Vietnamese enterprises under dual pressure of costs and “green” product pricing

Shoppers pause at green product shelves – while environmental awareness is rising, the “price barrier” remains the greatest challenge (Photo: VGP/QT)

The reality of Vietnamese enterprises under dual pressure

Vietnamese enterprises pursuing sustainable or “green” products face a persistent cost-price dilemma. Meeting eco-standards, whether through recycled packaging, plant-based textiles, or cleaner manufacturing, requires costly inputs and advanced technologies. The inevitable consequence is that “green” products are priced substantially higher than conventional alternatives.

At the same time, the domestic market remains highly price sensitive. Surveys show that while nearly half of Vietnamese consumers express interest in environmentally friendly goods, fewer than one-third are willing to pay a meaningful premium. When the price gap exceeds a reasonable threshold, most buyers revert to cheaper, non-green products, leaving businesses struggling to recover elevated costs and vulnerable to losing market share.

This tension highlights a core strategic paradox. On the one hand, adopting sustainable practices strengthens brand reputation, unlocks access to export markets, and positions enterprises ahead of increasingly stringent global regulations. On the other hand, it erodes short-term profitability.

The cost challenge of “green” transition

Shifting to green products is not only a strategic declaration to meet integration requirements, but also a cost challenge that extends from the initial stage through long-term operations. Enterprises must allocate significant resources to research and development (R&D) in order to redesign products, test new materials, and refine production processes to comply with environmental standards. For small and medium-sized enterprises (SMEs), the pressure on capital and cash flow is especially severe, as initial investments often exceed short-term financing capacity.

A major barrier lies in the cost of green materials, which can be up to 60% higher than conventional inputs. In addition, limited domestic supply forces companies to import, incurring extra costs for logistics, taxes, and foreign exchange risks. On the production side, most green businesses still operate on a small scale with fragmented supply chains, insufficient to achieve economies of scale. When output is low, fixed costs such as equipment maintenance, operational management, and quality control are spread across fewer units, driving up unit costs and making the “green break-even point” difficult to reach.

Financial pressures borne by enterprises in the pursuit of green transition (Photo: Internet)

Beyond production, enterprises also face the burden of compliance and certification costs. To obtain international standards such as ISO 14001, they must implement strict environmental management systems, including staff training, internal monitoring, and periodic audits. These are “hidden” but recurring expenses which, if not carefully planned, can turn into long-term financial pressures.

Market pressure & Consumer behavior

While enterprises are burdened with rising green production costs, both international and domestic markets are exerting unprecedented pressure. In export markets, global partners increasingly demand transparency in ESG reporting, strict climate accountability, and compliance with carbon standards. Vietnam has also launched a pilot emissions trading system (ETS) targeting energy-intensive industries such as steel, cement, and thermal power. Enterprises exceeding emission limits must purchase additional allowances or risk exclusion from international supply chains. From 2025, large emitters are required to submit their first greenhouse gas inventories, underscoring the growing mandate for environmental data transparency – a prerequisite for maintaining cooperation with global brands.

In the domestic market, green consumer trends are rising but remain cautious. Research indicates that around 50% of Vietnamese consumers are willing to pay up to 5% more for sustainable products, but beyond this threshold, they often revert to conventional alternatives. This highlights that while environmental awareness positively influences purchasing behavior, price remains a decisive barrier preventing broader adoption of green products.

The path forward: Breaking the “cost trap” with green finance

To escape the cycle of “rising costs – constrained pricing,” enterprises must adopt strategic and systemic solutions, with green finance playing a pivotal role. Access to preferential financing for sustainable transformation enables businesses to invest in modern technologies, optimize production processes, and, crucially, scale up operations, thereby gradually reducing unit costs.

Beyond cost reduction, green finance also equips enterprises to meet mandatory international requirements such as the EU’s Carbon Border Adjustment Mechanism (CBAM), global buyers’ ESG criteria, and Net Zero supply chain commitments. These are critical factors determining whether enterprises can sustain their positions in global value chains.

However, access to these capital flows requires enterprises to demonstrate robust capacity in emissions measurement and transparent reporting, along with clear commitments in their decarbonization roadmap. Proactively investing in emissions management infrastructure not only unlocks opportunities to secure green financing but also lays the foundation for long-term competitiveness and sustainable growth.

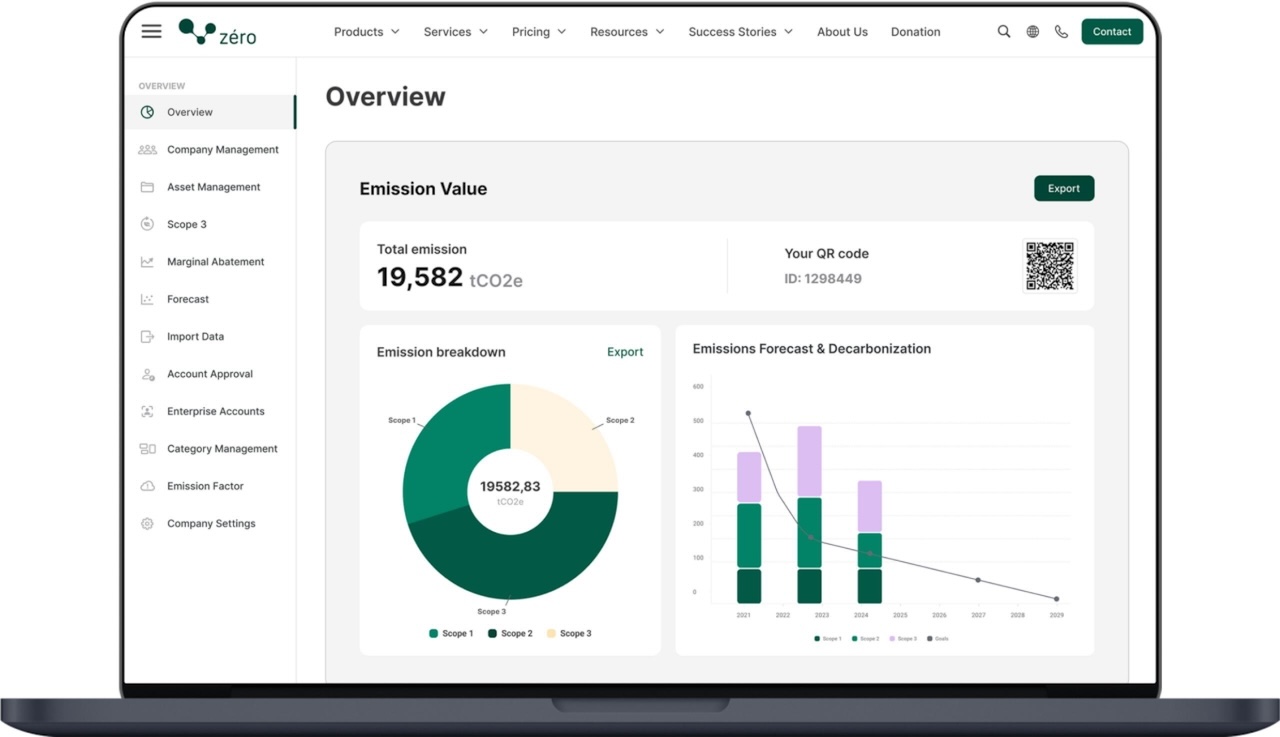

VertZéro – Carbon accounting solution supporting enterprises in accessing green finance

VertZéro helps Vietnamese enterprises ensure transparent emissions data and meet requirements for accessing green finance

VertZéro is an automated greenhouse gas inventory solution “Made by FPT” that enables Vietnamese enterprises to measure, account for, and transparently report emissions in accordance with international standards. The system automatically collects data from multiple facilities, calculates emissions across all three scopes (Scope 1, 2, and 3), and generates reports compliant with CBAM, GHG Protocol, ISO 14064-1, and others. This ensures standardized and transparent emissions data, ready for auditing or submission to regulatory bodies, thereby facilitating access to green loans.

Importantly, VertZéro has been certified by TÜV Rheinland – a globally recognized assessment organization – and is directly connected to ecoinvent, the world’s leading emission factor database. These validations guarantee accuracy and transparency throughout the inventory process, ensuring that enterprises’ emission reports meet the strictest requirements from international partners and financial institutions.

References

Le, H. (2025, September 8). Doanh nghiệp mắc kẹt giữa chi phí cho sản phẩm xanh và giá bán thị trường. Tạp Chí Kinh Tế Sài Gòn. https://thesaigontimes.vn/doanh-nghiep-mac-ket-giua-chi-phi-cho-san-pham-xanh-va-gia-ban-thi-truong/

Minh Thao. (2025a, July 31). Nhiều người tiêu dùng chuộng sản phẩm xanh nhưng ngại chi thêm tiền. Tạp Chí Kinh Tế Sài Gòn. https://thesaigontimes.vn/nhieu-nguoi-tieu-dung-chuong-san-pham-xanh-nhung-ngai-chi-them-tien/

Minh Thao. (2025b, August 9). Vật liệu xanh: Nguồn tài nguyên dồi dào nhưng thị trường ì ạch. Tạp Chí Kinh Tế Sài Gòn. https://thesaigontimes.vn/vat-lieu-xanh-nguon-tai-nguyen-doi-dao-nhung-thi-truong-i-ach/

| Exclusive article

by Members of the VertZéro Greenhouse Gas Inventory solution |