CBAM Compliance: A Guide to Calculating Your Emissions

In this guide, we’ll cover:

- Essential CBAM knowledge and timelines

- Strategic data selection for emissions calculations

- Tips to optimize your CBAM compliance process

1. CBAM: Understanding Implications for Businesses

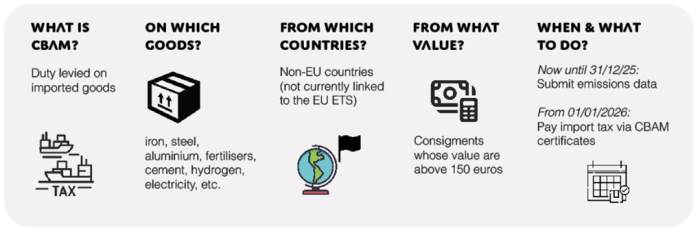

The Carbon Border Adjustment Mechanism (CBAM) is a significant new EU regulation addressing climate change and ensuring a level playing field for industries. CBAM places a carbon price on imports of selected high-emission goods (including cement, aluminum, iron and steel, fertilizers, hydrogen, and electricity). This aims to prevent “carbon leakage” and maintain the competitiveness of EU industries subject to carbon pricing under the Emissions Trading System (ETS). Businesses who export CBAM-covered goods should carefully evaluate potential financial implications of the regulation. Proactive compliance measures are essential.

Carbon Border Adjustment Mechanism (CBAM (EU Factsheet, 2024)

1.1. What imported goods are cover?

- Understanding which products are covered by CBAM is crucial for your business. Start by checking Annex I of the Regulation for the following categories:

- Iron, steel, and aluminum

- Certain fertilizers

- Cement

- Hydrogen

- Specific “downstream” products (e.g., bridge sections, rails, pipes, screws)

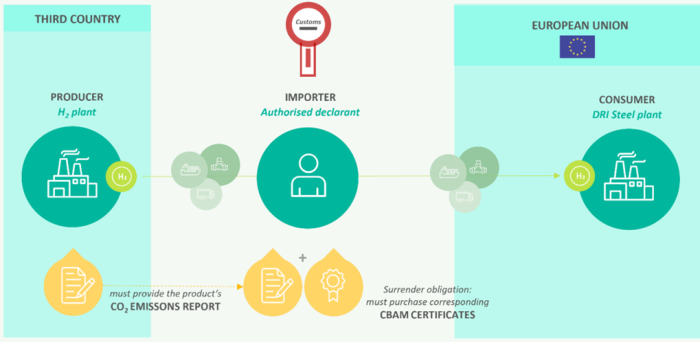

Overview of actors in the CBAM (PTX Hub, 2023)

1.2. Key Timeline and Requirements

- October 1st, 2023: Reporting initiation. Begin meticulous quarterly tracking of imported CBAM goods, production details, and emissions data.

- January 31st, 2024: First report submission covering Q4 2023 imports. Review and refine your report as needed until July 31st.

- Transitional Period (2023-2025): Streamlined reporting is permitted using default values if primary supplier data remains unavailable.

- 2026 Onwards: Financial phase commences. CBAM certificate acquisition becomes mandatory to offset imported emissions. Non-compliance risks hefty penalties.Calculating CBAM Emissions: A Strategic Guide

1.3. Carbon Price paid in a third country

CBAM Certificates

Businesses must purchase CBAM certificates to offset embedded emissions in imported goods. Certificate costs reflect the price difference between the EU ETS and any carbon pricing system in the country of origin. Accurate emissions reporting is crucial to avoid purchasing excess certificates (which are non-refundable beyond a limited amount).

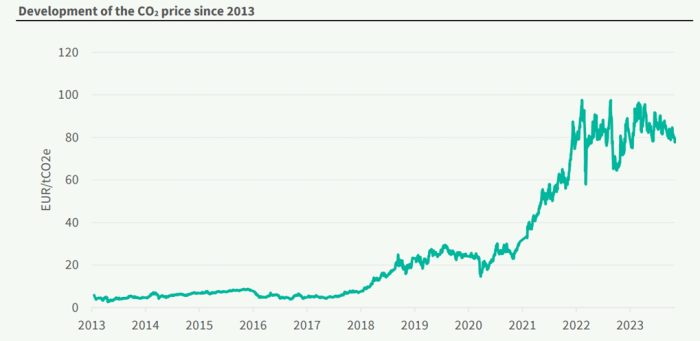

Average CO2e Price per ton (EEX, 2023)

How CBAM Impacts Producers: EU vs. Third Countries

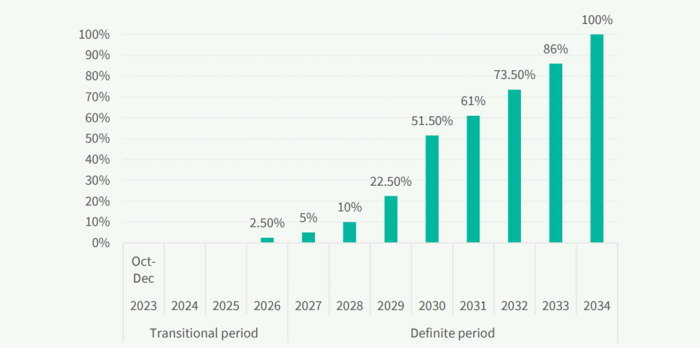

CBAM aims to level the playing field, ensuring imported goods face carbon costs similar to those produced within the EU. A reduction factor will be applied to free emissions allowances allocated under the EU ETS, phasing them out entirely by 2034.

Share of CBAM surrendering obligation (2023-2034)

Let’s consider the case of an ammonia producer. Regardless of location (EU or third country), the producer must report emissions based on their specific production methods and efficiency. Here’s the key difference:

- EU Producer: Receives a decreasing number of free emissions allowances under the EU ETS. Over time, they’ll need to purchase more allowances to cover the gap between their emissions and free allocation.

- Third Country Producer: Faces no free allocations. They must purchase CBAM certificates to offset the full emissions of their exported goods.

Overview of the share of emissions to be offset by CBAM certificates by importers compared to EU producers in different years ( Öko-Institut, 2023)

Verification

Starting in 2026, mandatory verification of CBAM declarations by accredited verifiers will be required. Verifiers ensure the accuracy of emissions calculations, with on-site visits as standard practice.

2. CBAM Reporting Step-by-Step Guideline

Calculating emissions for CBAM compliance requires a clear process. Here’s a breakdown:

2.1. Step 1: Identify Relevant Imports

Businesses should closely examine import documentation for goods covered by CBAM (iron & steel, aluminum, fertilizers, cement, hydrogen, electricity). Collaborate with customs reporting teams to obtain:

- Goods list (with CN codes)

- Import quantities

- Country of origin for each good

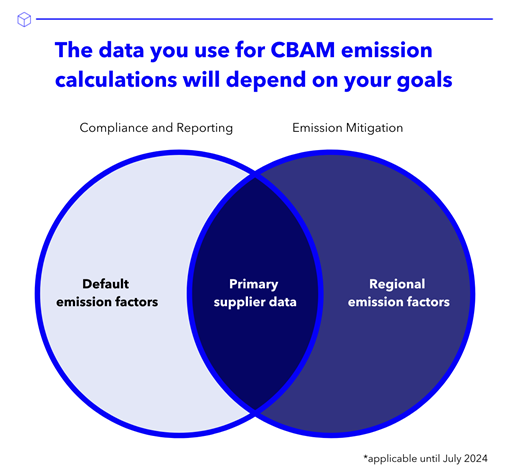

2.2. Step 2: Choosing Emission Factors for Calculation and Strategy

Three emission factor sources are available:

- Primary Data (Ideal): Obtain actual emissions data directly from suppliers.

- Default Factors (Compliance Focus): Provided by the European Commission for regulatory ease.

- Regional Averages (Insightful): Also from the EC, offering insights for emissions benchmarking and strategic decision-making.

2.3. Step 3: Deciding what Emission Factors to use:

Before July 2024: Default factors ensure compliance. To calculate emissions:

- Locate the appropriate emission factor for your goods.

- Multiply the weight of the goods (in tonnes) by the emission factor.

Beyond July 2024: Primary data from producers becomes mandatory for accurate CBAM reporting.

Different types of Emission Factors (Climatiq, 2023)

Why Data Choice Matters

While primary supplier data is the long-term goal for precise emissions tracking, here’s how to leverage default factors and regional averages in the interim:

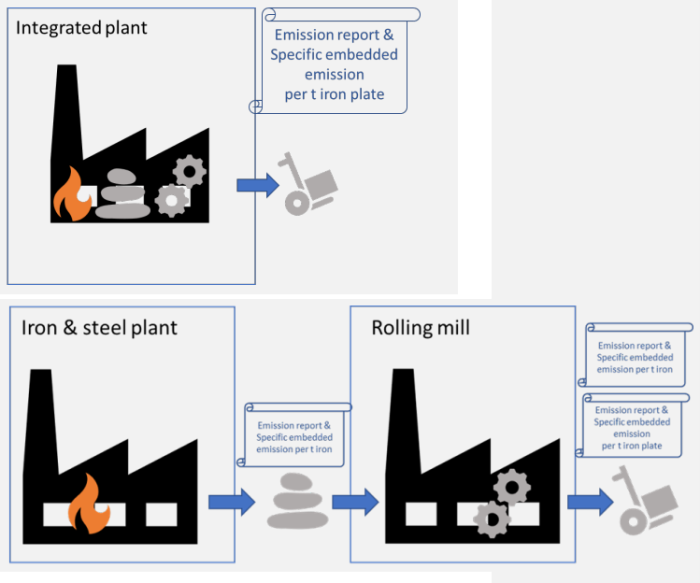

Primary supplier data: To achieve full CBAM compliance and ensure accurate reporting, closely follow European Commission guidelines. The EU mandates the use of primary supplier data – sourced directly from producers or exporters of CBAM goods – for the most precise emissions calculations. This data is essential for informed decision-making and minimizing financial liabilities come 2026.

Example of Simple and Complex Goods when collecting primary data (UBA, 2023)

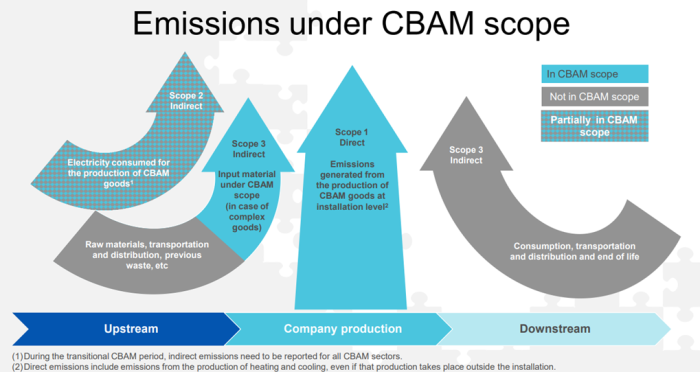

When primary data is collected, exporters need to understand the difference between Scope 1, Scope 2 and Scope 3 and which stages of product will fall under CBAM for accurate calculation.

Default Factors: In the initial CBAM reporting phase (until July 2024), businesses can utilize default emission factors provided by the European Commission (EC) when primary supplier data is unavailable. These factors offer a streamlined approach to estimate emissions for CBAM-covered goods.

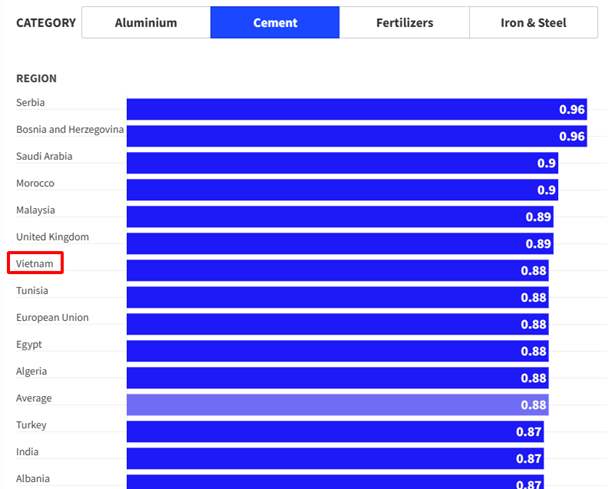

Regional Averages: Obtaining primary supplier data is crucial for precise calculations. When unavailable, regional emission factors provide a more nuanced alternative to default factors, factoring in the impact of varying energy sources and manufacturing practices

Example of Cement Emission Factor (kgCO2e/kg) by Region (Climatiq, 2023)

Default emission factors can obscure significant regional variations in carbon intensity. For example, South African aluminum production has a 76% higher emissions intensity compared to the EC’s default factor. Similarly, Chinese fertilizers have a 38% higher regional factor. Relying solely on default factors underestimates your true carbon footprint and potential CBAM costs. Regional factors provide a more accurate picture, empowering you to make informed decisions for both compliance and strategic emissions reduction.

2.4. Step 4: Aligning Goods with Emissions Factors

After selecting default or regional averages, the next step is matching your imported goods with their corresponding emissions factors. For optimal efficiency and accuracy, leverage the Combined Nomenclature (CN) coding system.

Why CN Codes Matter:

- Streamlined Workflow: CN codes are embedded in your existing customs documentation, simplifying calculations and minimizing errors.

- Automation Potential: CN-based mapping allows for automated processes, further enhancing efficiency.

- Compliance Assurance: Using this EU-standard coding system aligns with regulatory best practices.

Navigating CBAM reporting can be complex. For a seamless and stress-free experience, VertZero’s Carbon Accounting Software offers an intuitive solution. Our platform automates calculations, simplifies compliance, and provides the insights you need to make strategic emissions reduction decisions. Let VertZero empower you to tackle CBAM with confidence!

Exclusive article by FPT IS Technology Expert

Pham Tuan

VertZero Product Manager

FPT Information System Company.