Vietnam’s first Digital Financial Ecosystem that fully supports Businesses involved in both Domestic and Cross-border Trade Finance

Vietnamese companies, especially SMEs, are meeting tough challenges in obtaining loans from bank, leading to their slow capital turnover. By leveraging advanced technologies like Blockchain, Cloud, AI,… FPT IS pioneers the development of the TradeFlat digital financial ecosystem platform that fully connects banks and businesses.

1. Over 50% of businesses encounter difficulties in accessing bank loans

In today’s production value chain, companies are facing various major hurdles. One of them is the shortage of capital investment. To operate manufacturing plants as well as accelerate business activities and distribution of goods, bringing products to consumers, companies require substantial and timely funding.

However, the process of seeking, accessing and obtaining loans, especially from banks, is hugely time-consuming for businesses. The inadequacy of long-term and uninterrupted capital investment causes stagnation in business activities. According to the Provincial Competitiveness Index (PCI) survey – VCCI (2022), up to 55.6% of businesses said that access to bank loans is their biggest concern. A higher number of businesses (56.7%) expressed that they encounter difficulties in approaching bank credit.

Statistics from the Vietnamese Ministry of Planning and Investment showed that, by 2022, above 98% of businesses in Vietnam were small and medium companies, of which over 65% were of micro size. With average interest rates for short-term loans from banks offered at 9-10%/year, outstanding debt owed by small and medium enterprises (SMEs) currently accounts for just 19% of the total outstanding debt held by the entire economy. Only 17.8% of these businesses gain access to bank loans.

Capital, equity, financial capacity, and corporate governance level are the limitations of SMEs. Additionally, she pointed out that the most challenging issues for these enterprises revolve around untransparent financial data and a lack of collateral, presenting hurdles for banks to assess and consider credit approvals. Apart from the absence of collateral, failure to meet loan conditions, unaudited financial statements, etc., are also internal obstacles encountered by SMEs. This forces 12.5% of these companies to access informal credit with extremely high interest rates of up to 46.5%.

2. A comprehensive transaction platform…

TradeFlat is a revolutionary platform software solution built on the basis of online data processing and connecting with leading commercial banks in Vietnam. The solution provides superior digital financial services for businesses including Letter of Credit (L/C), Supply Chain Finance (SCF), Electronic Guarantee (eGuarantee), Business Financial Health Monitor

As a unified end-to-end transaction platform, TradeFlat supports the processing of domestic L/C, export/import L/C transactions, handles superior electronic guarantee operations and connects to the distribution management system (DMS) or ERP system of major enterprises in the production value chain, smoothening banks’ execution of working capital financing programs for suppliers or distributors in that value chain. It also allows data to be processed in real time, thereby saving storage space and ensuring high levels of security. TradeFlat is expected to create a breakthrough in the domestic L/C, import/export L/C processes, supply chain financing, and domestic and international electronic guarantees, opening up opportunities to fully connect the digital economy across Vietnam as well as promoting the expansion of cross-border cooperation.

In particular, the solution also integrates leading-edge technologies like AI, Machine Learning, and Deep Learning to evaluate and monitor financial health through big data analysis in all business evaluation and ranking activities. With this integration, TradeFlat helps speed up transactions, reduces document transfer time by 90% compared to traditional financing transaction flow, shorten the operational processing time of bank staff by 50%, and increase productivity and work efficiency by a factor of 3.

3. Opening up millions of connections for businesses and banks

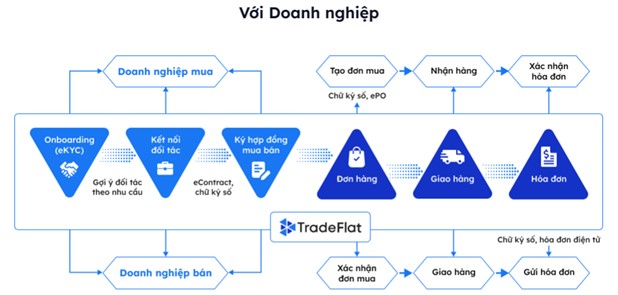

For businesses, TradeFlat connects vendors and purchasers from the first touch point until the product is consumed by the market. These businesses can carry out onboarding processes on the platform through eKYC technology. Their suitable partners will be recommended by the system based on their needs. Once the vendor and purchaser have been connected, the two parties can sign an online contract or agreement directly on the platform.

For banks, TradeFlat provides tools to connect banks with businesses in need of capital financing. Companies update their product information and their needs for funding sources from which banks will conduct assessments to find suitable customers. Documents and information about the organizations posted on the platform provide banks a good picture of the reputation and situation of businesses, empowering them to make rational cooperation decisions. If an agreement is reached by both parties, the business and the bank can sign financing contracts with FPT.eSign and FPT.eContract hassle-free.

Thanks to the data on funding programs made available by TradeFlat, companies can come up with plans for proper use of the loans received to promote their business. During this process, TradeFlat will continuously update information about the borrowers’ financial health, providing banks an overview of the businesses’ reputation and ability to pay their debts. At the end of the loan term, the platform will notify the borrowers about payment of debts, fees, and interest to the banks.

In short, all financial transactions between banks and businesses are carried out entirely on a single digital platform, minimizing the lack of information and difficulties in seeking banks for loans and product consumption partners. This helps enterprises shorten the time to access bank credit and ensure their operations, thus creating important “leverage” in promoting their business.

4. Towards a seamless operating model for cross-border financing on digital platforms

Boosting international trade digitalization is becoming an inevitable trend in global e-commerce, especially in the context that businesses are seeking opportunities to break into international markets and are driven by explicit benefits such as reduction in financing, courier and administration costs as well as the safety and speed of transfer of digital commercial documents.

A complete trade chain involves on average 6 to 10 parties, from carriers to seaports, customs, businesses and banks in different geographical locations with diverse tasks and procedures. The fragmentation and inconsistency between these activities create the need for digitalization and interconnection of operations between those parties.

The ability to operate seamlessly based on the integration between reputable, flexible and sustainable cross-border trade and trade financing platforms not only facilitates transactions and brings more economic benefits, such as assisting businesses in getting into new markets, expanding business scale and increasing revenue, but also acts as a requirement for the prestige and flexibility of each country’s global trade activities. However, accelerating the digitalization of international trade poses many challenges and risks. Companies will be under pressure to invest in technology and human resource training as well as improve their competitiveness to be able to adapt to the new business environment.

To care for these needs and obstacles, FPT IS and our TradeFlat digital financial ecosystem have made efforts towards a seamless operating model for cross-border trade financing on a digital platform:

- Participate in cross-border e-commerce promotion alliances:

Recently, the Pan-Asian E-Commerce Alliance (PAA) has officially announced FIS as its 20th member. It is the first regional e-commerce alliance in Asia that aims to provide and promote secure, reliable and efficient IT infrastructure and solutions for global commerce.

Becoming a member of PAA, FPT IS expects to partner with organizations to realize our goals of providing and promoting IT infrastructure and solutions for international trade activities. FPT IS will take full advantage of opportunities to exploit our strengths in developing and operating customs clearance and digital transformation systems for Vietnam Customs and other ministries and branches, to support international trade activities, introduce “Made by FIS” solutions on digital transformation for commercial businesses, and boost international trade: Digital financial ecosystem – TradeFlat, FPT.CA, FPT.eContract, etc.

- Integrate the processing of interoperable operations with cross-border trade platforms in countries:

The first step to reach this goal is the cooperation between the digital financial ecosystem, TradeFlat, with the leading commercial information interaction platform in Japan, TradeWaltz. The platform is invested in by large organizations in the country of cherry blossoms. The cooperation is within the framework of the Investment and Trade Promotion Grant program organized by the Ministry of Economy, Trade and Industry of Japan, aiming to innovate a trade support platform aiding in the optimization of traditional procedures.

The two platforms are developed on blockchain, which enables transparent and safe transactions. The combination of the two solutions enhances FPT IS’s desired partnerships with the Vietnamese Government and companies in connecting business opportunities and developing a comprehensive digital model of international trade activities. It also plays a part in removing barriers in the import-export process between businesses of the two countries. The deal with TradeWaltz marked the first time the “Make in Vietnam” solution cooperates with an international platform in Vietnam – Japan trade activities. The quality of TradeFlat is affirmed when it receives funding from the Japanese Government thanks to its fulfillment of all three criteria: business purpose and field help facilitate trade and reduce trade costs; highly feasible method with a team of potential experts; extensive practical experience.

Through the adoption of the most advanced technologies, TradeFlat is expected to create a comprehensive platform that connects businesses, organizations, and banks, effectively solving the problem of connecting trade financing and working capital loans, creating breakthroughs in digital financial and business services.

To learn more about TradeFlat, businesses and banks can visit: https://www.tradeflat.com/

Exclusive article by FPT IS Technology Expert

Nguyen Hong Oanh

TradeFlat Product Manager

FPT Information System Company