A 5-Step Guide to Sustainability-Linked Loans: Insights from the Enel Group Success Story

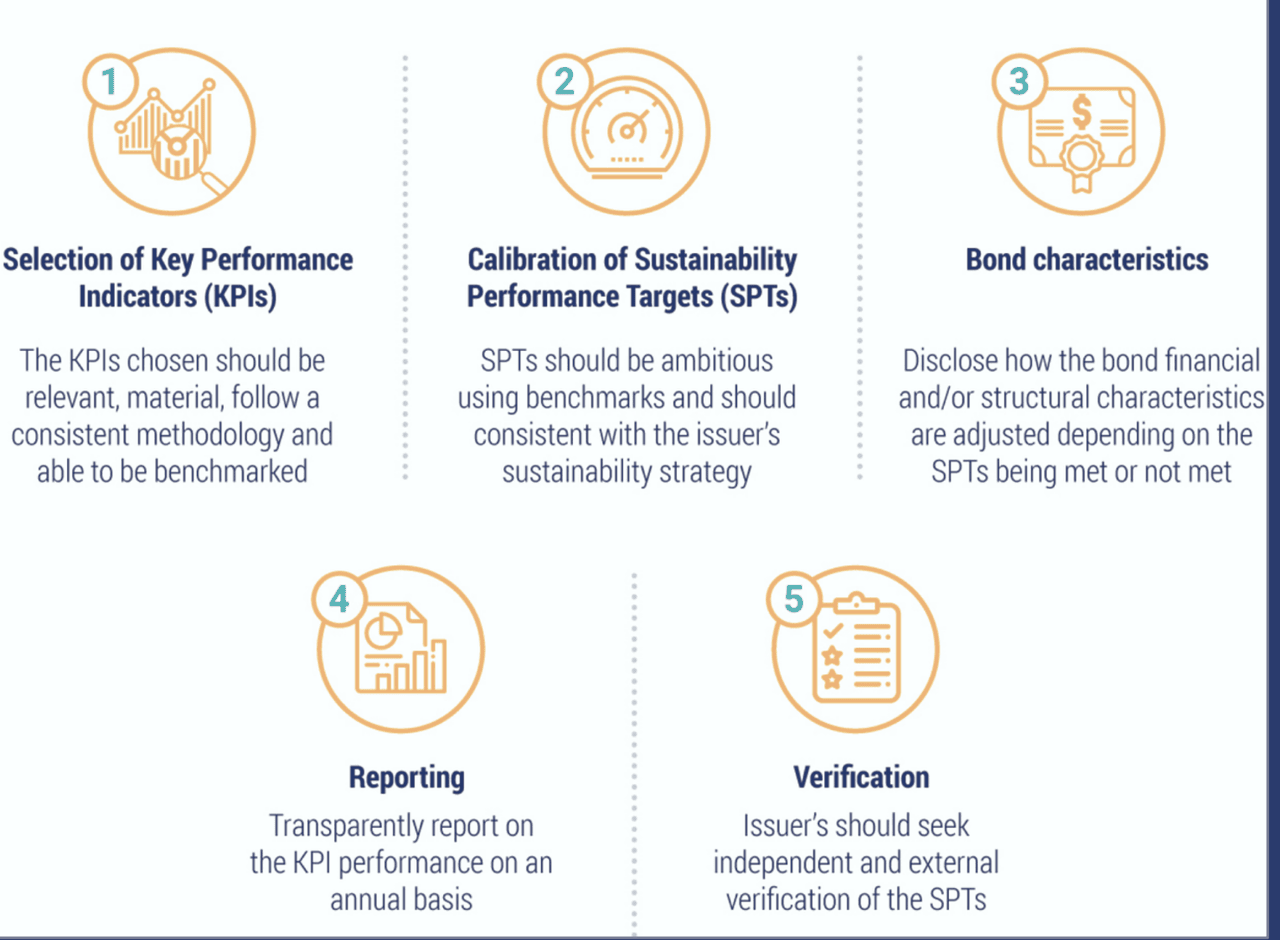

Sustainability-linked loans (Sustainability-linked loans – SLL) are becoming an important financial tool to help businesses link ESG strategies with preferential loan conditions. Unlike the traditional green lending system, SLL does not limit the target of capital use but focuses on measuring ESG performance through committed KPIs and SPTs.

To achieve success, businesses need to adhere to the principles of the Sustainability-Linked Lending Principles (SLLP) and ensure transparent measurement, reporting, and verification processes to avoid the risk of “greenwashing”.

This article will present the next 5 steps to approach a Sustainable Results-linked lending account, based on the latest benchmarks.Note: The content uses many specialized financial and ESG terms.

Terminology explained

To help businesses easily follow the content, below is a summary table of the technical specialties used in the article. Concepts are explained in a concise way according to financial and international ESG standards.

| Terminology | Explain |

| Sustainability Linked Loan (SLL) | Sustainability-linked loans: loans where financial terms (e.g. interest rates) vary based on the company achieving specific ESG goals. There is no limit to the use of funds. |

| Use of borrowed money | Targeted use loan: requires funds to be used only for specified green or social projects. |

| Environmental, Social and Governance (ESG) | Environmental (Environmental), Social (Social) and Corporate Governance (Governance) factors – a trio of criteria to assess the level of corporate sustainability. |

| Key Performance Indicators (KPIs) | Key performance indicators: number of tools that can be selected to measure a company’s ESG performance. |

| Sustainable Performance Targets (SPTs) | Sustainable performance target: Specific ESG target that the business commits to achieve over the loan term. |

| Sustainability-Linked Lending Principles (SLLP) | The Solid Linked Lending Principles issued by LMA, APLMA and LSTA guide the design and operation of international standard SLLs. |

| SLLP Guide | Detailed guide on how to apply SLLP to real account borrowing. |

| Sustainable margin adjustment | The interest rate adjustment mechanism is based on whether the enterprise achieves or fails to achieve the committed SPT. |

| External verification | Independent Verification: a third-party audit to confirm that the business achieves its KPIs/SPTs as reported. |

| Greenwashing | Greenwashing: Businesses exaggerate or misrepresent their environmental performance to gain financial advantage. |

| Declassified event | Declassification event: account creation event that is no longer considered a sustainable link, often fails to achieve KPI/SPT or violates reporting. |

| Sustainability Compliance Certificate | Solid Compliance Certification: Corporate assets are continuously deposited in the bank to report progress towards achieving KPI/SPT. |

| Verification report | ESG Determination Report: Third-party ESG independent report assessing the company’s performance on SPT. |

| Sustainability Report | Sustainability report: a publicly available (or internal) document summarizing a company’s ESG performance. |

| Conversion plan | Transformation plan: a business plan to achieve carbon neutrality or long-term ESG goals. |

| Terms of appointment | Re-judgment clause: a clause that allows KPI/SPT to be updated during the loan term if there is a major change in business operations or regulations. |

| Second Party Opinion (SPO) | Second-party assessment: independent pre-contract assessment of KPI and SPT compliance with established standards. |

| Limited Warranty | Validation limit: defined by a lower confidence level for completeness testing but still ensuring customer integrity. |

| Reasonable assurance | Reasonable form of verification: Higher assurance, compatibility testing, requires more thorough technical testing process. |

| Loan Market Association (LMA) | Loan Market Association – an international organization that sets standards for capital-efficient loan markets. |

| Asia Pacific Loan Market Association (APLMA) | Asia Pacific Loan Market Association. |

| Lending and Trading Association (LSTA) | American Loan Syndication and Transaction Association. |

To continue to have a solid loan account, businesses need to first build a solid ESG foundation. Determining the right weight indicators (KPIs) in line with the business strategy will be the first and most important step, serving as the basis for the entire process of Judging and operating the loan.

1. Build an ESG strategy and identify key KPIs

1.1. Internal Assessment: Determine the sustainability of the standard in relation to the overall business strategy

Before negotiating a sustainability-linked loan (SLL), businesses should conduct an internal assessment to identify strategic sustainability objectives that align with their long-term business plans.

As guided by the Guidance on Sustainability-Linked Loan Terms (LMA, 2024), businesses should:

- Assessing risks and ESG fundamentals across the entire value chain.

- Identify ESG issues that are important to current and future business operations.

- Align ESG goals with business development strategy.

1.2. Selecting the right KPI: Relevant – Material – Measurable – Comparable

To successfully approach a Firmware-linked loan (SLL), businesses need to start by building a solid ESG Firmware strategic foundation. As guided by the Guidance on Sustainability-linked Loan Terms (Slaughter and May, 2023), this process requires businesses to assess the content towards identifying subsequent sustainability objectives, in line with the overall business plan.

An internal assessment of ESG values requires businesses to analyze risks and solid foundations throughout the entire value chain, from production, operations, to product consumption. The ESG goals identified must be closely linked to long-term strategy and contribute to improving the sustainable competitiveness of the business. According to a McKinsey survey in 2023, 88% of CEOs affirmed that sustainability has become the center of strategy in their businesses. At the same time, BlackRock’s report also said that 70% of consultants have integrated ESG into investment decision criteria.

After identifying strategic ESG objectives, the next step is to select appropriate Key Performance Indicators (KPIs). According to the guidelines from the Sustainability-Linked Lending Principles (SLLP) and SLLP Guidelines (2023), KPIs should meet four requirements: be directly related to core business activities; be strategically important; be quantitatively measurable; and be benchmarked against common international or industry standards.

International standards such as GRI Standards, SASB Standards, TCFD Recommendations and ICMA KPI Registry are now widely used in the selection and identification of stable KPIs suitable for each discipline.

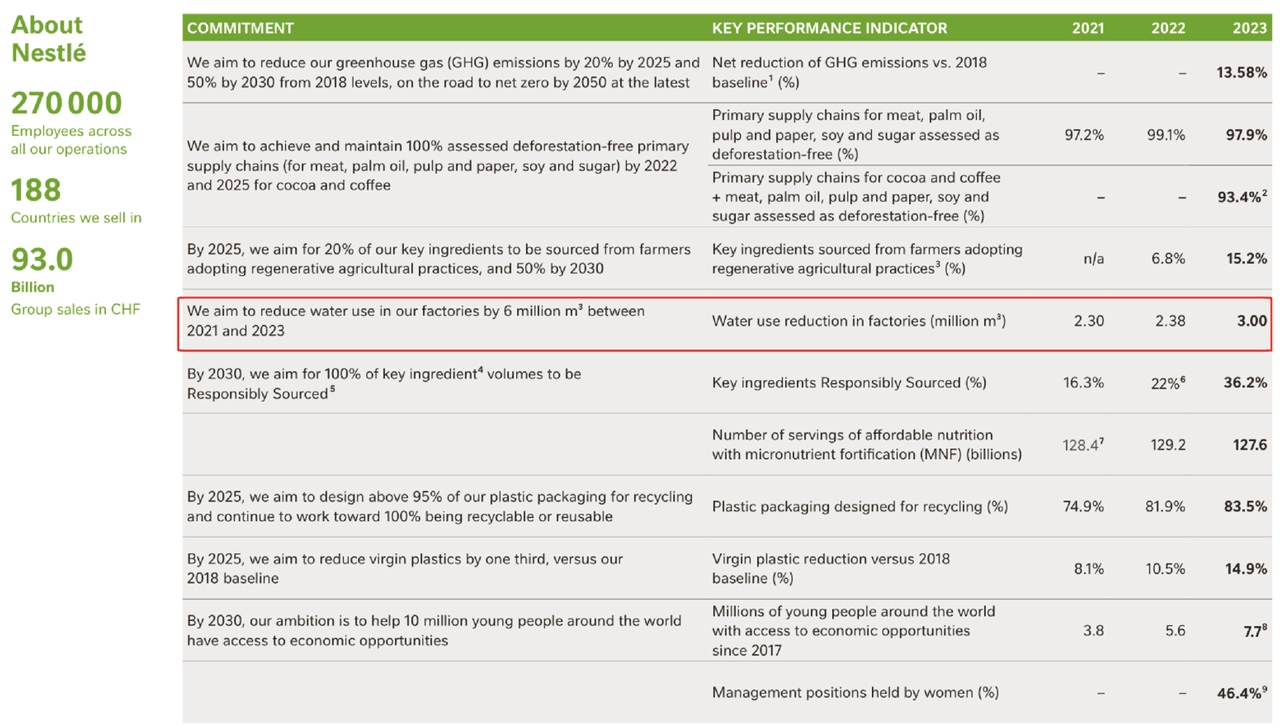

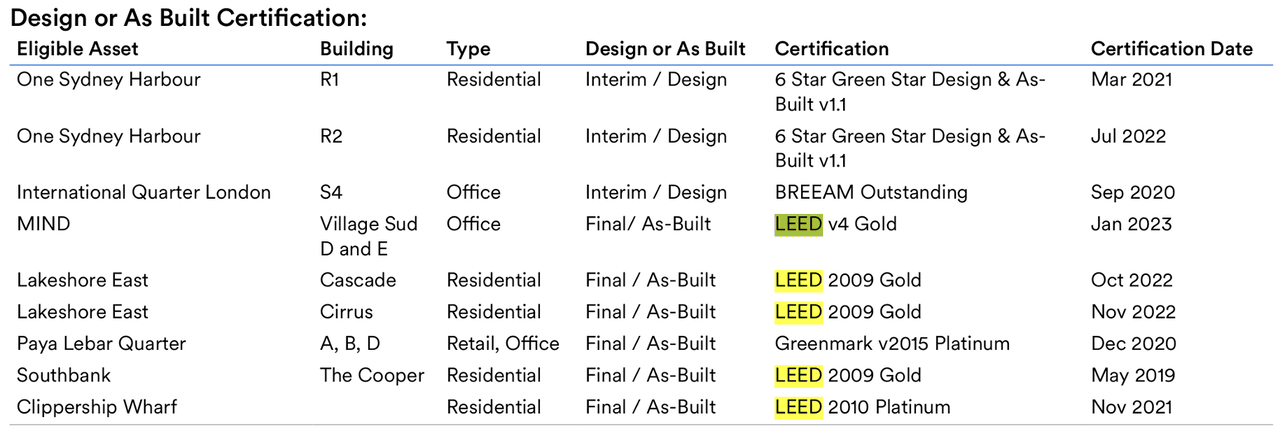

In fact, different industries have different KPIs. In large steel products, a common KPI is to reduce CO₂ emissions intensity per ton of production, referring to ISO 14404. In the food and consumer goods sector, large companies such as Nestlé aim to reduce water use per ton of product by 30% by 2030. In many real estate products, the proportion of jobs achieving certifications such as LEED Gold is chosen as an important KPI, Lending. In the banking and financial sector, organizations such as HSBC are committed to increasing the proportion of green credit in their total budget solutions portfolio, with a target of investing over USD 1,000 billion in sustainable projects by 2030. In deep technology, companies such as Microsoft are choosing to reduce Scope 2 greenhouse gas emissions by switching to 100% renewable energy for all data by 2025.

According to the EY Global Sustainability-Linked Loan Survey 2023, more than 65% of businesses choose KPIs related to carbon emissions reduction, about 20% choose KPIs related to renewable energy use, while only about 10% focus on KPIs related to social management or governance factors. This trend reflects the optimal priority for environmental indicators in the context of the global carbon neutrality target.

It can be seen that defining an ESG strategy associated with KPI tools, which can be measured and standardized internationally, is an important foundation, determining the level of success when continuing sustainable-linked loans. A clear, transparent KPI system, built on the basis of international standards, will help businesses improve their ability to negotiate with the organization’s financial functions, while affirming a commitment to a solid and responsible transformation.

2. Set ambitious Sustainable Performance Targets (SPTs)

Setting a Sustainability Performance Target (SPT) is central to the success of a sustainability-linked loan (SLL). According to the Guidance on Sustainability-Linked Loan Terms (Slaughter and May, 2023), the SPT must be clearly ambitious, i.e., above and beyond the minimum or common legal requirements.

To build a systematic SPT, each performance indicator (KPI) needs to be tied to a clear quantitative target. The SPT must demonstrate a significant improvement over the current state or baseline of the business and should be benchmarked against industry or international scientific standards. A survey by the Loan Market Association (2023) found that up to 82% of financial institutions require SPTs to exceed conventional standards to be accepted in loan applications (Loan Market Association, 2023).

International practice has recorded many typical corporate manifestations in the work of establishing ambitious SPT. Nestlé, in its 2023 sustainability report, commits to reducing water consumption per ton of product by 20% by 2025, compared to the 2020 baseline (Nestlé 2023). The energy group Enel also sets an ambitious target of using 75% of its total capacity from renewable sources by 2030 (Enel 2022).

Another important criterion highlighted in the international guidelines is the work of setting SPTs in measurement periods, usually annually , rather than setting a single target for the entire loan term. This approach helps banks and donors monitor progress, and provides a transparent basis for adjusting key financial conditions, such as the Sustainability Margin Adjustment mechanism.

For example, Microsoft in its sustainability strategy has set a goal of reducing its Scope 3 greenhouse gas emissions by 50% by 2030, with annual progress checks (Microsoft Sustainability Report 2023). The annual target divergence chart has become a new standard in the international sustainability-linked lending market, as illustrated in the S&P Global 2023 report.

In addition, the development of SPT Firmware needs to be based on reliable data. As suggested by the Guidance on Sustainability-Linked Loan Terms, businesses should use ESG operational data for at least the last three years to establish a baseline and assess improvement trends. At the same time, linking these targets to a transformation plan firmware (Transformation Plan) will enhance the visibility and commitment of businesses to the capital markets.

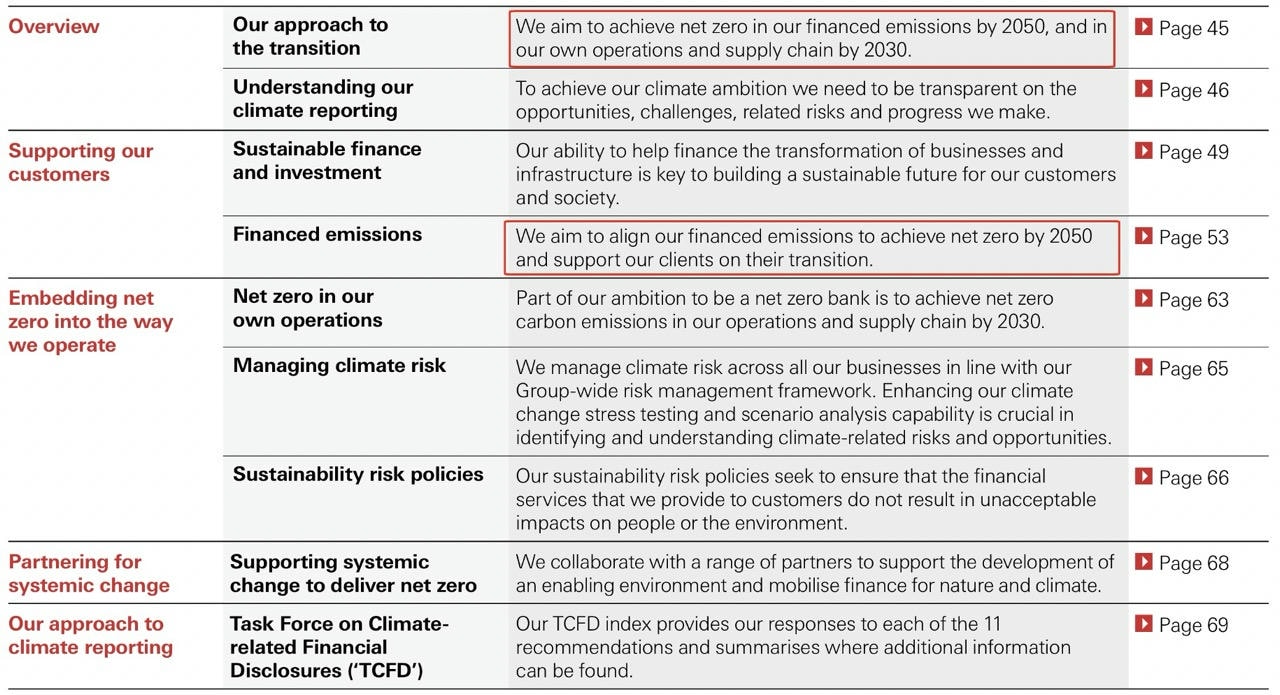

According to the TCFD 2021 guidance on transition plans, each Transition Plan should be supported by specific quantitative measurement tools that enable businesses to easily track and report on progress (TCFD 2021). SBC, in its 2023 ESG report, illustrated this by committing to reduce greenhouse gas emissions from its specialised energy finance lending portfolio by 34% by 2030, based on a 2019 baseline (HSBC ESG Review 2023).

An increasingly requested element by donors and advisors is the provision of a third-party review (Second Party Opinion – SPO) prior to the granting of a loan. According to the Guidance on Sustainability-Linked Lending Terms and International Market Implementation, the use of SPOs helps to confirm the ambition and feasibility of KPIs and SPTs, and to enhance the transparency of the loan account. Firms such as Sustainalytics, ISS ESG and Moody’s ESG Solutions are currently leading the way in providing this service.

Suggestions for Vietnamese businesses:

| Action content | Expected target |

| ESG data review for the last 3 years | Identify a solid foundation for building SPT |

| Building an ambitious SPT | Exceeding industry standards, meeting international financial support expectations |

| Split SPT by annual measurement period | Transparent progress, activating interest rate adjustment mechanism |

| Fix SPT to solid part of plan conversion | Increasing credibility for shell ESG limits |

| Implement SPO from independent organization | Enhance credibility with access to solid capital |

3. Design the precise mounting mechanism with ESG performance

After defining KPI parameters and standard performance Firmware (SPT) parameters, the next step in building Firmware Linked Loan (SLL) is to design a financial mechanism that is closely linked to ESG performance. As guided by the Guidance on Sustainability-Linked Loan Terms (Slaughter and May, 2023), this is a key element in ensuring the “linkage” between sustainability objectives and loan terms, creating a real incentive for businesses to make efforts to improve ESG throughout the loan term.

At the heart of this mechanism is the Sustainable Margin Adjustment model, under which the loan account interest rate will decrease if the business meets or exceeds the committed KPI/SPT and increase if the business fails to achieve the target. According to the Loan Market Association survey document (2023), more than 90% of current SLLs apply a margin adjustment mechanism that closely aligns ESG performance with the cost of capital [Loan Market Association, 2023].

The typical adjustment for Investment Grade businesses ranges from 2.5 to 5 basis points (bps) of the total prime interest rate. In some special cases, if the business achieves excellent ESG performance, the adjustment account can even increase to 7.5bps, especially for large-scale loans above $500 million [Bloomberg SLL Survey 2023].

Some financial institutions also apply a neutral rate mechanism, meaning that if the business only achieves average productivity – neither outperforming nor deteriorating compared to the baseline – the interest rate will remain the same, without adjusting up or down. According to the Guidance on Sustainability-Linked Lending Terms, this approach helps reduce financial pressure during short-term fluctuations, which is appropriate in a volatile market environment [Slaughter and May, 2023].

However, businesses need to pay special attention to the possible declassification event stipulated in the loan agreement. This is an event that is detected when the business seriously violates the committed KPI/SPT or fails to complete the required reporting definition. When Declassification occurs, the loan will be stripped of the “sustainable” label, leading to serious consequences such as:

- Apply higher salary by default.

- Early repayment of debt may be required.

- Loss of credibility in green capital markets.

According to Environmental Finance data (2023), although the occurrence rate of Declassification in global SLL loans is only about 3%, the negative impact on finance and brand image is very significant [Environmental Finance, 2023].

A typical example is the case of Enel energy. In its EUR 1.5 billion SLL loan with BNP Paribas, Enel agreed to a margin adjustment mechanism of ±2.5bps and committed to annual renewable energy growth targets. If the KPI on renewable electricity production is violated, the loan account will be immediately de-labeled SLL and a higher interest rate will be applied according to the 【Enel Sustainability-Linked Financial Framework, 2022】.

4. Prepare system report and independent installation

To ensure transparency and compliance with the principles of the Sustainability-Linked Lending Principles (SLLP), enterprises need to establish an annual reporting system, including: Sustainability Compliance Certificate, Sustainability Report (Sustainability Report) and Verification Report (Verification Report) from an independent third party 【Guidelines on Sustainability-Linked Lending Terms, 2023】. Annual

verification is mandatory, and enterprises need to choose reputable units such as SGS, Bureau Veritas, or TÜV SÜD. In addition, it is necessary to consider between two forms of verification: limited guarantee (limited confirmation) or reasonable guarantee (reasonable confirmation), depending on the level of requirements from financial partners and international markets.

5. Negotiation and signing of loan agreement

In the negotiation and signing of the solidity-linked loan (SLL) contract, the enterprise needs to agree on the details of the terms including: target KPI/SPT, adjustment of margin and KPI/SPT control process in case of major changes in business operations (“Rendez-vous Clause”) 【Guidelines on Sustainability-Linked Loan Terms, 2023】.

It is important to ensure a clear Declassification mechanism, a definition tool that can modify KPI/SPT (according to the consensus ratio such as majority lenders or all lenders) and full reporting and post-audit requirements.

According to international practice, the contract should refer to the draft LMA 2023 draft Terms template, and flexibly adjust according to each actual transaction 【Guidelines on Sustainability-Linked Loan Terms, 2023】.

Example of KPI / SPT / Interest Rate Adjustment Mechanism

| Content | Detail |

| KPI and target SPT | KPI: Scope 1 Emission Reduction (kg CO₂e/unit of product) Baseline: 200 kg CO₂e/tonne (2023) SPT: 180 kg CO₂e/tonne (2025); 160 kg CO₂e/tonne (2027) |

| Adjust amplitude | Meet SPT 2025 → decrease 5 bps Exceed SPT >10% → decrease another 2.5 bps Fail SPT → increase 5 bps |

| Terms of appointment | If there is integration, large regeneration structure → quickly and adjust KPI/SPT as agreed |

| Declassification mechanism | If serious violation → loan is withdrawn as ‘sustainable’, normal interest rate applied |

| KPI/SPT Amendment Regulations | KPI/SPT revisions need to be supported by a maximum number of bank accounts (66.67%) agreeing |

| Identify reporting and post-production checks | Annual ESG Report + Third-party Verification Report (SGS, Bureau Veritas) |

| Contract Template | Refer to the Draft LMA 2023 Terms and Conditions template and customize according to the transaction reality |

6. Suggestions for Vietnamese enterprises from Enel case study

6.1. Tie KPIs to key, quantifiable ESG goals

Enel selects two core KPIs:

- Scope 1 greenhouse gas emissions reduction (gCO₂/kWh of product).

- Increase the ratio of renewable energy installations to total capacity.

Choosing KPIs as core business activities (power generation) and directly measurable helps Enel easily define baselines, build medium-term and long-term targets, and facilitates the reporting process.

Suggestions for Vietnamese businesses:

It is recommended to select 1–2 most important KPIs that are directly related to core business activities (e.g. emissions, water consumption, energy efficiency), ensure they are measurable, verifiable, and linked to the SDGs or Vietnamese regulations such as the National Strategy on Green Growth.

6. 2. Build a clear presentation of the SPT in each stage

Enel does not specify an ultimate goal but sets annual white blood cell counts as:

- CO₂/kWh emissions are reduced to 148 g in 2023, 140 g in 2024 and 82 g in 2030, aiming for 0 g in 2040.

- Increase the proportion of renewable energy capacity from 58% (2021) to 66% (2024), 80% (2030) and reach 100% by 2040.

A clear target analysis makes it easy for Enel to track progress, activate the interest rate adjustment mechanism (Margin Adjustment), and at the same time be able to realize the best commitment on the market.

Suggestions for Vietnamese businesses:

When building SPT, it is necessary to divide the overall goals into green columns or every 2 years. This is in line with the requirements of the bank, and helps businesses adjust their operating strategies when there are economic activities or policy changes.

6. 3. Commitment to independent verification of performance

Enel is committed to having its KPIs and SPTs evaluated by independent third parties such as DNV GL and KPMG, and to publishing the results in its annual Sustainability Report.

Suggestions for Vietnamese businesses:

It is advisable to seek out independent verification partners (e.g. SGS Vietnam, Bureau Veritas Vietnam) early to support periodic assessment and enhance the reliability of SLL loan applications.

6.4. Design of the main financial adjustment mechanism (Sustainability margin adjustment)

In its loans and solidly linked bonds, Enel identifies:

- If SPT is not achieved, interest rates will increase (increasing profit margins).

- If the SPT is exceeded, in some cases the interest rate will decrease (diminishing margin).

Enel’s main financial adjustment mechanism (Enel, 2024)

Example of interest if ENEL KPIs are met/not met (Enel, 2024)

Suggestions for Vietnamese businesses:

It is necessary to propose in the loan application: if the KPI/SPT is achieved or exceeded, the business will receive preferential interest rate reduction; if not achieved, the interest rate will be increased. This is an approach widely applied by international banks such as HSBC, Standard Chartered, BNP Paribas.

6.5. Build the Firmware for the conversion plan (Conversion Plan) to accompany SPT

Enel jointly announced a detailed transformation plan until 2040: running out of electricity, stopping the sale of natural gas, investing 210 billion euros in renewables and digitalizing the electricity network.

Suggestions for Vietnamese businesses:

In addition to SPT, businesses should prepare a Transformation Plan linked to Net Zero or green transformation targets (for example, committing to 30–40% renewable electricity consumption by 2030, or reducing water use by 20% by 2028).

Enel – one of the world’s largest energy corporations – has successfully applied the Sustainable Performance Target (SPT) model in its Sustainability-Linked Loans (SLL) and created a great impact on the global green finance market. From Enel’s practice, Vietnamese enterprises can refer to the following lessons to effectively build and operate SPT:

Setting ambitious sustainability performance targets (SPTs), anchoring them in transparent financing mechanisms, and operating a regular reporting and verification system are key factors for businesses to successfully access sustainability-linked loans (SLLs). Lessons from international corporations such as Enel show that only businesses with a solid ESG profile, reliable data, and a commitment to transparency can make the most of the green financing incentives offered by global capital markets.

In Vietnam, FPT IS and the VertZero platform are ready to accompany businesses throughout this entire management process – from consulting on building KPI/SPT, designing emission measurement systems, preparing ESG standard reports, enabling independent verification support and preparing sustainable loan applications. With experience in developing digital ESG solutions according to international standards, VertZero is committed to becoming a strategic partner to help Vietnamese businesses access green financial opportunities, enhance their reputation in the global market and successfully implement the sustainable transformation process.

|

Exclusive article by FPT IS Technology Expert Mr. Tuan Pham – PhD Candidate in Climate Finance in Europe, Director of VertZéro Greenhouse Gas Inventory Solutions |

References:

- (2023) Sustainability-linked loans: A growing green finance phenomenon. Available at: https://www.bloomberg.com/professional/blog/sustainability-linked-loans-a-growing-green-finance-phenomenon/ (Accessed: 30 April 2025).

- (2022) Sustainability-linked financial framework: January 2022. Available at: https://www.enel.com/company/investors/fixed-income/sustainability-linked-bonds (Accessed: 30 April 2025).

- Environmental Finance. (2023) Green Loans and Sustainability-Linked Loans 2023: Strong Outlook but Challenges Remain. Available at: https://www.environmental-finance.com/content/analysis/green-loans-and-sustainability-linked-loans-2023-outlook-strong-but-challenges-remain.html (Accessed: 30 April 2025).

- (2023) Global Sustainability-Linked Loan Survey 2023. Available at: https://www.ey.com/en_gl/climate-change-sustainability-services/sustainability-linked-loans (Accessed: 30 April 2025).

- Guide to Sustainability-Linked Loan Terms (Slaughter and May). (2023) Borrower’s Guide to Sustainability-Linked Loan Terms. Available at: https://www.slaughterandmay.com/media/k2eozb1b/guide-to-sustainability-linked-loan-terms-august-2023.pdf (Accessed: April 30, 2025).

- (2023) ESG Review 2023. Available at: https://www.hsbc.com/-/files/hsbc/investors/hsbc-results/2023/annual/pdfs/hsbc-holdings-plc/240221-esg-review-2023.pdf (Accessed: 30 April 2025).

- Loan Market Association (LMA). (2023) Sustainability-linked lending principles 2023. Available at: https://www.lma.eu.com/sustainable-lending/sustainability-linked-loan-principles (Accessed: 30 April 2025).

- McKinsey & Company. (2023) The Green Business Opportunity for Southeast Asia. Available at: https://www.mckinsey.com/capabilities/sustainability/our-insights/the-green-business-opportunity-for-southeast-asia (Accessed: 30 April 2025).

- (2023) Microsoft Sustainability Report 2023. Available at: https://www.microsoft.com/en-us/corporate-responsibility/sustainability/report (Accessed: April 30, 2025).

- Nestlé. (2023) Creating Shared Value and Sustainability Report 2023. Available at: https://www.nestle.com/sites/default/files/2024-02/creating-shared-value-sustainability-report-2023-en.pdf (Accessed: 30 April 2025).

- S&P Global. (2023) Sustainability-linked loan guidelines increase pressure for ambitious targets. Available at: https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/sustainability-linked-loan-guidelines-increase-pressure-for-ambitious-targets-71130239 (Accessed: 30 April 2025).

- Working Group on Climate-related Financial Disclosures (TCFD). (2021) Guidance on Metrics, Targets and Transition Plans. Available at: https://www.fsb-tcfd.org/publications/tcfd-guidance-on-transition-plans/ (Accessed: 30 April 2025).

- (2023) Overview of the Second Party Opinion Process. Available at: https://www.sustainalytics.com/corporate-solutions/sustainable-finance/second-party-opinion-sustainability-linked-loans (Accessed: 30 April 2025).