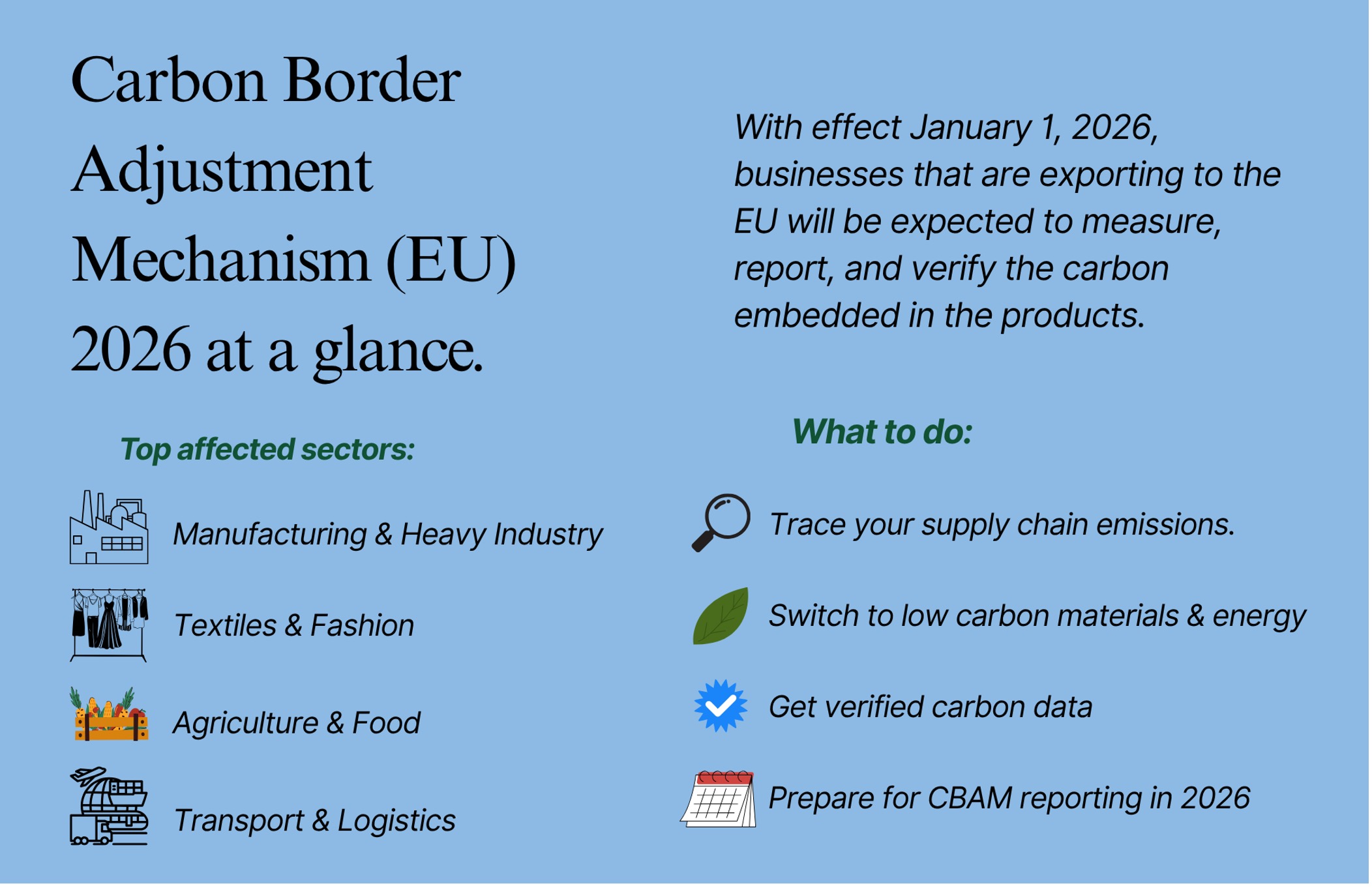

Top 4 Industries in Vietnam most affected by CBAM in 2026

The Carbon Border Adjustment Mechanism (CBAM) will be in full effect from January 1, 2026, and will greatly affect how trade is done globally. The main reason for the change in policy is to prevent any “carbon leakage” and promote cleaner production worldwide. This is done through tagging a price to the carbon emissions emitted by the goods that are brought in.

For a fast-growing export like Vietnam with strong ties to the Europe (EU) market, this means that the greenhouse gas emissions needed to be paid will be high, causing a rise in the local market prices and creating more competitiveness among businesses. While CBAM initially targeted a few main sectors, its ripple effects will soon reach more industries that drives Vietnam’s economy.

Here are four industries that will be most affected by CBAM in 2026 in Vietnam and how local businesses can adapt to stay ahead.

Manufacturing & Heavy Industry

Manufacturing comes top in this list. The EU’s initial coverage includes iron, steel, aluminum, cement, electricity etcetera, materials that are commonly used in construction and machinery industries. Even if a Vietnamese company does not export these materials directly, there will still be an impact that is felt through the higher input costs and stricter data requirements by the receivers in the EU.

Sectors like automotive and machinery manufacturing are at risk of facing rising materials cost as suppliers need to have someone foot the higher cost. The same goes for the construction and industrial goods producers, who will also have to adjust to the new expectations for verified emissions data from overseas buyers. Vietnamese companies will have to start mapping their supply chain emissions, engage partners for help on data transparency, and prepare for carbon verification requests. In global trade, carbon information will soon weigh as heavily as product quality itself.

Textiles & Fashion

Textiles and fashion remain one of the highest earning exporters in Vietnam and has been receiving more focus in the past few years. While CBAM has not yet included finished clothing in their regulations, the time and energy consumed to produce a piece of clothing is getting more attention from the EU regulators. Many European fashion brands have been applying logic similar to CBAM in their supply chains and favor manufacturers who are able to show the low-carbon operations supporting sustainability.

As EU frameworks such as the Ecodesign for Sustainable Products Regulation tighten its rules, textile producers who rely on fossil-fueled electricity or synthetic fibres will be faced with higher emissions reporting. To stay relevant and competitive, Vietnamese manufacturers must start transforming to renewable power sources and monitor their emissions across product lines while integrating sustainability metrics into their export documentation. Those who can show the results of successful reductions will gain an edge in this increasingly selective market.

Agriculture & Food

Same for agriculture and food, although they are not yet directly involved with CBAM, their exposure is growing indirectly through the high cost needed to keep the crops healthy. Vietnam’s agricultural exports rely heavily on the carbon-intensive inputs and logistics chains that will soon carry cost premiums.

The EU’s ‘Farm to Fork’ strategy and upcoming sustainability rules are gradually linking imported food products to their greenhouse gas footprints. For Vietnam’s agribusinesses, this means that being transparent about their emissions will become an essential part of doing business with Europe. Increasing fertilizer prices and energy expenses will narrow profit margins, while European buyers may prefer suppliers who can prove measurable reductions in their environmental impact. To stay relevant, exporters should start accounting for emissions released from farming to processing and explore alternatives like biofertilizers.

Transport & Logistics

The CBAM’s reach goes beyond taxing production and affects how goods are moved around the world. Whether shipping, air freight, or land logistics, all types of transportation will face a higher cost due to carbon pricing, and reporting standards will spread across the global supply chain. For Vietnam, an export-oriented economy, this presents both a challenge and an opportunity.

EU importers are now prioritizing routes that have low emission with cleaner fleets and transparent logistics data. Shipping costs may fluctuate as fuel prices and carbon-related fees evolve, forcing exporters to learn about the emissions footprint of their logistics partners. Transportation companies who can track their emissions and provide transparent data will be able to stand out from their competitors and upgrade to more efficient fleets, adopting digital tools that are able to provide real-time emission visibility. As trade systems become more focused on climate-conscious, carbon efficiency will be just as important as low cost and efficiency.

How VertZéro helps Vietnamese businesses prepare

As CBAM reshapes global trade, Vietnamese businesses now must decide how fast they will respond to this change. Each of the affected industries will face mounting pressure to improve their environmental performance. The ability to measure, verify, and communicate greenhouse gas data will soon define market access, pricing power, and long-term growth. This transition demands more than just good intentions.

VertZéro helps organizations measure, account for, and transparently report on greenhouse gas emissions that are in line with local, EU and other international standards. The software simplifies the complexity of collecting emissions data across facilities, suppliers, and logistics companies, creating clear, audit-ready reports.

Beyond reporting, VertZéro supports companies with executing their sustainability plans through identifying reduction opportunities and linking verified data with financial incentives like green loans and funds. For many companies, this transformation of compliance to competitiveness is now seen as a strategy for credibility, efficiency, and new market access. Vietnam’s exporters need VertZéro to bridge the gap of being locally and globally ready. Its solutions are built to meet international expectations and stay rooted in Vietnam’s business-reality.

In conclusion, CBAM is not just an EU regulation, but a preview of what global trade will look like in the next decade to come. Companies who adapt early will be leaders in the next wave of green growth, and VertZéro is ever ready to help local businesses get there.

References

How will the CBAM affect companies before 2026 and beyond? | Homaio. (n.d.-b). https://www.homaio.com/post/how-will-the-cbam-affect-companies-before-2026-and-beyond#what-is-the-cbam-in-the-european-union

Admin. (2025, September 23). CBAM – The EU Carbon Border Adjustment Mechanism from 2026: What Companies Need to Know – ZAZOON. ZAZOON. https://zazoon.com/cbam-the-eu-carbon-border-adjustment-mechanism-from-2026-what-companies-need-to-know/

| Exclusive article

by JOO FAITH CHNG SIN – Member of the VertZéro Greenhouse Gas Inventory solution |