital use to ensure:

- Capital is used for the right purpose,

- Meet committed environmental and social standards.

Step 3: Manage and report on capital usage

3.1.1. Capital management

All proceeds from green bond issuance are managed separately. If the project has been disbursed before the issuance date, BIDV will allocate through the refinancing mechanism within a maximum limit of 36 months before the issuance date. Undisbursed amounts will be used to directly finance new projects within 24 months from the issuance date.

3.1.2. Control of capital use

BIDV conducts periodic monitoring:

- Project implementation progress,

- Disbursement rate,

- Remaining balance.

- If the capital is not used immediately, it will be deposited at the State Bank or credit institutions, in the form of deposits or cash equivalents.

3.1.3. Periodic reports

BIDV publishes annual report on green bonds:

- Capital allocation,

- Project portfolio by field, geography,

- Refinance/new financing ratio.

- Reports may include additional impact indicators (e.g. CO₂ avoided, number of people with access to clean energy, area of forest protected…).

- The report is published on BIDV website: https://www.bidv.com.vn

3.4. External assessment

An independent organization (e.g. Vigeo Eiris, S&P Global) conducts a Second Party Opinion (SPO) assessment to confirm that the bond framework complies with ICMA standards. BIDV also conducts post-issuance assessments to verify the use of funds.

BIDV – The pioneer bank in Vietnam successfully issued green bonds

Source: BIDV (2023)

Not only relying on commercial capital, BIDV is also a strategic partner of many international financial institutions. The bank is managing more than 250 foreign capital trusts with a total committed value of up to 19.7 billion USD (nearly 500,000 billion VND). Partners include:

BIDV Green Capital Utilization Report 2024

Source: BIDV (2024)

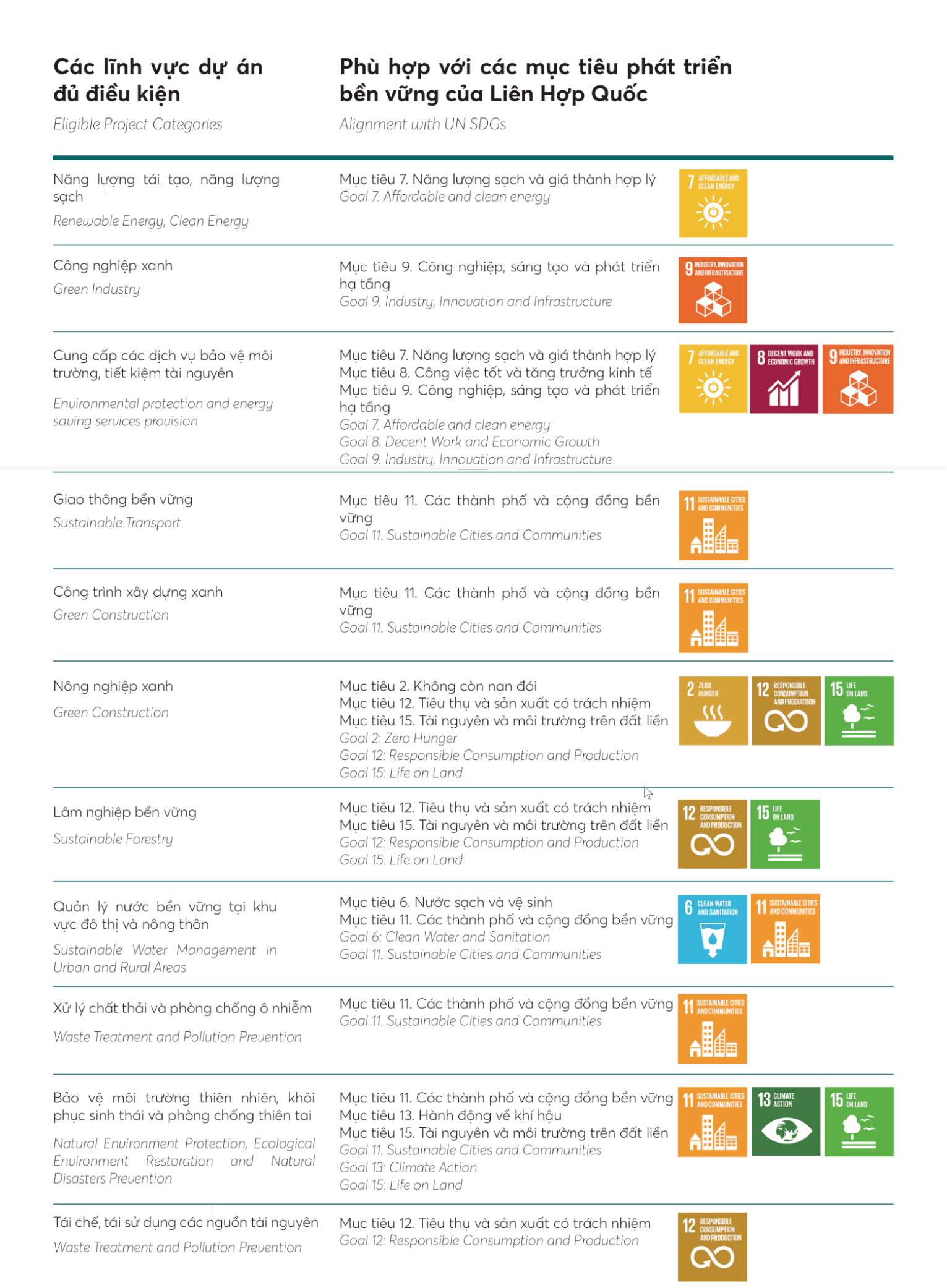

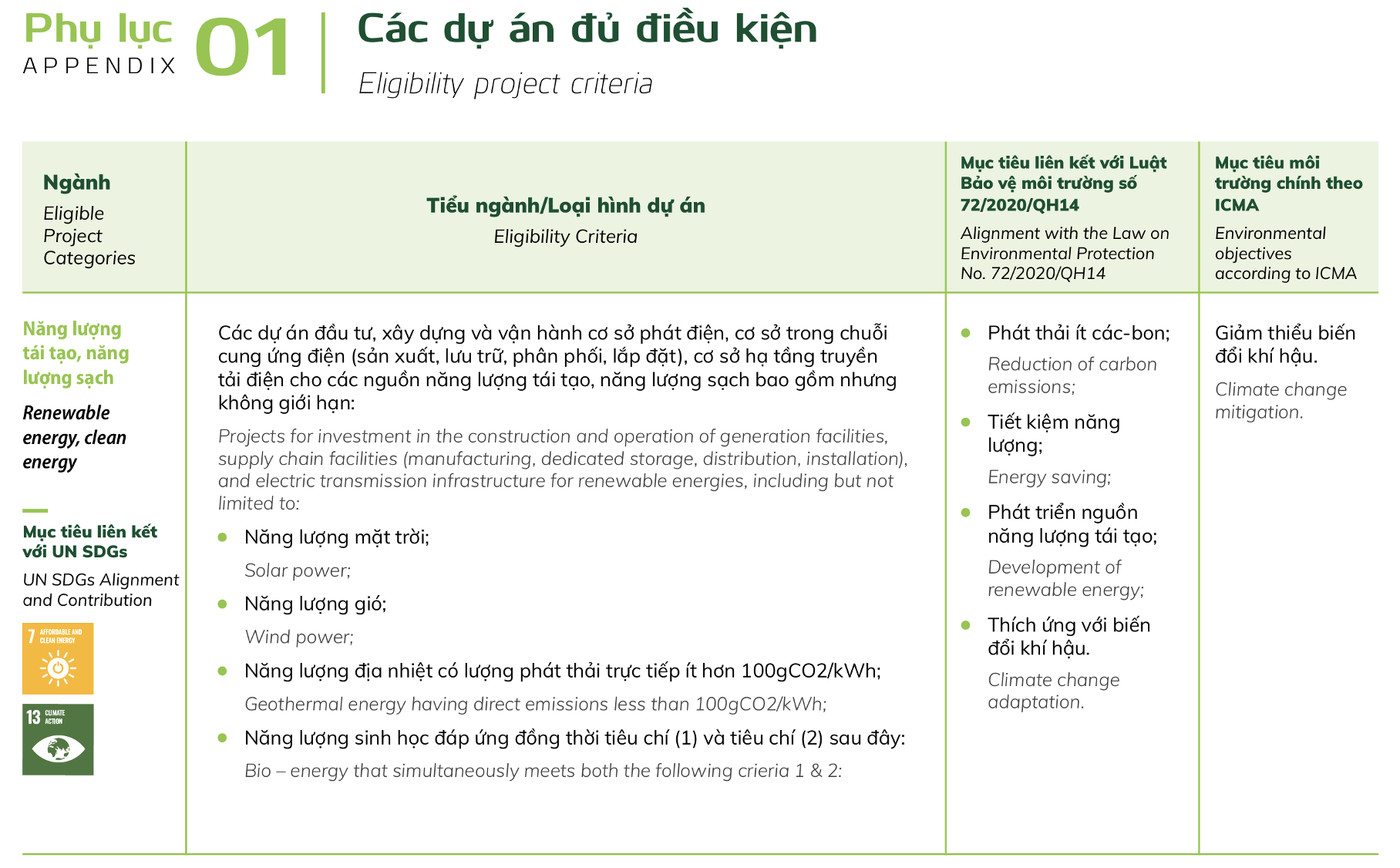

According to BIDV’s green bond framework, projects considered eligible for access to green capital must have a positive impact on the environment and make a practical contribution to sustainable development goals. Priority areas include renewable energy and clean energy – in line with United Nations Goal 7 on affordable and sustainable energy. In addition, projects in green industry, green construction, sustainable transport, waste treatment and environmental protection are also encouraged to access this capital, as they contribute to goals such as building sustainable cities (Goal 11), creative industries (Goal 9), responsible consumption and production (Goal 12), and conservation of natural resources (Goal 15).

In the agriculture and forestry sector, projects oriented towards clean production, low carbon emissions, efficient use of resources, and circularity are also strongly supported. This is especially important in the context of Vietnam’s need to ensure food security (Goal 2) while reducing pressure on natural resources. In addition, BIDV also prioritizes projects on ecosystem restoration, natural disaster prevention, and sustainable water management – especially in urban and rural areas that are strongly affected by climate change.

The clear linkage between each project portfolio and the SDGs system helps BIDV ensure transparency, efficiency and standardization according to international practices in managing green capital flows. This is also the basis for businesses to orient their green investment strategies, build loan profiles and demonstrate environmental impacts during the approval process.

2. Vietcombank – Pioneer in green finance development in Vietnam

2.1. General introduction

With a vision to become the number 1 bank in Vietnam by 2030 and among the top 200 largest financial groups in the world, Vietcombank identifies sustainable development and ESG governance as strategic pillars. The issuance of green bonds is a practical action to realize Vietcombank’s commitment to the community and the environment, while actively contributing to the process of realizing Vietnam’s Net Zero goal.

Joint Stock Commercial Bank for Foreign Trade of Vietnam (Vietcombank) has affirmed its pioneering role in the field of green finance through the successful issuance of VND2,000 billion of green bonds in November 2024. This is the first time a bank in Vietnam has issued green bonds in compliance with both domestic laws and the Green Bond Principles of the International Capital Market Association (ICMA). Vietcombank’s green bond framework was developed with technical support from the Global Green Growth Institute (GGGI) and is rated “Medium Green” by S&P Global – the second highest level in the six-step scale according to S&P Global’s Shade of Green assessment framework.

Vietcombank’s Green Bond Framework is designed to closely follow:

- International Capital Markets Association (ICMA) Green Bond Principles 2021,

- United Nations Sustainable Development Goals (UN SDGs),

- Vietnam’s legal system related to environmental protection and green credit.

Capital mobilized from green bonds is used by Vietcombank to finance projects that have a positive impact on the environment, including: renewable energy, sustainable transportation, water management, green buildings, waste management, sustainable agriculture – forestry – fisheries and efficient energy use.

By the end of the first quarter of 2024, Vietcombank’s green credit balance reached VND47,700 billion, accounting for 3.7% of the bank’s total outstanding loans. Of which, funding for renewable energy and clean energy projects accounted for 84.1%; sustainable water management accounted for 10.4%; waste treatment and pollution prevention accounted for 2%; recycling and reuse of resources accounted for 1%.

Vietcombank also launched preferential interest rate programs for short-term production and business loans with a scale of up to VND 160,000 billion from January 1, 2024, to support businesses in the green sector.

2.2. Approval & Disbursement Process

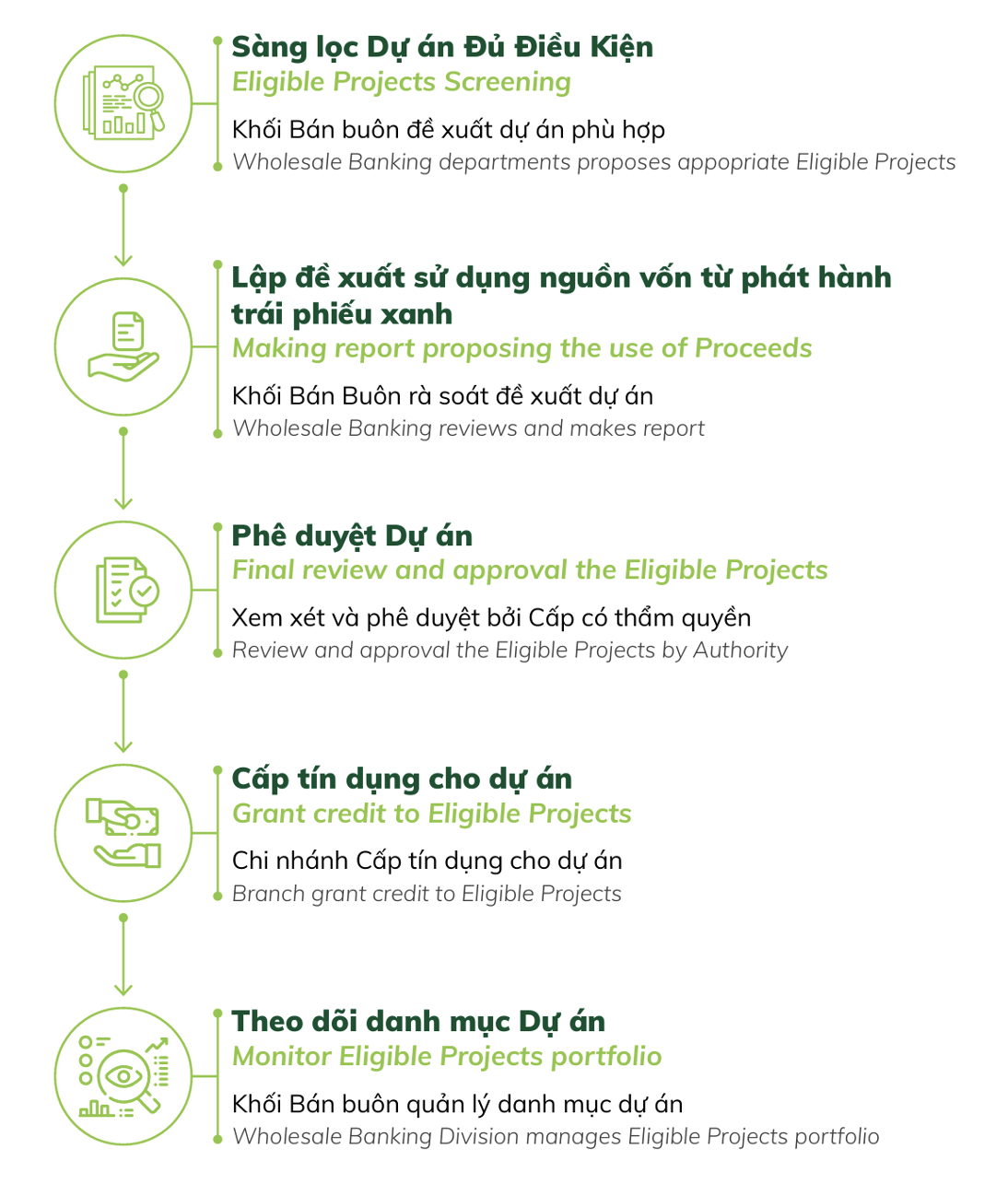

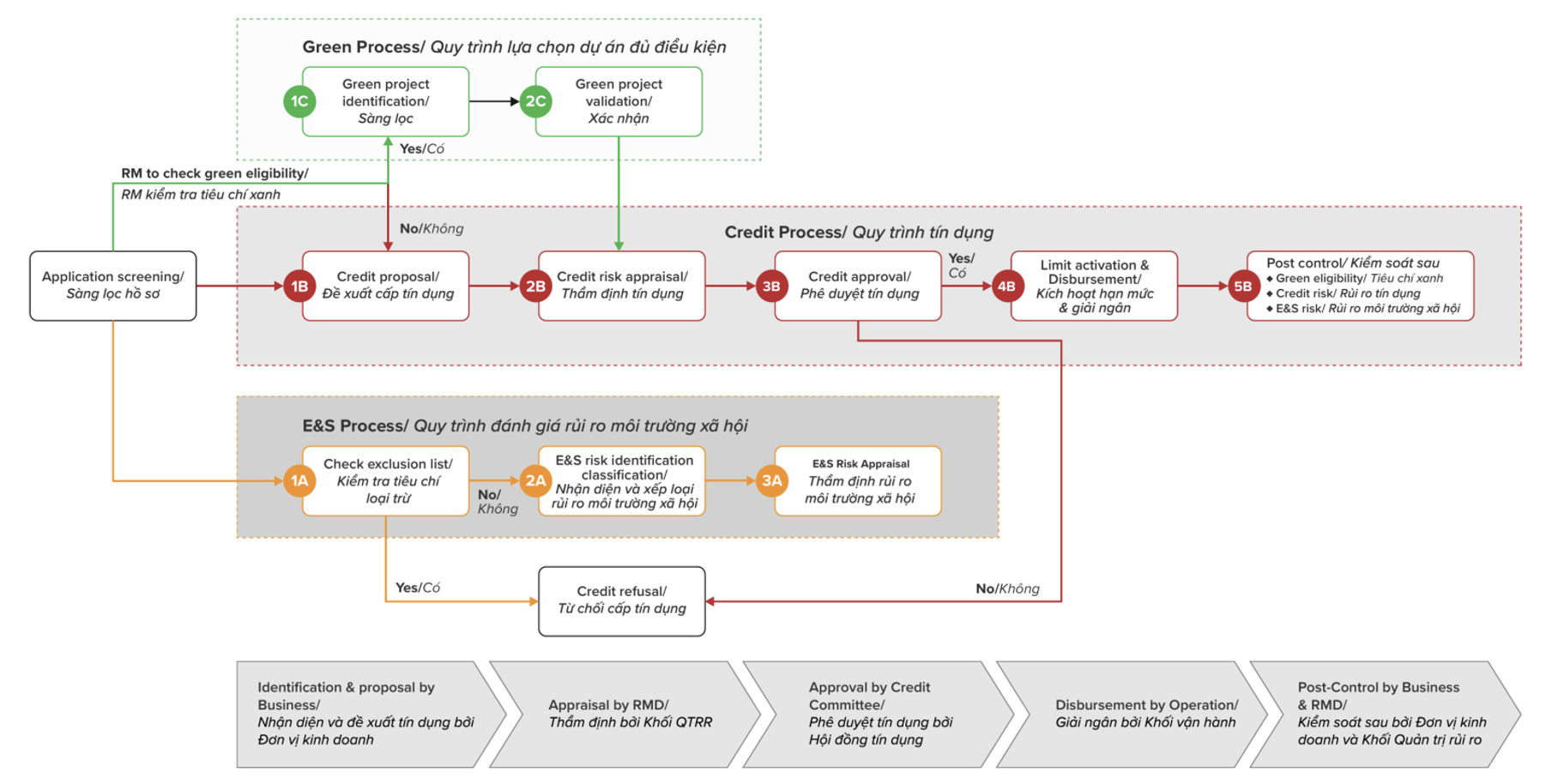

Vietcombank’s green capital disbursement process

The green capital disbursement process at Vietcombank is implemented according to a strict roadmap to ensure transparency and efficiency in capital use. First, the Wholesale Division conducts screening of eligible projects (Eligible Projects Screening) by proposing projects that meet the criteria for using green capital. Then, this unit proceeds to propose the use of capital from issuing green bonds (Making report proposing the use of Proceeds) through detailed review and development of a report presenting the capital use plan for each specific project. Next, the competent authority in the Vietcombank system will conduct final review and approval of the Eligible Projects to ensure compliance and consistency with the bank’s sustainable development strategy. Once the project is approved, the Vietcombank branch will grant credit to the project (Grant credit to Eligible Projects), disbursing capital as committed. Finally, the Wholesale Block will continue to monitor the project portfolio (Monitor Eligible Projects Portfolio), ensuring that the use of capital is periodically checked and monitored, complying with the environmental protection and sustainable development goals as initially committed.

Vietcombank’s green capital disbursement criteria

To ensure objectivity and international credibility, Vietcombank selected S&P Global to provide a Second Party Opinion, confirming the Green Bond Framework’s compliance with ICMA standards.

With the Green Bond Framework, Vietcombank not only opens up attractive investment opportunities for investors aiming for sustainable development, but also strongly demonstrates its commitment to leading the Vietnamese banking system in green transformation and low-carbon economy.

3. Techcombank – The first private bank

3.1. General introduction

Techcombank puts sustainable development at the heart, with ESG (Environmental – Social – Governance) strategy integrated into the entire business model:

- Five ESG pillars: Customers – Shareholders – Employees – Legal regulations – Social and internal practices.

- Priority areas 2024: Renewable energy, green transport, green industry, clean hydrogen.

- 54% of the credit portfolio is currently in sectors affected by green policies.

In addition, Techcombank has developed a comprehensive Environmental and Social Management System (ESMS) and implemented ESG training programs for all employees, to meet the increasing expectations from customers, investors and international regulations.

Issued in 2024, Techcombank’s Green Bond Framework is built in line with the ICMA Green Bond Principles 2021 and is rated by the prestigious S&P Global Ratings.

This bond framework ensures:

- Use transparent funding: Only fund eligible green projects such as renewable energy, sustainable transport, green buildings, green agriculture, sustainable forestry…

- Tight capital management: Track cash flows separately for each green bond issuance.

- Rigorous project evaluation and selection: Integrated into the credit appraisal process, with an independent team of ESG experts.

- Annual Report: Transparent disclosure of use of funds and environmental impact achieved.

Typical green project categories:

- Wind and solar energy projects,

- Development of electric transport, hydrogen fuel,

- Projects with international green certification (LEED, EDGE, LOTUS),

- Organic agriculture, low-emission agriculture,

- Sustainable water management and resource recycling.

3.2. Approval & Disbursement Process

Project evaluation and selection process at Techcombank

- Step 1: Screening of applications and Checking of exclusion criteria

- Application screening / Application screening : The sales department (RM) receives credit application documents from customers.

- 1A – Check exclusion list / Check exclusion criteria:

- RM checks whether the project is on the list of sectors excluded by regulations (for example: coal production, primary forest exploitation…) or not

- If Not Qualified: Credit Rejection.

- If Pass: Continue process.

- Step 2: Identify and validate green criteria

- 1C – Green project identification / Green project screening:

- RM determines whether the project falls within the category of eligible green projects (under the Green Bond Framework).

- 2C – Green project validation / Green project validation:

- If the green criteria are met, the project is recorded for processing under the green credit process.

- If the green criteria are not met, the application can still proceed but will follow the normal credit process.

- Step 3: Assess credit risk and environmental and social (E&S) risks

- 2A – E&S Risk identification and classification / E&S Risk identification and classification:

- Environmental and social risks are assessed and classified (High, Medium, Low).

- 3A – E&S Risk Appraisal / Environmental and social risk appraisal:

- The ESG department conducts in-depth E&S risk assessment.

- 2B – Credit risk appraisal / Credit appraisal:

- Analyze credit risk according to internal standards, including financial and ESG risk factors.

- Step 4: Credit approval

- 3B – Credit approval / Credit approval:

- Techcombank Credit Council approves or rejects credit applications based on credit assessment and E&S results.

- If Failed: Credit Rejected.

- If Passed: Go to disbursement activation step.

- Step 5: Disbursement and Post-Disbursement Control

- 4B – Limit activation & Disbursement / Limit activation & disbursement:

- Credit limit is activated, disbursement is made according to approved terms.

- 5B – Post control / Post control:

- Periodic control of:

- Green eligibility,

- Credit risk,

- Environmental and social risk (E&S risk).

- Techcombank requires projects to maintain green eligibility throughout the life of the loan. If the criteria are violated, the project may be removed from the green portfolio.

Techcombank requires projects to maintain green eligibility throughout the life of the loan. If the criteria are violated, the project may be removed from the green portfolio.

The salient principles in the process:

- Independence in assessment: Assessments of green criteria and E&S risks are performed by independent ESG experts and credit assessors.

- Integrate ESG into every step: Require environmental and social impact assessments in parallel with traditional credit appraisal.

- Dedicated capital management: Green credits are monitored and managed separately to ensure transparency and compliance with international green bond issuance requirements (ICMA Green Bond Principles).

- Transparency reporting: Green projects are updated periodically in capital use reports and environmental impact reports.

In the context of green credit becoming an important driving force for sustainable development in Vietnam, the cooperation between commercial banks and technology consulting units such as FPT IS plays a key role. Through the joint implementation of digital solutions such as the VertZéro platform, FPT IS not only helps businesses standardize environmental data and inventory emissions according to international standards, but also significantly shortens the time to access and appraise green loan applications. This is an important breakthrough, contributing to increasing the ability to absorb green capital in the economy, supporting Vietnamese businesses to improve their competitiveness, meet the strict requirements of international markets, and at the same time realize the goal of net zero emissions by 2050.

If your business does not know where to start, let us, VertZero of FPT IS, accompany your business in the process of measuring emissions, standardizing environmental records and accessing green loans according to international standards.

Contact us on the website now for free consultation on the green credit access roadmap for your project: https://vertzero.eco/

|

Exclusive article by FPT IS Technology Expert Mr. Tuan Pham – PhD Candidate in Climate Finance in Europe, Director of VertZéro Greenhouse Gas Inventory Solutions |

References

- BIDV (2024) BIDV develops green credit and issues ESG bonds. Available at: https://www.bidv.com.vn (Accessed: April 29, 2025).

- BIDV (2025) Cooperation between BIDV and FPT IS in deploying the VertZéro platform to support businesses in emission inventory. Available at: https://www.bidv.com.vn (Accessed: 29 April 2025).

- Government Newspaper (2025) Green credit in Vietnam grows strongly, contributing to the goal of net zero emissions. Available at: https://baochinhphu.vn (Accessed: April 29, 2025).

- VnEconomy (2024) Lack of unified green classification – Challenges in green credit disbursement. Available at: https://vneconomy.vn (Accessed: April 29, 2025).

- Vietcombank (2024) Vietcombank successfully issued green bonds according to international standards. Available at: https://www.vietcombank.com.vn (Accessed: April 29, 2025).

- Techcombank (2024) ESG strategy and green bond issuance at Techcombank. Available at: https://www.techcombank.com.vn (Accessed: 29 April 2025).