FPT presents ecosystem of digital, green, and AI transformation solutions for the banking sector to the Prime Minister

Recently, at the Digital Transformation Day of the Banking Sector in 2025, FPT showcased the Made by FPT – Future Now with AI ecosystem. With a platform centered around AI technology, combined with a comprehensive solution ecosystem, FPT is committed to accompanying banks in the goal of mastering data, making intelligent decisions, and directing green credit flows.

Digital Transformation Day of the banking sector in 2025

The Digital Transformation Day of the banking sector in 2025 was jointly organized by the Banking Times and the Payment Department, under the direction of the State Bank of Vietnam. With the theme “Smart Digital Ecosystem in the New Era,” the event demonstrated the industry’s strong determination to enhance customer experience, foster inter-sectoral connectivity, and ensure information security on a fully digital platform.

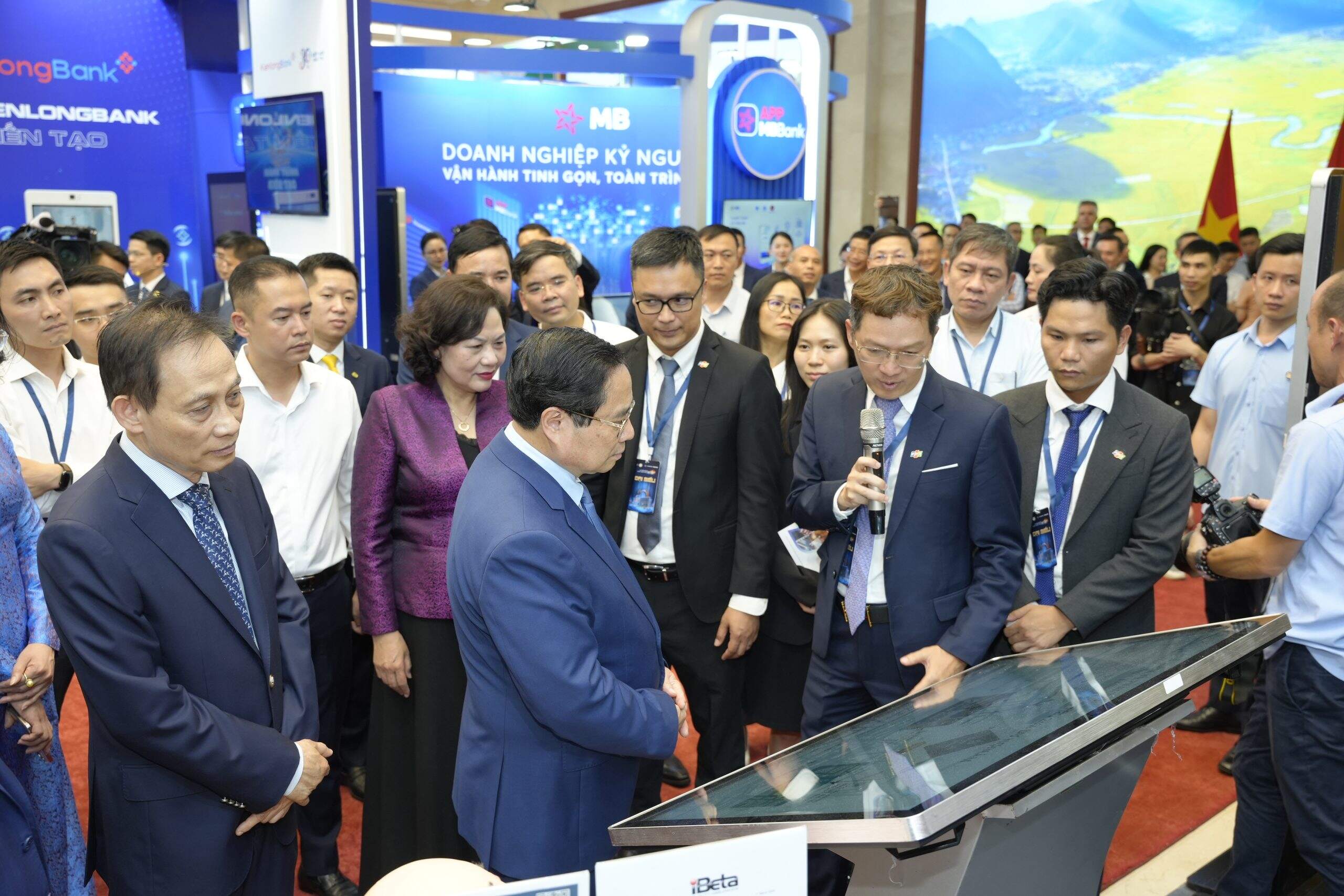

Prime Minister Pham Minh Chinh and delegates visiting FPT’s booth

The event was attended by Prime Minister Pham Minh Chinh; Comrade Le Hoai Trung, Party Central Committee Secretary and Chief of the Party Central Office; Comrade Nguyen Thi Hong, Member of the Party Central Committee and Governor of the State Bank of Vietnam; Comrade Phan Van Mai, Member of the Party Central Committee and Chairman of the National Assembly’s Economic and Financial Committee; along with leaders from ministries, agencies, international organizations, financial institutions, corporates, and enterprises.

Speaking at the event, the Prime Minister stated: “Digital transformation in the banking sector in the coming years will facilitate better connections between commercial banks, the people, businesses, and the Government. This transformation will contribute to rapid and sustainable national development; foster a digital government, society, and citizenship; and help maintain macroeconomic stability, control inflation, ensure growth, and balance key economic indicators. Effective digital transformation, with active public participation, will lower operational costs for the banking sector and bring tangible benefits to citizens and businesses, while also helping to reduce corruption and negative practices.”

FPT’s booth at the event

The Digital Transformation Day of the Banking Sector in 2025 featured participation from leading banks and tech enterprises, notably FPT. At the exhibition, Mr. Tran Dang Hoa – Chairman of FPT IS, FPT Corporation introduced the Prime Minister and delegates to cutting-edge technologies promoting targeted and green credit, a breakthrough in improving safe, accurate financial access for both citizens and businesses.

Amid the government’s 2025 goals of 16% credit growth and 8% GDP growth, banks face the challenge of not only growing but growing selectively, safely, and effectively. In reality, capital is not scarce—what matters is its timely, targeted, and appropriate disbursement.

On the topic of targeted credit and fraud prevention, Mr. Hoa explained that with smartphones, chip-based citizen IDs, and digital signatures, people can easily apply for loans from home. Banks can implement top-tier ISO-standard eKYC systems, AI assistants, and automation robots to verify, analyze, and process applications in under 10 minutes, doubling labor productivity. To date, FPT has supported 13 million chip ID authentications and 95 million facial verifications for financial transactions in Vietnam.

To promote green credit, FPT has developed VertZéro – carbon accounting software assisting banks and enterprises in emission accounting and green loan tracking. This aims to help the sector achieve an annual growth rate of around 26%. FPT and BIDV are currently deploying this solution, offering it for free or at preferential rates to businesses, and integrating it with core systems for green loan assessment and approval.

Also at the event, FPT introduced a specialized AI technology ecosystem for the banking sector – Future Now with AI – designed to tackle four major challenges. First, it enables AI and Cloud infrastructure with FPT AI Factory and FPT Cloud. Second, it enhances operational efficiency through solutions like akaBot, Kyta Platform, Procuva, and ArchiveNex. Third, it elevates customer experience via FPT CX Suite. Fourth, it drives digital and green financial models using tools such as Tradeflat, VertZéro, Lendvero, Volar Finex, Votum Suites, and Velox Suites.

Especially noteworthy is the strong integration of AI Agents within the Made by FPT ecosystem, aimed at enhancing customer experience. Deployed via the FPT AI Agents platform, these AI staff members can perform tasks like customer consultation, Q&A, and transaction reminders across chat and automated call center channels. As a result, banks can increase customer service center productivity by up to 50% and boost telesales revenue by 20% through proactive, intelligent, 24/7 engagement.

Aligned with its “Build Your Own AI” strategy, FPT has developed the FPT AI Factory – a comprehensive solution suite equipped with high-performance GPU computing infrastructure and advanced AI platforms and models. This enables financial institutions to independently research and build tailored AI models, maximizing potential and securing long-term competitive advantages.

With its AI-First strategy and over 30 years of experience supporting banking digital transformation, FPT pledges to accompany the sector in enriching data efficiency and transparency, fostering green credit development, and driving sustainable economic growth in line with Resolution 57-NQ/TW of the Politburo.