The role of technology in combating money laundering and financial crime

Despite significant challenges, technological advancements and international cooperation can turn anti-money laundering systems into powerful assets in the fight against money laundering, enhancing the stability and transparency of the global financial system.

1. Increasingly complicated money laundering crime

In recent years, the global landscape of money laundering has become increasingly intricate and diverse, especially with the rise of the digital economy. The World Bank estimates that criminal activities in the US alone result in the laundering of approximately $300 to $500 billion annually. Major financial markets have implemented numerous measures to detect and combat money laundering, yet criminals continually find ways to shift their operations to less developed markets. Money laundering is not only linked to transnational organized crimes such as arms smuggling, drug trafficking, and terrorism, but also involves a myriad of complex financial transactions. Notable money laundering cases from around the globe include:

The Danske Bank scandal, one of the largest scandals in European history, was uncovered between 2017 and 2018. Investigations revealed that around €800 billion in suspicious transactions flowed through the bank’s Estonian branch between 2007 and 2015. These transactions involved funds from Estonia, Russia, Latvia, and other countries, which were then distributed to different places like China, Switzerland, and Turkey. Danske Bank, headquartered in Copenhagen, Denmark, acquired the Estonian branch from Finland’s Sampo Bank in 2007, which was subsequently used for money laundering activities. Both Danish and Estonian financial watchdogs were criticized for their failure to monitor and prevent these activities. The scandal led to the resignation of Danske Bank’s CEO and Chairman of the Board, and numerous senior employees were dismissed for non-compliance with legal obligations. Danske Bank faced investigations from various regulators and fines from Danish, Estonian, European, and US authorities. This case also prompted investigations into other banks, including Deutsche Bank, Swedbank, and Raiffeisen Bank, for allegedly aiding in the illegal transfer of money from Danske Bank.

The SEB Bank scandal involved the bank being fined SEK 1 billion (approximately $107 million) for inadequate anti-money laundering (AML) measures at its branches in the Baltic countries. SEB was accused of failing to comply with AML regulations, which facilitated potential money laundering activities through its branches. This case was part of a series of money laundering scandals involving major European banks, including Danske Bank.

The London Laundromat Case in 2021 involved a UK golden visa scheme that allegedly created a haven for dirty money. A millionaire DJ and her husband were required to repay £4 million to the National Crime Agency (NCA) after admitting to illegally bringing money into the UK through a $2.9 billion money laundering scheme known as the “Azerbaijani laundromat.” This golden visa program, offered from 2008 to 2015, attracted thousands of wealthy individuals from Russia and other former Soviet republics to the UK, particularly London. During this period, 97% of investors did not have to undergo rigorous checks on the legality of their assets. This case was part of the broader “Global Laundromat” money laundering scheme, wherein Russian nationals funneled billions of dollars into Europe, the US, and other countries from late 2010 to early 2014. Law enforcement agencies in Moldova and Latvia tracked at least $20 billion in illicit funds, with estimates suggesting the total could be as high as $80 billion. These transactions were conducted through shell companies, primarily registered in the UK, and the money was transferred through the global financial system to 96 countries, including major economies like the US, UK, Germany, France, and China, as well as smaller localities like Slovenia and Taiwan.

Faced with the growing complexity of money laundering and terrorist financing, countries around the world have been continually enhancing compliance requirements. Embargoes have become more frequent and intricate. In 2023, the US and its allies expanded sanctions against Russia, targeting revenue streams from key industries and penalizing third parties supporting Russia. US Executive Order 14114 authorizes sanctions on foreign financial institutions involved in transactions with Russia’s military-industrial base or those violating US sanctions. US agencies such as the Office of Foreign Assets Control (OFAC), the Bureau of Industry and Security (BIS), and the Department of Justice (DOJ) have intensified their investigations and enforcement actions against sanctions violations.

In Vietnam, the rapid pace of globalization and digital transformation has significantly increased the risks of financial fraud and money laundering. In June 2023, the Financial Action Task Force (FATF) placed Vietnam on its grey list due to deficiencies in its anti-money laundering and counter-terrorism financing mechanisms. This designation has adversely affected Vietnam’s international reputation and its ability to access financing. In response, the Vietnamese government has committed to strengthening its anti-money laundering measures and implementing FATF recommendations, with the aim of exiting the grey list within two years. Key measures include issuing guidelines on the Anti-Money Laundering Law, enhancing risk assessment, and improving inspection, investigation, and prosecution processes related to money laundering.

In fact, Vietnam has had an Anti-Money Laundering Law in place since 2012. However, due to the increasingly complex nature of money laundering crime, the National Assembly of Vietnam enacted the Anti-Money Laundering Law No. 14/2022/QH15 in 2022. This updated legislation expands the range of entities required to report suspicious activities and clearly defines indicators of money laundering across various sectors, including banking, payment intermediary services, life insurance, securities, and real estate.

Understanding Anti-Money Laundering (AML)

AML efforts focus on three fundamental operations as follows:

- Know Your Customer (KYC) is an AML strategy implemented by financial institutions and finance-related businesses to identify and verify their customers’ identities. The primary goal of KYC is to prevent the use of financial services for money laundering or financing illegal activities.

KYC procedures involve gathering personal details from customers such as their name, address, date of birth, and nationality. Such information is verified using identity documents like passports, identity cards, or business registration licenses. Additionally, KYC includes assessing customer risk and monitoring their financial transactions for any unusual or suspicious activities. This ongoing process ensures that risks posed by customers are continuously evaluated throughout their relationship with banks or financial institutions. Customers are evaluated at various stages: initially when they open an account or establish a relationship, when they update or amend their information, or when irregular transactions or behaviors are detected. Financial institutions must consistently update and maintain KYC information to ensure its accuracy and effectiveness.

Some criteria used to evaluate customer risk include:

| Risk Assessment Criteria | Description |

| Personal information | – Occupation |

| – Income | |

| Business | – The industry or sector in which the customer operates |

| – Level of regulatory oversight and associated risks within the industry | |

| Nationality and Residence | – Customer’s nationality |

| – Country of residence | |

| – Political stability and economic conditions prevailing in the country where the customer resides | |

| – Whether the customer’s country is on an embargo list | |

| Related risks | – Customer having transactions in high-risk areas for money laundering |

| – Customer and related entities on the list of politically exposed persons (PEPs) or individuals/organizations subject to international sanctions | |

| – History of engaging in transactions related to risky activities such as terrorist financing, drug trafficking, or organized crime |

Financial institutions must adhere to KYC regulations established by financial regulators, with violations potentially leading to significant penalties. In many countries, KYC is widely recognized as a crucial component of anti-money laundering and anti-financial crime systems.

- “Screening” involves examining and analyzing customer information, financial transactions, or any party involved in financial activities to identify risks related to money laundering or financial crime.

Screening activities typically include:

- Blacklist screening: This involves comparing information with publicly available blacklists, which list crime-related individuals or organizations, terrorist organizations, or internationally sanctioned individuals. These blacklists are provided by international organizations such as OFAC, UN, EU, and by private organizations, which typically charge fees, such as Accuity, World-check, and Dow Jones. Each country may also maintain specialized blacklists managed by agencies like the State Bank and Ministry of Public Security.

- Geographic screening: This involves identifying risks associated with areas known for higher levels of financial crime or money laundering.

- Ownership screening: This identifies the ultimate owner of a financial institution or account to prevent identity concealment.

- Transaction screening: This analyzes financial transactions to detect signs of money laundering or financial crime.

Screening activities are crucial for detecting and preventing illegal financial activities, safeguarding the financial system from risks, and ensuring compliance with anti-money laundering and financial crime laws. This helps financial institutions avoid transactions or relationships with entities listed on blacklists.

- Transaction monitoring in anti-money laundering involves the continuous surveillance and scrutiny of financial transactions to detect and prevent money laundering activities and other financial crimes. Its objective is to identify signs of unusual and suspicious activity within financial transactions, aiding financial institutions in preventing or reporting crime-related activities.

Specific activities of transaction monitoring include:

- Daily tracking of transactions: Financial activities such as money transfers, withdrawals, deposits, and securities trading are continuously monitored and recorded.

- Data analytics: Financial transaction data is analyzed to uncover patterns indicative of an unusual activity. This includes examining irregular transaction patterns, large transactions, high-frequency transactions, or transactions involving high-risk countries or regions.

- Alarm identification and management: Surveillance systems generate alarms when potentially suspicious transactions are detected. These alarms are reviewed and investigated promptly by anti-money laundering personnel. Immediate measures must be taken to verify transaction validity and prevent illicit activities.

Transaction monitoring is a multifaceted process crucial for swiftly and effectively identifying instances of money laundering.

2. Vietnam’s measures against money laundering crime

Vietnam has implemented several measures to address money laundering issue both domestically and internationally:

- Law on Anti-Money Laundering: Vietnam has enacted comprehensive legal frameworks such as the Law on Anti-Money Laundering, along with detailed decrees and regulations that guide its implementation. These laws cover AML measures like cash controls, reporting suspicious transactions, and establishing internal control systems within financial institutions.

- Enhanced Control and Monitoring: Authorities such as the State Bank, the Police Investigation Agency (Ministry of Public Security), and the SBV’s Anti-Money Laundering Department have bolstered their oversight of financial activities. This includes heightened scrutiny of financial transactions, monitoring of financial networks, and conducting investigations into suspicious activities.

- Strengthened International Cooperation: Vietnam has actively collaborated with international organizations and other countries to combat money laundering. Such cooperation involves sharing intelligence, conducting joint investigations, and participating in global forums focused on anti-money laundering efforts.

- Increased Awareness: The Vietnamese government and authorities have conducted training programs to educate stakeholders about the economic and societal risks associated with money laundering. Financial institutions are also mandated to train their personnel on anti-money laundering practices.

- Enhanced Penalties and Enforcement: Vietnam has toughened penalties and enforcement actions against individuals and entities found violating money laundering regulations. This includes imposing criminal penalties, asset forfeiture, and administrative sanctions on offenders.

Banks, in the meantime, have been proactive in updating internal policies and regulations to align with the new Anti-Money Laundering Law. They have focused on enhancing customer awareness and improving transaction monitoring to mitigate money laundering risks. Collaborating closely with regulatory agencies, banks have reviewed high-risk customer information in specific cases. Moreover, they have also intensified supervision of transactions associated with embargoed markets. Monitoring of suspicious transactions has been conducted through scenarios and manual reviews at departments and branches to identify unusual transaction patterns. However, the limitations of manual monitoring have prompted most banks to pursue the development and deployment of advanced systems for preventing money laundering and financial fraud.

3. Anti-financial crime software

Across the globe, anti-financial crime software is continually evolving to combat increasingly sophisticated criminal activities. Below are some notable solutions:

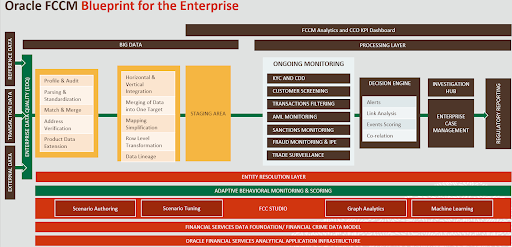

Oracle Financial Crime and Compliance Management (Oracle FCCM) stands out as an advanced tool capable of addressing various forms of financial crime. It empowers financial institutions to efficiently detect and prevent financial misconduct while ensuring operational efficiency.

With innovation at its core and expertise in next-generation technologies such as AI, ML, NLP, and graph analytics, Oracle FCCM offers numerous advantages to its users.

- Comprehensive Know Your Customer (KYC): The solution enables the identification of potential money launderers and ensures compliance with Customer Due Diligence (CDD) and Know Your Customer (KYC) regulations throughout the customer’s relationship with financial institutions. It supports rapid and accurate risk assessment. Customer information is cross-checked with global watchlists. The customer onboarding process is conducted seamlessly and swiftly.

- Effective Monitoring and Detection: Leveraging AML software and advanced analytics like AI, ML, and graph analytics, the solution detects suspicious transactions and anomalies in customer behavior. It employs pre-defined scenarios widely adopted by financial institutions worldwide.

- Efficient and Accurate Investigations: The solution optimizes the investigation and management of alarms across the financial institution. AI capabilities assist in identifying networks of suspicious entities, enabling investigators to focus on legitimate threats rather than false alarms.

- Customer and Transaction Screening: It enables precise, real-time identification of customer risks and suspicious transactions. Screening functionalities encompass checks against global watchlists, sanction lists, and lists of politically exposed persons (PEPs).

- Compliance Reporting: The solution facilitates the creation of suspicious activity reports (SARs) and suspicious transaction reports (STRs) compliant with global AML reporting standards and regulations.

Oracle FCCM is widely used in the finance and banking industry, and is highly rated for its performance and reliability. It helps organizations comply with stringent legal regulations and protects them from increasingly complex forms of financial crime.

Some international accolades and recognitions for Oracle FCCM:

In Vietnam, FPT IS has collaborated with Oracle to implement the Oracle FCCM solution at four major joint stock commercial banks known for their extensive scale and operational scope.

NICE Actimize’s AML solution focuses on entities and utilizes AI and ML technologies to optimize efficiency and accuracy, while meeting compliance and audit requirements in anti-money laundering. Key features of the solution include:

Fiserv Financial Crime Risk Management solution leverages predictive analytics to detect and mitigate money laundering, fraud, and other financial crimes. Fiserv AML Risk Manager for Financial Institutions is a robust anti-money laundering solution designed to exceed conventional transaction monitoring and ensure adherence to regulatory requirements. Key benefits for financial institutions include:

- Continuous risk management through ongoing monitoring and evaluation of customer information.

- Utilization of advanced analytics to minimize false alarms and prioritize alarms effectively.

- Screening capabilities with watch-lists for handling high-volume transactions and achieving enhanced performance.

- Enhanced operational efficiency through step-by-step alarm management and investigation with customizable workflows.

At FPT, we have developed our own anti-financial crime software called FPT.AFC, featuring the following capabilities:

- Screening and Scanning: It conducts real-time screening and scanning of customer information against blacklists or embargo lists. Results are promptly fed back to trading systems to support transaction blocking upon detection of suspicious activities.

- Transaction Monitoring: By aggregating customer transaction data and applying predefined monitoring rules and scenarios, potential fraud or money laundering activities can be identified.

- Customer Risk Assessment: The solution utilizes assessment criteria to assign risk scores to customers during account creation or periodic evaluations of existing customers.

This product has been successfully deployed and operationalized at the Mobiphone Digital Service (MDS). It is applied to transaction processes involving e-Wallets and Mobile Money, enabling immediate detection and blocking of suspicious transactions. This capability reduces false alarms, optimizes resource allocation, and lowers costs associated with investigation and verification processes.

4. Conclusion

Money laundering poses a significant global threat, severely impacting economies and national security. Criminal organizations employ sophisticated tactics to disguise the origins of illicit funds, thereby undermining financial system stability and causing societal harm. In response, the implementation of effective anti-money laundering systems is more crucial than ever.

To maximize the effectiveness of anti-money laundering efforts, close collaboration among banks, financial institutions, and regulatory agencies is essential. Coordinated sharing of information and resources can establish a robust anti-money laundering network. Moreover, raising awareness and providing ongoing training to personnel are vital for implementing effective measures against money laundering.

Despite formidable challenges, advancements in technology and international cooperation offer opportunities to enhance anti-money laundering systems significantly. By leveraging these tools, anti-money laundering application systems can become a potent force in combating money laundering crimes, thereby safeguarding the stability and transparency of the global financial system.

| Exclusive article by FPT IS ExpertAuthor Ha Thi Thanh Ngoc – Deputy Director of Data Analysis Center, Finance – Banking Division, FPT IS |