FPT.eContract creates growth leverage for financial services

Recently, FPT Information System Corporation (FPT IS) has organized a webinar on “Customer experience enhancement and flexible expansion”, offering Banking – Securities enterprises a comprehensive view of the role of e-signing in enhancing customer experience.

Technology becomes an important key for the future of Banking – Securities industry

In recent years, the Securities sector has developed rapidly and explosively. By the end of June 2022, the total number of securities trading accounts on the Vietnamese market has exceeded 6,161 million, of which the number of accounts owned by domestic individuals is over 6,105 million.

According to Mr. Nguyen Xuan Viet, Chief Technology Officer, FPT IS, technology is becoming an important key of the future of the Banking – Securities industry. Technology allows transactions to be carried out in a quick and convenient way, contributing to improving the competitiveness of enterprises against competitors in the industry.

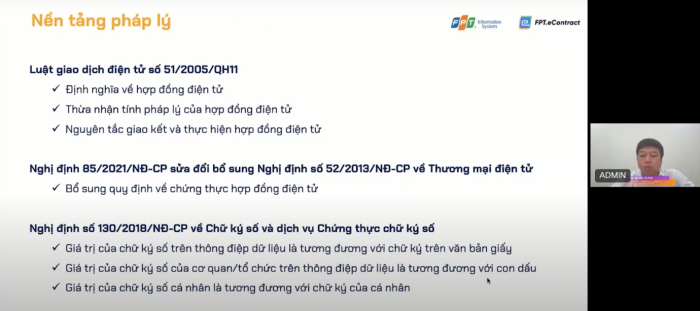

Particularly, Mr. Viet also affirms that one of the important “push” towards technology of Banking – Securities enterprises is the adoption of e-signing for daily transactions. With the e-signing method, enterprises can initiate, set up the review and signing flow to create e-contracts with complete legal validity in the shortest time with the most advanced digital signing technology.

Speaking at the webinar, Mr. Nguyen Ta Anh, Deputy Director of Electronic Service Center, FPT IS, says: “With FPT.eContract, FPT IS has affirmed its pioneering position in providing electronic contract signing solution in Vietnam. All contracts signed on FPT.eContract are authenticated with the electronic seal of the Vietnam Ministry of Industry and Trade via the CeCA. Meanwhile, FPT IS is always ready to support and accompany enterprises in the authentication process.”

Launched in 2020, FPT.eContract has been deployed in more than 1,000 enterprises and organizations, serving more than 2,000,000 users, delivering a “fresh new wind” for contract signing and management.

Mr. Nguyen Ta Anh speaks at the webinar.

FPT.eContract creates “leverage” for the Banking – Securities industry

Being aware of the importance of the adoption of electronic contracts in the Banking – Securities industry, however, enterprises still hesitate about the motivation to promote digital transformation as well as selection of service providers. The webinar on “Customer experience enhancement and flexible expansion” is part of a series of DX Quick-win seminars organized by FPT IS and its partners with the desire to pave the way for enterprises in the Banking – Securities industry on the journey of adopting electronic contracts.

Tien Phong Securities (TPS) is one of many companies in the Banking – Securities industry that has deployed the FPT.eContract solution. Towards the vision of being a technology securities company, TPS has pioneered in adopting technologies to enhance the experience of both external and internal customers.

Mr. Pham Thanh Tuan, TPS Chief Technology Officer, speaks at the webinar: “Our motivation to switch to e-contracts originates from the difficulties encountered during remote working due to the impact of the Covid-19 pandemic. Apart from distance, other issues such as printing, storage, long waiting time for signing…have also prompted us to adopt technical solutions into operation, enhancing customer experience”.

TPS achieves amazing results upon adoption of FPT.eContract.

Besides TPS, Mirae Asset Securities Vietnam (MAS) has also achieved remarkable results in digital transformation. Specifically, MAS has implemented a 100% online account opening system via digital signature, customers do not have to submit paper contracts as before. With its technology ecosystem, MAS is confident to deliver the customers the best experience with astonishing speed and convenience.

“As the number one securities company in Korea, and one of the leading securities companies in Vietnam with 10 branches in major cities, we realize the importance of adopting technology to accelerate operations and enhance operational efficiency of the company. With an extensive network, it is always in our interest to reduce the barriers related to remote signing. That is an important motivation for us to decide and adopt an e-contract solution via digital signing to the process of opening securities trading accounts. Using e-contracts via digital signing delivers increased convenience and security, customers can transact as soon as they successfully open an account”, said Mr. Ngo Dang Trieu, Deputy Director of Information Technology, MAS.

MAS delivers enhanced customer experience upon adoption of FPT.eContract.

Solution is ready-made with proven effectiveness, therefore, arousing of transformation motivation and seizing of opportunities to catch up with new technologies are what enterprises in Banking – Securities industries need to pay attention to in order to create competitive advantages in the market. FPT IS and the electronic contract solution FPT.eContract expect to be a reliable “companion” on the digital transformation journey of enterprises. Details can be found here.