Newgen shakes hands with FPT IS to to digitalize lending process

Recently, FPT Information System Corporation (FPT IS) and Newgen Software (Newgen) have jointly organized a workshop themed “Accelerating credit processing with digital technologies”, exploring ways to adopt technologies into lending process at financial institutions.

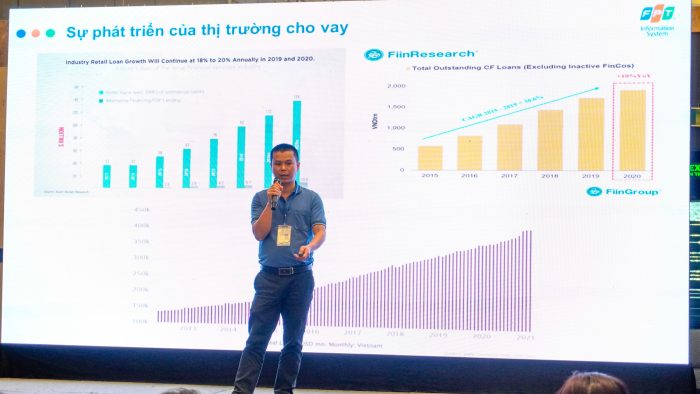

Currently, the credit market in Vietnam has seen rapid growth along with outstanding development of the economy. This poses many challenges for financial institutions since they have to adapt to changes in customer habits, rapid development of information technology, etc. In addition, the strong emergence of fintech companies and non-financial service providers in the lending market with new and technology-based operational methods also puts a great deal of pressure on financial institutions in transforming their operational methods.

FPT IS and Newgen discuss and address companies’ issues regarding digitalization of the lending process.

Responding to such situation, Newgen suggests a number of technology solutions to assist financial institutions in setting up lending process on digital platforms. With a presentation themed “New definition of digital lending process using low code”, Mr. Swaminathan Ganesan – Business Consulting Director, APAC & AZ Newgen Software – has affirmed the importance of fintech companies in conquering customers in the digital era. Digital transformation creates outstanding advantages for companies to seize opportunities and better serve Gen-Y and Gen-Z customers, who have the most demand for payment methods today. In addition, with the use of technologies, companies can effectively implement initiatives and improvements to meet the increasingly high expectations of customers.

Mr. Swaminathan Ganesan – Business Consulting Director, APAC & AZ Newgen Software – affirms the importance of fintech companies in conquering customers in the digital era.

Currently, Newgen is providing a loan origination solution built on NewgenONE – a digital transformation platform based on cloud computing and low code. NewgenONE solutions give companies the flexibility and adaptability to ensure operational efficiency in the best way. The solution allows companies to expand the scope for all types of loans, including retail, microfinance, SME, commercial, remittances, and trade finance. Furthermore, the solution ensures compliance with legal requirements and regulations, streamlining companies’ lending process by connecting the Assurance and IT Divisions, and consistently managing intermediary and supporting teams.

Delivering a presentation themed “Accelerating loan process with digital technologies” on behalf of FPT IS, Mr. Tran Anh Tuan – Senior Consultant of the Finance and Banking Sector – has given multiple suggestions to adopt technologies into lending transactions. “Deeply understanding challenges of the market, FPT IS has been developing digital solutions focusing on digitalization of important components in loan processing lifecycle, such as: Digital loan document processing system, Enterprise content management system, Record management system. Made-by-FPT solutions, including Data integration, management and exploration platform (FPT.dPlat), FPT Digital Onboarding, Remote signature (FPT.eSign), Electronic contract (FPT.eContract), Robotic process automation solution (akaBot)… have been creating an important push for Banking and Finance companies to leap forward in the race of digital transformation”.

Mr. Tran Anh Tuan – Senior Consultant of the Finance and Banking Sector, FPT IS – has given multiple suggestions to adopt technologies into lending transactions.

Tien Phong Commercial Joint Stock Bank (TPBank) is one of FPT IS’ customers who have successfully deployed and officially launched technology solutions based on big data analysis in lending transactions. Using smart search engine (Smart Search), TPBank has made remarkable improvements in appraisal process, helping users easily look up information, add or remove documents and search criteria, open documents online directly on TPBank’s ECM system. In addition, Customer Churn utility – a model that predicts the likelihood of customers to stop using products/services – has provided a multi-dimensional and more detailed view of customers’ behaviors, allowing the Bank to develop appropriate actions to minimize the number of customers likely to stop using credit card and Ebank services.

With more than 28 years operating in the field of Finance – Banking, fully understanding and solving numerous key issues, via the cooperation with Newgen, FPT IS expects to continue and accompany Finance – Banking companies on the journey of digitalization of financial transactions, turning technologies into competitive advantages.