The trend of reshaping cross-border payments

The continuous changes in cross-border payment processes are leading to new business models and trends that are altering the volume of global transactions. What are the current forms of cross-border payments in the Asia-Pacific region, as well as in Vietnam? And the current and future trends shaping cross-border payments?

1. Trends Reshaping Cross Border Payments

The constant changes of the cross-border payments process lead to new business models and new trends that modify the world transactions volume. The trends we now can predict are:

- Consumer demands are changing rapidly

The banking services are expected to become more flexible and fast, while the consumers are less likely to pay for additional banking services. The developing era of smartphones and quick alternative payment methods (APMs) raised the demand for cross-border payments quality to a new level. The new providers come with new cross-border payments solutions and offer cheaper and more transparent advantages than the banks.

- Trade with emerging markets

Another increasing trend of cross-border payments is the switching focus on new international markets in Latin America, Africa, and Asia. There is a prediction of increasing cross-border trade by 5% (CAGR) until 2022 from global markets powered by initiatives like the African Continental Free Trade Area and China’s Belt and Road Initiative. While in western markets, there is a slight growth of around 2% (CAGR) caused by the changing political situations, including Brexit and US trade tensions.

- More world access to the mobile phones and e-payments

With the rise of phone accessibility and switch to the remote way of life, more customers discovered that e-payment solutions could bring more benefits and save their time. In 2021, the number of smartphone users worldwide raised to 3.8 Billion, which means 48.20% of the world’s population. This figure is predicted to increase every year. Overall, the global wallet at the POS (point-of-sale) is expected to increase to 52% in 2023. All this will lead to the development and more accessibility of cross-border commerce volumes.

- A wide range of electronic payment providers

All over the world, there is increased popularity and demand for electronic payments. Many electronic payment providers currently maintain services for storing, money exchanging, money transferring, and payments. Each provider has its own strong and weak points, so there is no definite answer to the question of which one should be entrusted with your funds.

2. Fintech and Cross Border Payments

The global trend of Fintech development at the moment is digitalization, automation, and informatization. These are pillars of modern development programs in many countries. Cross-border payments are no exception. Solving the problems of transferring operations often depends on the implementation of blockchain technologies, big data, and many other innovative systems.

New alternatives for fintech settlements improve the overall efficiency of cross-border payments. These include:

- Interconnections between internal payment infrastructures;

- The expansion of closed systems across borders;

- Blockchain-based peer-to-peer payment solutions, also known as Distributed Ledger Technology (DLT);

- CCPS (Cross-Carrier Payment Systems) work in mobile operators’ networks and conducts cash transactions in real-time.

The payment system in the blockchain systems uses Rich Communications Services (RCS) protocol, an advanced SMS simulator that can transmit multimedia data and perform service discovery. Thanks to the presence of RCS, customers will be able to use applications on their mobile devices for cross-border payments and don’t need to change the currency at the bank.

The companies are also developing systems for transferring funds using mobile networks. However, such payment systems are just the beginning of distributing blockchain solutions for the communications sector. They also plan to deal with another important aspect of financial transactions – security issues. It requires the development of concepts of identification and client authentication.

3. The Future of Cross Border Payments and A new paradigm

International payments have long been a power enabling cross-border trade and investment in today’s global economy. The banks deserved the reputation of cross-border market owners, while the great list of requirements such as regulations and technical infrastructure has prevented international trade from developing fast.

Today, the demand for cross-border payments is so high that we can observe a new paradigm of changes that lead to the general improvements of the whole cross-border payments landscape. Here are some of the most brilliant examples of the future cross-border direction.

The growing role of SMEs in international business

The SMEs (Small and Medium Enterprises) have started to benefit more from the simplification of cross-border payments, as they have more access to affordable solutions, giving more flexibility in their options (like SWIFT or Mastercard). The traditional banks are no longer able to fulfill this fast access to international payments.

Global eCommerce

With the development of e-commerce, there is an increase in the number of payment systems. They become faster, which leads to a decrease in cash transactions in the world. As businesses and consumers have grown accustomed to faster, cheaper, and more convenient payments, customers’ expectations are higher. It has helped drive innovation in interface systems that improve the user experience with mobile technology, e-wallets, and e-commerce.

A Single Global Payment Area

The example of a Single European Payment Area (SEPA) shows the considerable benefits for the European trade, bringing more transparency, security, liability, efficiency, and quality customer services. Open banking is becoming a standard that customers are getting used to.

New standards and infrastructures

Modern, open, and globally implemented standards are crucial to ensuring an instant and easy cross-border payments comparable to internal payments. The transition of payment systems in Europe, the USA, and the UK to the open standard ISO 20022 in November 2021 will push the development of integration both within and between countries.

The use of this standard will allow banks to make instant cross-border and domestic payments directly to the accounts of final recipients. It will enable the markets with the lower turnover to develop faster and reach the international level. And for larger markets, it will create conditions for making payments across the entire set of currencies in real-time within the market between banks, various payment service providers, card schemes, a gross settlement system, and local clearinghouses. Moreover, this standard will create long-term prerequisites for the introduction of new technologies in the financial industry.

4. Summary Asia-Pacific Cross Border Payments

- SWIFT largest network with over 785 Banks across APAC live on GPI

- Significant progress of cross-border enablement for retail through central banks, driven bi-lateral arrangements across the region

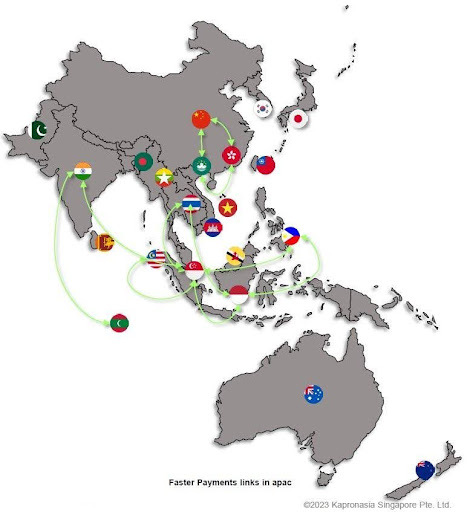

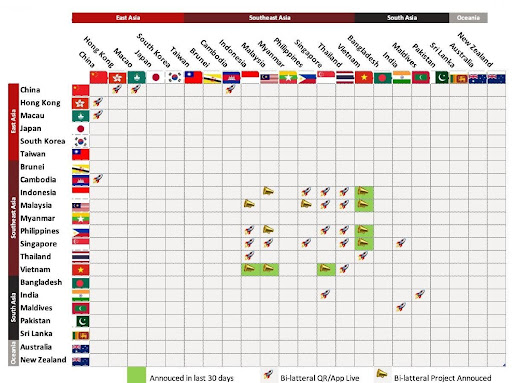

- 12 faster payments systems linked for cross border as of August 2023.

- SE Asia most active with Philippines/Malaysia, Indonesia/Philippines announced recently for QR and In app use cases

- Over 20 existing or potential multilateral wholesale platforms, most of which are regional systems

- Several wholesale projects moving from pilots into live phases

APAC bi-latteralpartnerships growing strong, however some key mature markets falling behind, with emerging market central banks leading the charge.

Low adoption remains a concern, high-cost implementation yet to find adoption and deliver volumes.

Vietnam announced in August it will connect to a number ofneighboring South-east Asian markets including Singapore, Philippines, Indonesia and Malaysia

Some of the largest economies –Japan, Korea, Taiwan, Australia, New Zealand sill lag behindon interop projects, with governments increasing pressure on central banks to start programs.

5. Vietnam’s Cross-Border Payments

Vietnam’s central bank has signed an MoU to develop its cross-border payments service system together with five other ASEAN member countries.

Vietnam is striving to improve its regional payment connectivity and facilitate the development of more transparent, affordable, trackable, and faster cross-border transactions. This has seen the emerging Southeast Asian nation sign on to an MoU with other ASEAN states to work together on a mutually beneficial cross-border payments system.

Some statistics

In 2021, there were nearly 24.7 million mobile wallet users in Vietnam, according to Statista. That number is expected to increase almost threefold by 2026, reaching around 67.6 million users.

In this vein, a Decision Lab survey in 2021, found that in over three months, 70 percent of respondents said they had used internet banking to make a payment, followed by cash (63 percent of the respondents), and 61 percent had used an ATM card or made a bank transfer.

As per Robocash research, the Vietnamese FinTech market is anticipated to reach US$18 billion by 2024. This presents a significant shift in Vietnam’s financial services sector, where faster and cheaper payment innovations are overtaking traditional payment methods.

And now Vietnamese consumers and businesses are demanding a more robust payment infrastructure to facilitate cross-border transactions that can support payments in multiple currencies.

What’s in the MoU on cross-border payments?

Under the MoU, the Vietnamese government has committed to developing cross-border payment connectivity for retail transactions, including quick response (QR) codes, instant payments, and other emerging payment models.

Vietnam’s participation in this agreement will help the country to launch cross-border payment systems, which will contribute to the development of regional trade, investment, tourism, e-commerce, and many other economic sectors.

Policy and regulations

Vietnam has established several policies for the financial services sector to assist its digital transformation.

For example, Decree 101/2012/ND-CP, dated November 2012, provides guidelines and requirements for non-cash payments in Vietnam. It covers setting up and using accounts, non-cash payment services, payment intermediary services, and organizing and managing payment systems.

There is also Decision No. 2545/QD-TTg, dated December 2016, which sets out key objectives and solutions to promote non-cash payments. It targets the changing payment habits of Vietnamese citizens, creating risk management mechanisms, and improving the transparency of payment systems. This highlights Vietnam’s ambition to become a cashless society and to transform its payment systems.

Furthermore, Decision No. 316/QD-TTg, approved by the Prime Minister in 2021, enables Vietnamese mobile phone users to use their mobile phone accounts to pay for low-value commodities and services. This policy authorizing ‘mobile money’ was dubbed a tipping point in favor of non-cash payment in Vietnam, by Pham Trung Kien, the CEO of Viettel Digital.

Indeed, Vietnamese regulators are striving to create an open and equal environment for non-cash payments for both banks and non-bank operators; however, there has yet to be a specific legal framework in Vietnam for managing cross-border payments.

Regional initiatives

There have been a number of initiatives regarding cross-border payment systems proposed and implemented in the ASEAN region. Outstanding examples are ASEAN’s Regional Payment Connectivity (RPC) and the ASEAN Payments Policy Framework (APPF).

In 2019, ASEAN adopted the APPF to provide specific guiding principles and payment frameworks for the implementation of cross-border, real-time retail payments within the region. This policy framework will help ASEAN member states enhance their financial integration and regional connectivity.

Specifically in November 2022, central banks of five ASEAN member states signed a memorandum of understanding (MoU) on cooperation in RPC to develop cross-border payments. The RPC initiative is in line with the G20’s Roadmap for Enhancing Cross-Border Payments, underscoring the advancements in payment integration in the ASEAN region.

In light of this cooperation, ASEAN countries are aiming to enhance economic growth, advance the interoperability of QR code payments, and facilitate real-time payment systems. Several programs have already been launched between ASEAN members to create instant and low-cost transfers. For instance, Indonesia and Malaysia announced the implementation of cross-border QR code payment linkages in May 2023.

Implications for relevant stakeholders

Vietnam having the fastest-growing digital economy in Southeast Asia in 2022, it provides a fertile foundation for fintech firms and cross-border PSPs to achieve scale. With Vietnam’s ascension to the agreement for cross-border transactions, stakeholders in its payments ecosystem, including non-bank payment service providers (PSPs), domestic and foreign banks, and financial market infrastructure (FMIs) companies, can move forward with expanding their products and services knowing there is a roadmap in place.

References:

- Enhancing Cross-border Payments by FSB

- Kapronasia_APAC Cross Border Payments Monitor_August2023

- Interlinking payment systems and the role of application programming interfaces a framework for cross-border payments

- The article “How do Cross-Border Payments Drive A New Paradigm?”

- The article “Vietnam’s Cross-Border Payments Infrastructure and ASEAN”

Article 1/2: Cross-Border Payments and things you need to know

Article 2/2: The trend of reshaping cross-border payments

| Exclusive article by FPT IS Expert

Author Phan Tuan Anh – Solution consultant, Consulting Center for banking and finance |