What is green loan and what is the roadmap for businesses to green financing?

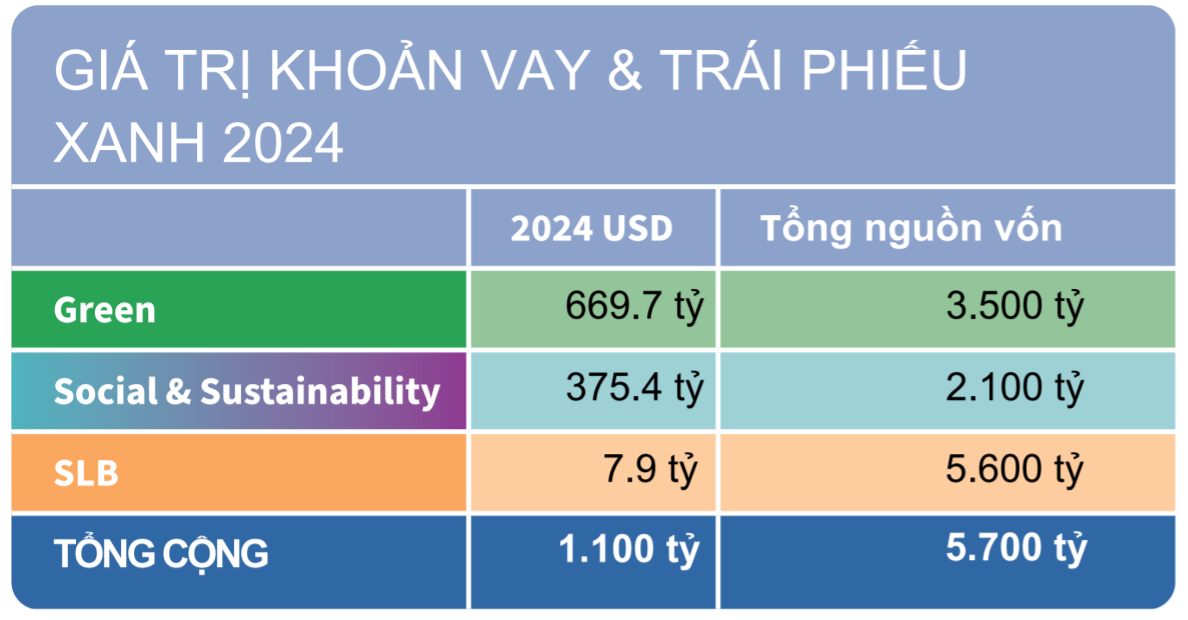

In 2024, the total value of green, social, sustainability, and sustainability-linked (GSS+) loans and bonds classified as “aligned” under the Climate Bonds Initiative standards reached USD 1.1 trillion, bringing the cumulative market value to USD 5.7 trillion (CBI, 2025). Among these, the green bond and loan segment alone accounted for over 60%, equivalent to USD 669.7 billion – the highest level ever recorded.

In Vietnam, green credit is also expanding rapidly, with total outstanding loans reaching nearly VND 637 trillion by the end of Q1/2024, primarily allocated to renewable energy, clean production, and green agriculture.

Several major commercial banks in Vietnam – including Vietcombank, BIDV, and UOB – have launched large-scale green credit programs worth tens of trillions of dong, offering interest rate incentives of up to 1–2% for projects that meet emission standards.

Source: Climate Bonds Initiative, 2024

So, what exactly is a green loan? What has been and continues to be driving thousands of businesses worldwide, from energy and manufacturing to construction and logistics, to proactively transform their models to meet sustainable finance standards and access preferential funding? More importantly, is your business falling behind in the race to restructure its capital in one of the most critical financial shifts of this decade?

The following article will clarify the concept of green loans, break down common evaluation criteria, and outline a practical roadmap to help businesses effectively access sustainable financing – both domestically and internationally.

1. What is green loan?

1.1. Green loan in accordance with international standards

Green Loan is a loan granted to finance projects that provide clear environmental benefits. According to the Green Loan Principles (GLP) issued by the International Capital Market Association (ICMA) and the Loan Market Association (LMA), a loan is considered a “green loan” when it meets the following core principles:

| Core principles | Content |

| 1. Use of capital for green purposes | The loan must be used exclusively for projects that fall under the “green” category, such as renewable energy, energy efficiency, clean transportation, green buildings, resource circularity, sustainable agriculture, and so on |

| 2. Project evaluation and selection | The enterprise must clearly describe the project selection criteria, environmental risks, and the anticipated environmental benefits |

| 3. Management of loan proceeds | Loan proceeds must be tracked separately or managed transparently to ensure they are not used for unintended purposes |

| 4. Transparent periodic reporting | The enterprise must commit to providing periodic reports to the bank on the progress of the project and the actual environmental outcomes (avoided emissions, energy savings, etc.) |

Green loans often require enterprises to be able to measure, inventory, and verify environmental indicators such as emission intensity (gCO₂/kWh), emissions reduction (tCO₂e/year), or energy savings.

In Vietnam, green credit was first introduced in the law in the 2020 Environmental Protection Law (Clause 1, Article 149), which defines it as “credit granted for investment projects that effectively use natural resources; respond to climate change; address pollution; improve the environment; restore natural ecosystems; conserve biodiversity; and create other environmental benefits.

EMASI Plus Waterpoint School, Long An province, receives VND 120 billion in green financing from Standard Chartered.

Source: Vietnamnews (2025)

2. The differences between green loans and commercial loans

Green loans are not merely a form of preferential financing – they also represent a company’s commitment to sustainable development. Below is a comparison table that highlights the differences between the two types of loans:

| Criteria | Commerical Loans | Green loans under GLP |

| Purpose of use of funds | Flexible, not limited to any industry | Must fund projects that benefit the environment |

| Techinical Requirement | Primarily based on credit and collateral. | Must have an environmental assessment report, emission quantification, or green benefits |

| Cost of capital | Interest rates depend on the credit rating | It is possible to receive an interest rate discount of 0.5% – 2% if the emission criteria are met. |

| Capital usage monitoring | Minimal requirement for in-depth reporting | Must report periodically on environmental impact and progress |

| Brand impact | No significant ESG impact | Enhancing ESG credibility, facilitating international fundraising, and gaining access to the global supply chain |

| Ability to access international funds | Low or ineligible | High, especially if there are emission certifications or transparent ESG disclosures |

2. Criteria that businesses need to meet if they want to secure green loans

Accessing green loans is not simply about ‘submitting a loan application’ – it is a process of proving that the business is creating or will create a significant positive impact on the environment, according to measurable standards. Below are the core conditions, common evaluation criteria, and common mistakes businesses need to be aware of:

3.1. Core requirement for eligibility

To have a green loan approved by banks or financial institutions, businesses must meet several foundational conditions:

Possession of “Green” project

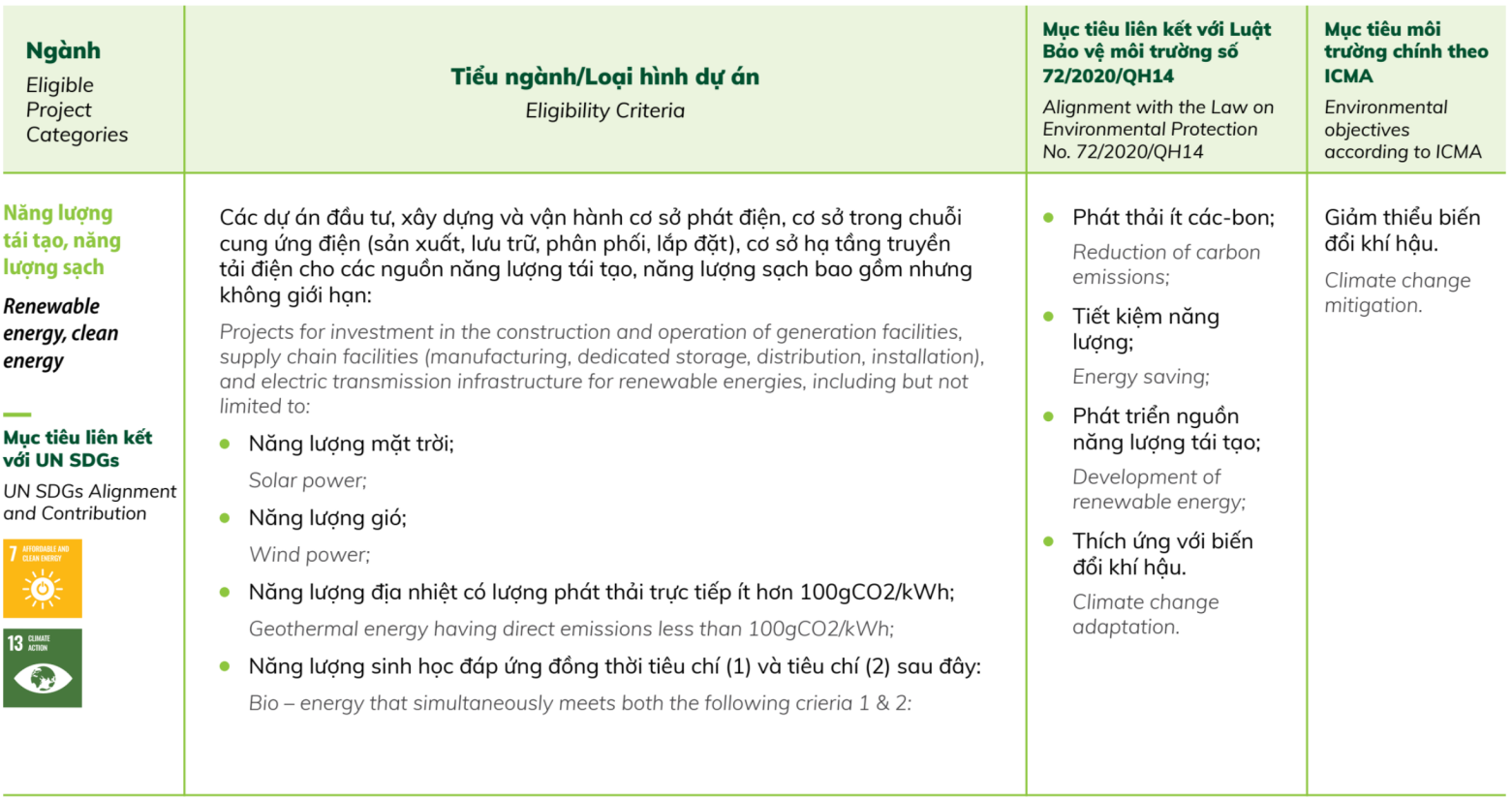

According to the Green Loan Principles (ICMA) and the green financing framework of banks in Vietnam, the industries eligible for green loans typically include:

- Renewable Energy (solar, wind, biomass)

- Energy Efficiency & Performance

- Clean Transportation (electric vehicles, green logistics)

- Green Buildings (certified with EDGE, LEED, etc.)

- Water & Waste Management, Circular Economy

- Smart Agriculture, Organic Farming, Low-Emission Practices

Some Common Green Building Certifications

Ability to measure and demonstrate environmental impact

Traditional banks require businesses to provide verifiable emission data, including:

- CO₂e/kWh Emission Intensity

- Energy Savings Ratio

- Total Annual Emission Reductions

This data typically needs to be calculated and/or verified by an independent third party. Monitoring and calculating these metrics annually to ensure eligibility for green loans requires businesses to have a team of experts familiar with environmental impact measurement and calculation standards, such as ISO 14064-1 and ISO 14067. Some companies are using the VertZéro Greenhouse Gas Inventory Software (developed by FPT IS) to calculate environmental impact and determine the feasibility of green loan programs.

Capital management and transparent reporting

Businesses need to demonstrate the ability to:

- Manage separate capital flows for green projects

- Track the proper use of funds allocated for green initiatives

- Provide regular reports to banks on progress and emission results

- Comply with environmental accounting standards, where applicable

3.2. Common criteria used of evaluation

When reviewing applications, banks typically rely on specific quantitative metrics:

| Criteria | Meaning | Example |

| Emission Intensity (gCO₂/kWh) | The emission level per unit of energy or product produced. | <100 gCO₂/kWh for approved renewable energy |

| Avoided emissions | Comparison with older technologies or baseline methods to calculate CO₂e reduction. | Using biomass instead of FO oil, reducing 1,500 tons of CO₂ per year. |

| Technical Green Certification | Enhances project reliability and accelerates the validation process | ISO 14064 (GHG inventory), EDGE, LEED (buildings), PCAF (finance) |

Note: If a business lacks the capacity to measure emissions internally, it can hire a consulting firm or use technology platforms like VertZéro to perform the process quickly, accurately, and cost-effectively

Example of Green Loan Project Criteria at Vietcombank in Vietnam

Source: Vietcombank (2024)

3.3. Common mistakes That Cause Businesses to Fail in Green Loan Applications

In practice, many businesses are not approved for green loans not due to lack of capability, but due to inadequate technical preparation:

- Lack of emission baseline: There is no data on current emission levels to compare with the new approach.

- Unable to calculate emission reduction effectiveness: Failing to demonstrate the “green impact.”

- Incomplete technical documentation: Project descriptions are unclear, lacking information on technology, production capacity, and equipment.

- Failure to provide necessary information to calculate environmental metrics.

- No independent verification: Self-reported data is often not accepted by banks or funding organizations without independent verification.

- Project lacks certification or measurement results according to international standards.

Meeting these criteria is essential for businesses not only to access green loan funding but also to enhance their credibility, making them more attractive to investors and long-term partners.

5-Step Roadmap for Businesses to Access Green Loans for the First Time

Accessing a green loan is not simply a matter of filling out an application and waiting for approval — it is a strategic journey that requires businesses to build technical capabilities and prepare transparent documentation. Below are five key steps for businesses to effectively access green financing programs, both domestically and internationally.

Step 1: Identify a Green-Eligible Project

The first step is for businesses to determine whether their project falls within the sectors eligible for green financing. According to ICMA standards and green finance frameworks adopted by banks in Vietnam, commonly eligible sectors include:

- Renewable energy (solar, wind, biomass, small-scale hydropower)

- Low-emission transportation (electric vehicles, clean logistics)

- Green buildings (new construction or retrofitting to meet EDGE, LEED certifications)

- Cleaner production (technology upgrades for energy savings and waste reduction)

- Resource and waste management

- Sustainable and organic agriculture

Step 2: Conduct a Preliminary Assessment of Emissions and Reduction Potential

Next, businesses should assess the current emissions baseline and determine the project’s potential to reduce emissions compared to the status quo.

- Calculate emission intensity: gCO₂e/kWh or gCO₂e per ton of product

- Estimate avoided emissions: the amount of CO₂ reduced annually if the project is implemented

- Benchmark against international standards: e.g., less than 100 gCO₂/kWh for renewable energy projects

Suggestion: Consider using greenhouse gas inventory software like VertZéro or engaging third-party consultants certified under standards such as ISO 14064-1 or ISO 14067 to ensure credible, independently verified results.

Step 3: Prepare Technical and Loan Application Documents

A successful green loan application requires comprehensive preparation in two aspects:

Technical and Environmental Documentation:

☑ Project description and technology drawings

☑ Input data: electricity, fuel, and material consumption

☑ Output production data

☑ Baseline analysis and emissions reduction performance

☑ Technical certifications, if available (e.g., EDGE, ISO…)

Loan application documentation:

☑ Financial plan

☑ Investment structure

☑ Debt repayment capability

☑ Legal documents of the business

Note: Some banks require independent verification of emissions reports, especially for loans exceeding VND 10 billion or those financed by international funds

Step 4: Choose the right bank and Green Loan Program

Today, many banks in Vietnam offer their own green credit programs, such as Vietcombank, BIDV, Vietinbank, UOB, and others. Each bank has different criteria, regulations, and incentives. At FPT IS, we have established partnerships with leading banks and understand their criteria and incentive programs well. If your business wants to save time and access green capital more easily, feel free to contact us.

Step 5: Monitor, Report, and Maintain Transparency

After disbursement, businesses must maintain periodic reporting (usually every 6–12 months) covering:

- Project implementation progress

- Actual emissions results

- Any newly acquired certifications

Failure to maintain transparency may result in:

- Loss of preferential interest rates

- Suspension of further disbursements

- Removal from green credit portfolios (which could harm the business’s brand image)

In a world that is rapidly advancing the green transition with strict financial standards and clear capital incentives, green financing is no longer a distant concept, it has become a strategic tool for modern businesses. Understanding the criteria, proactively measuring emissions, and standardizing technical documentation will not only help businesses access preferential capital but also enhance competitiveness across global value chains.

The green capital door is open but credit limits are finite. Businesses that act early will seize the opportunity.

If you’re unsure where to start, let us, VertZero by FPT IS accompany your journey. We’ll support your emission measurement, environmental documentation standardization, and access to green loans in line with international standards.

Contact us at the link below for a free consultation on your green credit roadmap: https://vertzero.eco/.

| Exclusive article by FPT expert

Mr Tuan Pham, Product Owner of VertZero European MBA in Climate Change. Specializing in GHG Inventory, LCA, and EU Taxonomy. In charged of VertZéro product development. |

References:

- Climate Bonds Initiative, 2024. Green Bond Market Summary Q4 2024. [online] Available at: https://www.climatebonds.net/resources/reports [Accessed 20 Apr. 2025].

- HSBC Global Research, 2023. Sustainable Financing and ESG Integration in Asia: Corporate Sentiment Survey. [online] Available at: https://www.hsbc.com/sustainability/reports [Accessed 20 Apr. 2025].

- UOB Vietnam, 2023. UOB Launches Green Real Estate Financing Programme in Vietnam. [press release] Available at: https://www.uob.com.vn/about/news.page [Accessed 20 Apr. 2025].

- Vietcombank, 2024. Báo cáo thường niên 2024 – Chương trình Tín dụng Xanh. [online] Available at: https://www.vietcombank.com.vn [Accessed 20 Apr. 2025].

- EY Global, 2023. How ESG Impacts Enterprise Valuation: Private Equity Perspectives. [online] Available at: https://www.ey.com/en_gl/esg/how-esg-creates-long-term-value [Accessed 20 Apr. 2025]

- VnExpress, 2024. Phó thống đốc: Dư nợ tín dụng xanh gần 637.000 tỷ đồng. [online] VnExpress. Available at: https://vnexpress.net/pho-thong-doc-du-no-tin-dung-xanh-gan-637-000-ty-dong-4749388.html [Accessed 20 Apr. 2025].