Human and AI alliance creates competitive advantage in the Digital age

(Picture generated by AI – Human and AI alliance) may thanks to AI and innovators making my work more and more efficient.

“We were behind on automation and digitization, and we finally closed the gap. We don’t want to be left behind again, but we aren’t sure how to think about generative AI.” That’s the sentiment shared by executives in the latest McKinsey report of GenAI this year. One of the most repeated keywords of the technology world in 2023 is “How ChatGPT is changing the world”; after one year ChatGPT has achieved many outstanding results. 100 million users in 2 months, ChatGPT quickly became the fastest-growing app in history; Gartner predicts that 30% of outbound messages from business will be written by AI by 2025.

A report from McKinsey showed that Generative AI’s impact on productivity could add trillions of dollars in value to the global economy, estimated at $2.6 trillion to $4.4 trillion annually across the 63 use cases we analyzed—by comparison, the United Kingdom’s entire GDP in 2021 was $3.1 trillion. About 75 per cent of the value that generative AI use cases could deliver falls across four areas: Customer operations, marketing and sales, software engineering, and R&D. Generative AI will have a significant impact across all industry sectors. Banking, high tech, and life sciences are among the industries that could see the biggest impact as a percentage of their revenues from generative AI; in the Banking sector, the potential impact is also significant at an additional $200 billion to $340 billion annually if the use cases were fully implemented. After RPA which takes advantage of digitization & automation, Generative AI has the potential to change the anatomy of work, augmenting the capabilities of individual workers by automating some of their individual activities. RPA, AI & other technologies when combined have the potential to automate work activities that absorb 60 to 70 percent of employees’ time. In the digital era, the duration from a prototype to a giant is the shortest ever seen, just in one year OpenAI with ChatGPT made the race between tech giants such as Google, Microsoft, X, Meta, and Amazon, without any careful preparation. However a full realization of the technology’s benefits will take time, and leaders in business and society still have considerable challenges to address. These include managing the risks inherent in generative AI, determining what new skills and capabilities the workforce will need, and rethinking core business processes such as retraining and developing new skills.

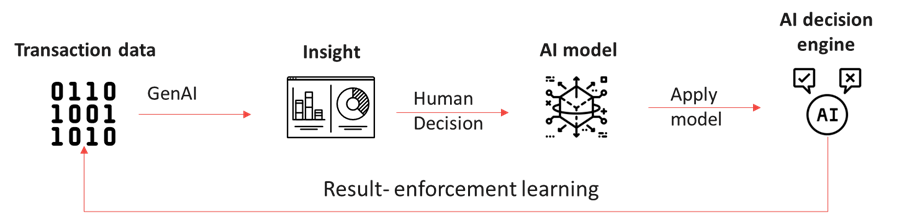

In the Banking sector, generative AI is probably still the hottest topic in the world of business; and the key takeaways from many discussions of the top leaders are “Gen AI will not change banking, but will change how banking gets done”; “AI will alter banking, but it won’t change the need for human bankers”. We can see some initial of using generative AI in banking such as: product RnD or software engineering; customer operation, marketing & sale and risk & compliance. Citi Bank is using GenAI to optimize the migration of the old framework to a modern tech stack with natural-language translation capabilities. “Humans still look at the code to make sure it’s doing what they expected it to do. They are still supervising, like a co-pilot,” he said. “The AI tool is given to the developer to enable them to produce code more quickly – it’s not replacing them. We are using AI to amplify the power of our employees.” Stuart Riley co-chief CIO of Citigroup said in the interview with Bloomberg. HSBC has introduced AI Markets, a cutting-edge artificial intelligence service designed to elevate the global connectivity of institutional investors to financial markets. Leveraging natural language processing (NLP), this innovative service aims to enrich the interaction between institutions and the markets by enabling the creation of customized analytics and providing access to HSBC’s extensive cross-asset data sets. Barclays has applied genAI to their fraud detection value-chain to reduce more than 32% fraud damage; after upgrading from a rule-based engine to an AI-powered to create fraud detection patterns from customer behaviour. Machine Learning (ML) comes in. Using ML, banks can now build behavioural-based segmentation models that look not just at demographic attributes, but at payment patterns and other human behaviours. ML enables financial services organisations to incorporate multiple features representing these behaviours into models and they can find which combination best defines targeted customer segments. Ultimately, these predictive models show the strongest combination of features/behaviours that define each group, which in turn allows more accurate risk analysis. Now GenAI can help the risk inspectors have more insightful risk identification reports, or detect new unusual transactions… new value-chain of fraud detection is created.

Barclays recognizes that AI is not a replacement for human expertise. Instead, AI serves as a powerful tool that complements the skills of human fraud investigators.

The gen AI game is on mastering where and how to leverage it, then scaling its adoption is the key to unlocking a competitive edge. But it’s a team effort – leaders must invest in building the talent and skills needed to continually experiment and outrun the pack. Gen AI is more than just technology – it’s a cultural shift. Banking leaders must champion its adoption, equipping their teams with the skills and confidence to embrace the unknown. Only then can they harness its power to stay ahead of the pack. Gen AI casts a long shadow over the C-suite, blurring the lines between value creation and industry reinvention. Leaders must step into the light and confront the questions redefining work in this AI-powered landscape. Four key questions are being asked to C-level in the report from McKinsey:

- What are the organization-wide implications of gen AI?

- Does the organization have the right technical talent and risk infrastructure in place?

- How can corporate culture enable or inhibit the adoption and usage of gen AI?

- How should organizations change their talent management approaches?

These organisation-wide questions could lead to a foundation topic – human & AI collaboration transformation, how we transform our workforce mindset, value, skill, shared value, working culture…

We agree an believe with them that the the organization of the future will be enabled by gen AI, driven by people.

Exclusive article by FPT IS Technology Expert

Luong Ngoc Khang

Director of Digital Transformation Consulting and Solution Design Center

FPT Information System Company.