Understanding Core Banking and its development trend

-

What is Core banking?

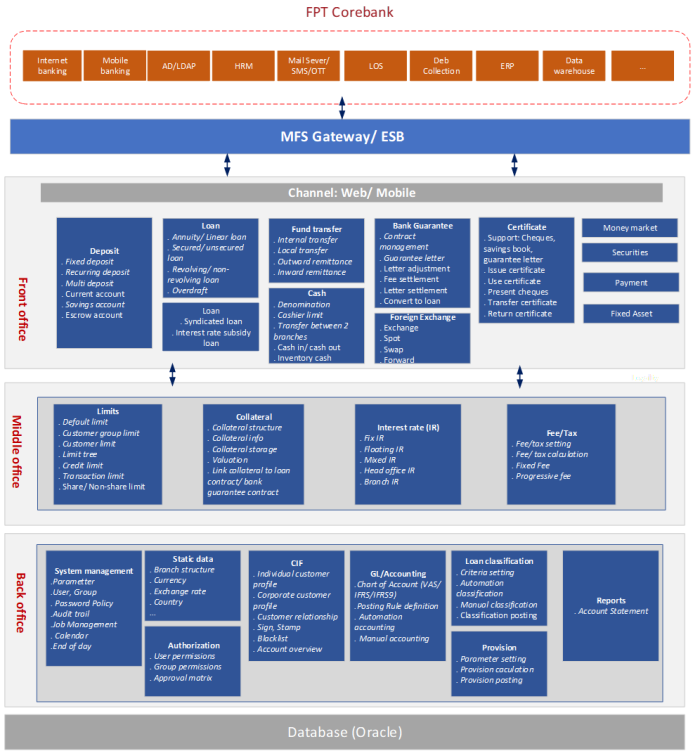

Core banking refers to the essential software system in the banking industry that manages and handles fundamental banking operations. It is integrated with various other systems within the bank to ensure seamless and efficient operations. The core banking system includes the following functions:

- Deposit management: This module handles various types of accounts, including fixed deposit accounts, demand deposit accounts, escrow accounts, and savings accounts.

- Loan management: This module supports users in managing various types of loan contracts, including line of credit, non-revolving loan, syndicated loan, interest rate subsidy loan, and overdraft loan.

- Fund transfer and payment management: This module facilitates various types of fund transfers, including internal transfers using identity papers, local interbank transfers, outward/inward remittances, and payroll services for enterprises

- Cash management: This module oversees the declaration of cash management funds (treasuries), the establishment and regulation of cashier limits, and the comprehensive management of cash balances by fund, currency, denomination, and bill eligibility for circulation. It also manages cash inflows and outflows, transfers between branches, currency exchanges between branches or with customers, ATM deposits, and the handling of issues related to counterfeit and suspected counterfeit bills, as well as sample and souvenir bills. Furthermore, it maintains inventory records by fund and currency type to ensure compliance with circulation standards.

- Foreign exchange: This module manages various foreign exchange operations, including spot, forward, swap, and internal foreign exchange transactions between departments.

- Guarantee management: This module supports various types of guarantees, including regular guarantees and co-guarantees. It also manages guarantee contracts, guarantee letters, letter adjustments and letter settlement.

- Trade finance: This module provides features for managing trade finance contracts, including contract creation, amendments, and payment/settlement operations.

- Certificate management: This module manages and tracks important certificates within the system, including those for term savings books, non-term savings books, cheques, and guarantee letters.

- Money market management: This module facilitates the management of borrowing, depositing, loan reception, and deposit reception activities between banks and their financial partners.

- Limit management: This module supports functionalities related to customer and user limits.

- Collateral management: This module oversees commitments to ensure loan performance through collateral, mortgages, and collateral linked to the loan contract or the guarantee contract of the third party

- Customer Information File (CIF) management: This module oversees the management of customer profiles across corporate and retail banking sectors.

- General Ledger/Accounting: This module establishes accounting systems, defines accounting rules, and maintains accounting books.

- Loan classification and provision: This module conducts daily loan classification as per regulatory guidelines and executes periodic provision accounting.

- System management: This module empowers administrators to execute tasks pertaining to system operations and administration.

- Product management: This module enables the definition and configuration of products.

- Fee management: This module enables the definition and configuration of fee packages.

- Interest rate management: This module allows definition and configuration of interest rate packages applicable to deposit and credit transactions.

- Integration management: This module facilitates connectivity with internal systems and external services.

- Reports: This module generates balance reports, account statements, and balance sheets to fulfill daily operational requirements.

Visual representation of a Core Banking functional model:

2. Core banking development trends

Key trends in core banking implementation globally in recent years and projected for the next five years include:

- Digital transformation and adoption of new technologies: Banks are focusing on digital transformation to enhance customer experience, increase flexibility, and strengthen competitiveness. Leveraging cloud computing technology helps banks improve the adaptability of their core banking systems. This enables them to scale infrastructure seamlessly and expand IT resources as needed without encountering hardware or infrastructure limitations. Below is a list of banks transiting their core banking systems to cloud computing:

- CitiBank: It has successfully migrated its core banking system to the cloud for enhanced flexibility and performance.

- DBS Bank: It has implemented a cloud-based core banking solution called “DBS Digibank” to deliver an advanced digital banking experience to customers.

- Santander Bank: It has integrated cloud computing technology into its core banking system to enhance flexibility and scalability.

- BBVA: As one of the leading banks in Spain, the Bank has transitioned its core banking system to the cloud to enhance flexibility and achieve cost savings.

- Standard Chartered Bank: It has implemented a cloud-based core banking solution to offer advanced and flexible digital banking services to its customers.

- Bank of America: It has initiated efforts to migrate its core banking system to the cloud, with the objective of enhancing performance and reducing operating costs.

- HSBC: It has also initiated plans to migrate its core banking system to the cloud, aiming to enhance flexibility and respond promptly to market needs.

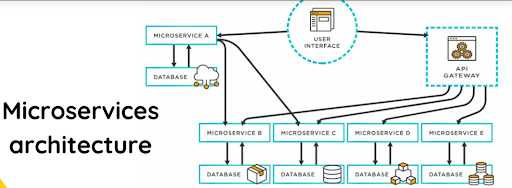

- System integration and open interface: Banks are transitioning from standalone monolithic core banking systems to architectures based on microservices and open APIs. In a microservice architecture, the application is decomposed into small, independent components known as microservices, each of which is tasked with a specific function within the system. These microservices are typically developed, deployed, and managed independently, enabling development teams to work more autonomously and flexibly. Communication between microservices occurs through APIs. Since microservices operates independently, the failure of one microservice does not impact others, thereby enhancing the system’s stability. This architectural paradigm enables the core banking’s flexible and rapid connection with external services, utility applications, and new systems. Below is an illustration of a microservice architecture:

- Centralized customer service: Core banking has transcended its traditional role of transactional processing, pivoting towards prioritizing optimal customer experiences. Banks are progressively integrating various customer communication and interaction channels, spanning from mobile applications to chatbots and self-service systems.

- Product customization capabilities: In a landscape characterized by intense competition, increased product transparency, and ongoing market dynamics, agility and speed to market are paramount for banks to seize market opportunities and meet consumer demands effectively. A pivotal aspect of Core banking lies in its product development and customization toolkit. Leveraging intuitive product development tools, banks can rapidly craft personalized products for distinct customer segments, enabling them to create unique, relevant products and swiftly introduce them to the market to gain a competitive edge.

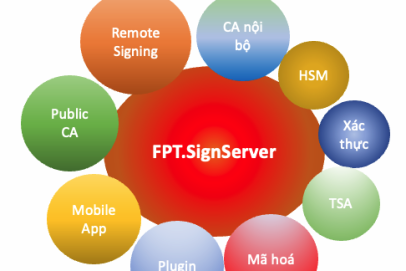

- Security and regulatory compliance: Amidst rising security threats and increasingly stringent regulatory mandates, the integration of robust security measures and regulatory compliance mechanisms into core banking systems becomes paramount.

- Focus on sustainable and social development: Many banks are now prioritizing the integration of sustainable development principles and social responsibility into their core banking solutions. This approach aims to create value for both communities and the environment. For instance:

- Green finance: Incorporate green financial products and services into core banking solutions, offering preferential loan packages to businesses and individuals engaged in sustainable projects like renewable energy, green construction, and clean transportation.

- Community support: Develop core banking features to automate the management and tracking of community support activities, facilitating more efficient provision of banking services to nonprofits and charities. This aids in amplifying the power and impact of these initiatives.

| Exclusive article by FPT IS Expert

Author Do Thi Ly – Finex financial core product manager, FPT IS |