SMEs and household businesses urged to proactively adapt to 2025 legal reforms

As Vietnam’s legal landscape undergoes comprehensive changes to keep pace with digital economic development, the recent FPT BizNext talk show “Legal Outlook 2025: Enterprises Catch the Trend – Accelerating into the New Era” drew strong attention from small and medium-sized enterprises (SMEs) nationwide. The event offered critical insights from legal, tax, and tech experts on key upcoming regulatory shifts and introduced support solutions to help businesses quickly adapt to new policies.

The online talk show “Legal Outlook 2025: Enterprises Catch the Trend – Accelerating into the New Era” featured top industry experts sharing updates on key legislation, taxation, and technology changes.

The talk show featured key speakers, including Mr. Le Duc Anh– Deputy Director of the E-commerce and Digital Economy Development Center, Vietnam E-commerce and Digital Economy Agency, Ministry of Industry and Trade; Ms. Nguyen Thi Dung– Director of D&P Vietnam Consulting and Tax Agency Co., Ltd., and Member of the Vietnam Tax Consultants’ Association; and Mr. Le Thanh Bac– Director of the Electronic Services Center at FPT Corporation.

Legal Milestone: E-Commerce Legislation Marks Major Turning Point

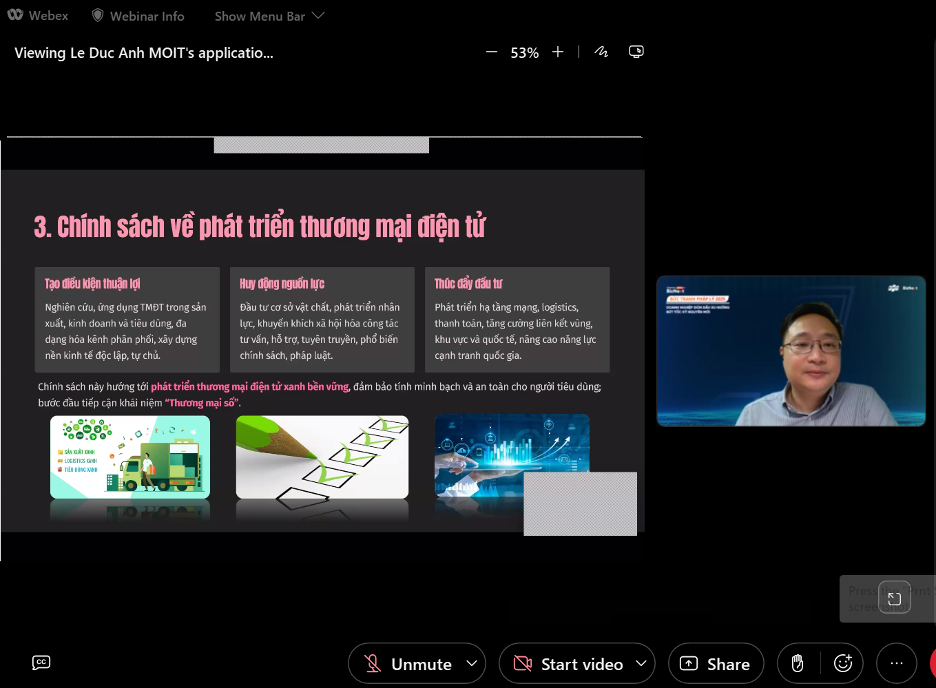

Speaking at the event, Mr Le Duc Anh– Deputy Director of the E-commerce and Digital Economy Development Center, Vietnam E-commerce and Digital Economy Agency, Ministry of Industry and Trade, revealed that the draft Law on E-Commerce is currently being developed with several groundbreaking provisions. The draft is expected to be submitted to the National Assembly in October 2025. If approved smoothly, the law could be passed within the year, marking the first time e-commerce is comprehensively codified into law in Vietnam.

Mr. Le Duc Anh– Deputy Director of the E-commerce and Digital Economy Development Center, Vietnam E-commerce and Digital Economy Agency, Ministry of Industry and Trade

SMEs and Household Businesses Urged to Adapt to Tax Policy Shifts

At the event, Ms. Nguyen Thi Dung– Director of D&P Vietnam Consulting and Tax Agency Co., Ltd., and a Vietnam Tax Consultants’ Association member – highlighted significant upcoming changes in tax policy and administration models.

According to Ms. Dung, several new tax policies are expected to take effect soon, covering transfer pricing regulations, tax management for individual businesses, risk-based oversight, and automated inspections alongside the E-Commerce Law. These shifts pose considerable challenges for tax operations and accounting processes, particularly for small and medium-sized enterprises and household businesses.

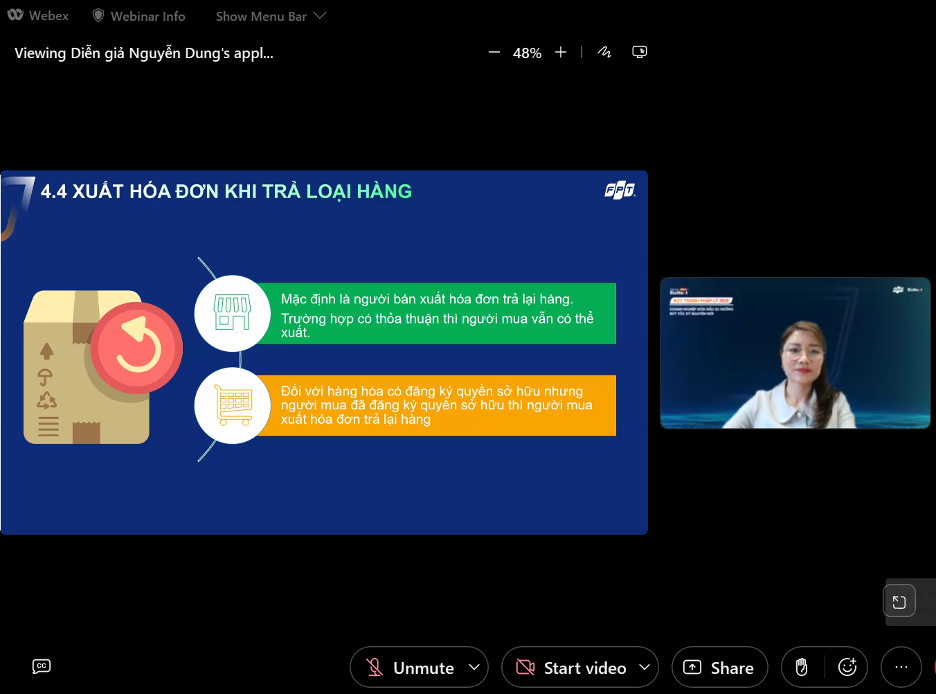

Ms. Nguyen Thi Dung – Director of D&P Vietnam Consulting and Tax Agency Co., Ltd., and Vietnam Tax Consultants’ Association member – outlined a series of notable upcoming changes in tax policies and management models.

Ms. Dung’s remarks emphasized a fundamental shift in the tax administration model toward modernization, focusing on risk-based segmentation, data integration, and full-scale digital transformation. Under this direction, businesses will need to adapt to greater transparency in declarations, adopt standardized accounting software, and proactively stay updated on their tax obligations rather than waiting for instructions from tax authorities.

She stressed: “In the future, tax compliance will not merely be an obligation, but an integral part of the risk management strategy for SMEs.” She also advised that businesses should promptly review their accounting systems, digitize financial processes, and select suitable technological tools to minimize errors and improve compliance efficiency.

FPT BizNext – Tech Solutions Supporting Business Legal Readiness

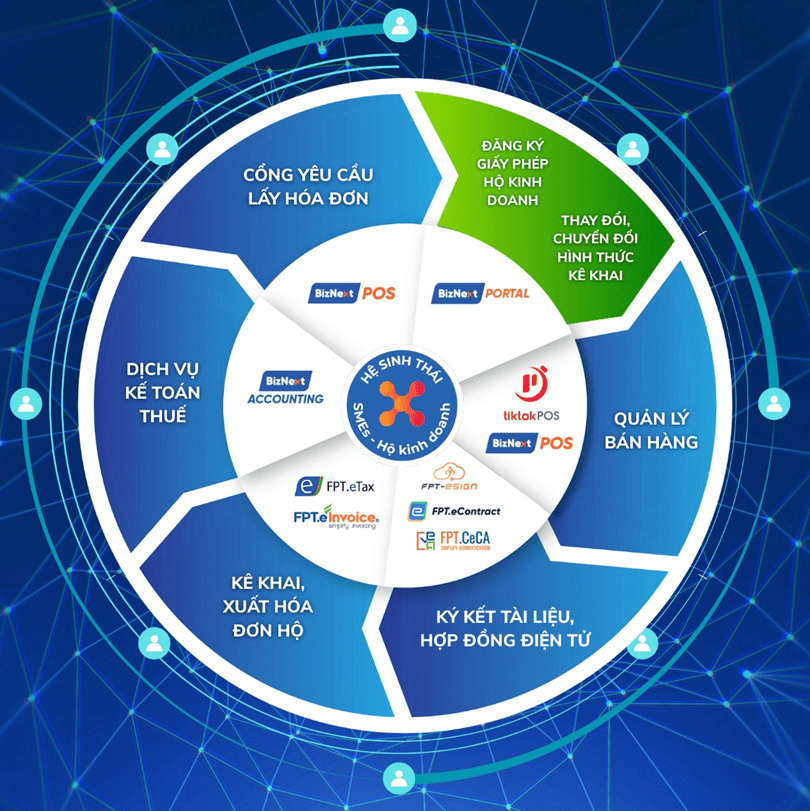

To support small and medium-sized enterprises (SMEs) and household businesses in preparing for the upcoming wave of legal changes, Mr. Le Thanh Bac– Director of the Electronic Services Center at FPT Corporation – highlighted the challenges businesses will face as the lump-sum tax regime for household businesses will be discontinued starting January 1, 2026. He introduced FPT BizNext, a comprehensive digital ecosystem designed to help businesses navigate the transition by enabling flexible operations, digitizing processes, and ensuring automated compliance with legal requirements.

FPT BizNext is a digital ecosystem that empowers businesses to operate with agility, digitize their processes, and comply with legal regulations in an automated and efficient manner.

FPT BizNext offers a full suite of essential services tailored to the needs of SMEs and household businesses, including tax, accounting, and legal support—core areas also prioritized by the Government under Resolution 198/2025/QH15, issued on May 17, 2025. These services are further reinforced by solutions such as e-invoicing, point-of-sale software, customer relationship management (CRM), e-contracts, and tax reporting tools. All components are built in compliance with the latest regulations from the Ministry of Finance, the Ministry of Industry and Trade, and the Ministry of Science and Technology. The platform enables seamless API-based data sharing with government agencies, helping businesses reduce legal risks and optimize operational costs.

“FPT aims to support all businesses, particularly SMEs, not only in their digital transformation journey but also in ensuring compliance and achieving sustainable growth. With BizNext, businesses can accelerate confidently toward full digital integration,” Mr. Bắc affirmed.

The event concluded on a high note with a dynamic Q&A session, drawing more than 50 questions from participants. This intense engagement reflected the business community’s keen interest in navigating significant upcoming changes in tax policy, e-invoicing, and the broader legal framework. Questions spanned a wide range of topics, from reorganizing accounting and tax systems to updating regulatory compliance strategies, selecting the right digital tools, and ensuring data security throughout business operations.

The discussion featured several real-world scenarios, such as whether securities firms must issue invoices for every customer transaction on the exchange; how to handle cases where buyers fail to issue return invoices within 15 days; and how electronics businesses should manage VAT invoices when selling both taxable new goods and non-taxable used items to corporate clients. Tax expert Ms. Nguyen Thi Dung thoroughly addressed these issues, providing clear explanations based on current regulations and offering practical solutions aligned with upcoming draft decrees.

Regarding questions on the legal validity of e-contracts, Mr. Le Thanh Bac (FPT) underscored the importance of digital identity verification, data integrity, and legally compliant archiving to ensure enforceability, especially in disputes. From the regulatory perspective, Mr. Le Duc Anh– Director of the Center for Informatics and Digital Technology (Ministry of Industry and Trade) – reaffirmed that e-contracts are fully recognized under Vietnamese law, and that authorities are working to enhance the legal framework to ensure consistency and protect businesses in the digital environment.

The “Legal Outlook 2025” talk show was more than just a legal update—it offered strategic insights, emphasizing that proactive adaptation to change is the key for businesses to accelerate and thrive in the new era.